Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 19, 2025

By Aman Gupta

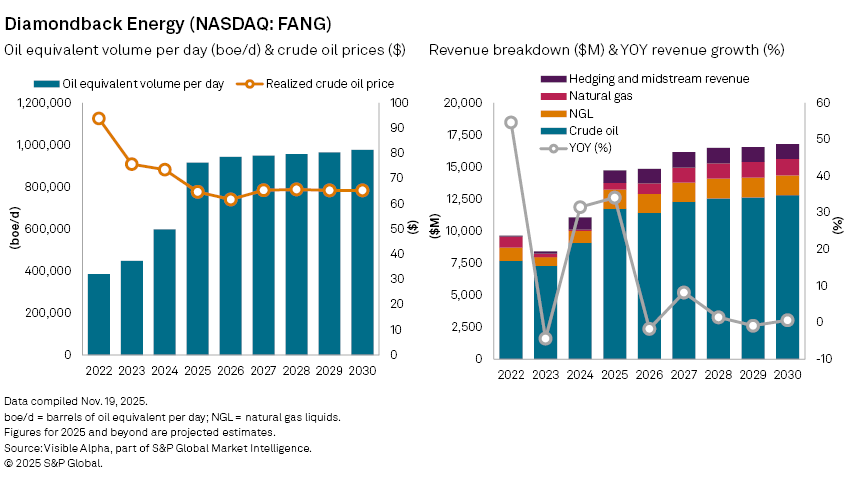

Diamondback Energy Inc. (NASDAQ: FANG) delivered stronger-than-expected third-quarter earnings earlier this month. Visible Alpha consensus estimates point to a sharp step-up in scale in 2025 with revenue forecast to climb 34% year-on-year to $14.8 billion, buoyed by the recently closed Endeavor Energy Resources transaction and the acquisition of Double Eagle, two major private Permian Basin operators. 2025 production volumes are projected to surge 53% to roughly 916,000 barrels of oil equivalent per day (boe/d), highlighting the uplift from consolidation.

The company is leaning heavily into a roll-up strategy designed to cut costs, boost operating leverage, and streamline its asset base. As part of that push, Diamondback announced plans to sell its subsidiary, Viper Energy Inc.’s (NASDAQ: VNOM) non-Permian assets for $670 million to an affiliate of GRP Energy Capital and Warwick Capital Partners. The move adds to a growing list of divestitures aimed at hitting a $1.5 billion disposal target to help reduce leverage. Recent sales include Environmental Disposal Systems for $694 million and Diamondback’s stake in pipeline operator EPIC Crude Holdings for $504 million.

Still, 2025 top-line momentum is expected to be partly offset by weaker commodity pricing. Diamondback’s realized crude price is expected to fall 11.9% to $64.80 per barrel in 2025, reflecting pressure from softer Brent benchmarks as OPEC+ supply additions and slowing global demand weigh on the market.

Looking further ahead, analysts expect the growth engine to cool down. By 2026, revenue gains are projected to moderate amid disciplined capital spending, lower drilling activity, and persistent commodity-price headwinds. Output is expected to flatten as Tier-1 drilling inventory declines, and fewer new wells come online.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment