Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Nov. 20, 2025

S&P Global Commodity Insights reports on the world's top copper producers in 2024 and their reserves replacement strategies over the 2015–24 period, following the previous Copper Reserves Replacement Strategies (RRS) articles published in 2021. These studies examine the relationships between each company's production, reserves, costs, exploration budgets, acquisitions, divestitures and copper discoveries during the period. The strategies of each of the top five producers, starting with Corporación Nacional del Cobre de Chile (Codelco) and BHP Group Ltd., are presented individually. A follow-up article will examine the top 10 producers' strategies and rankings across various RRS metrics.

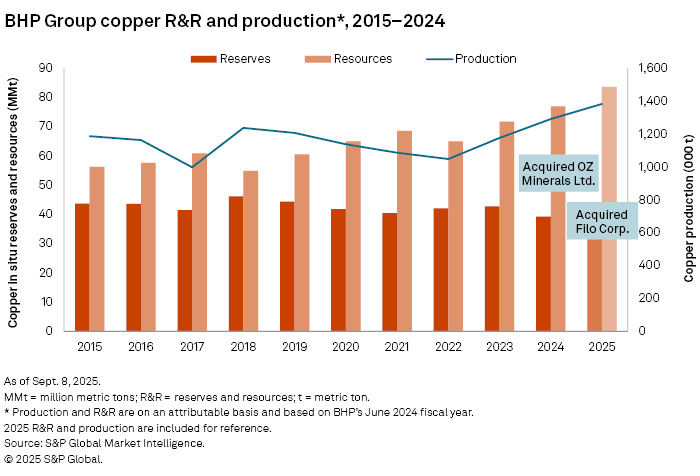

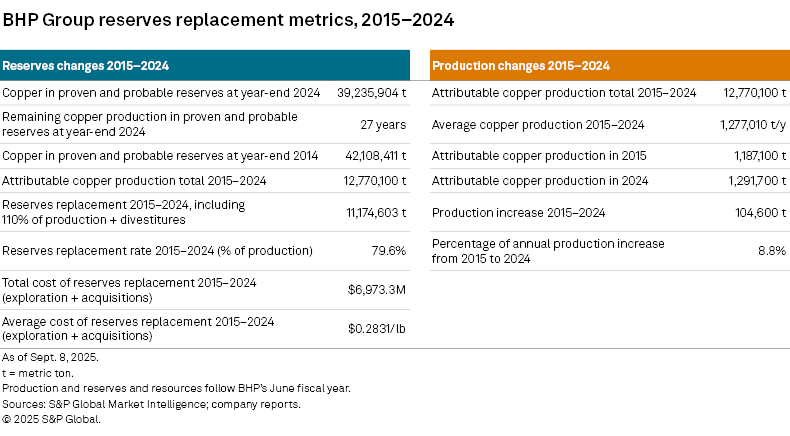

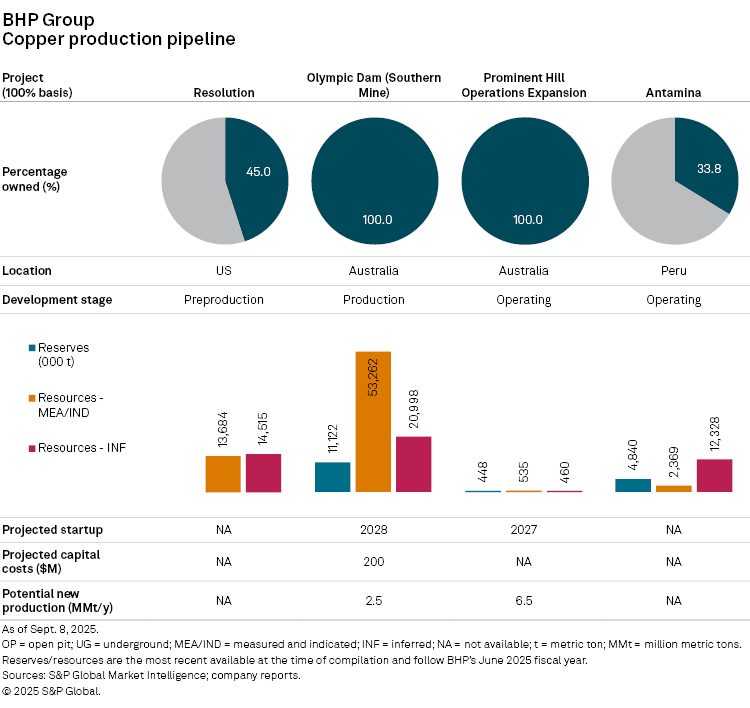

Our metrics calculations and analysis of BHP's activities primarily cover the 10-year period through the company's fiscal year ended June 2024, although the following commentary contains references to the June 2025 fiscal year.

➤ In 2024, BHP produced 1.3 million metric tons of attributable copper cathode and concentrate, marking the company's highest output in 15 years.

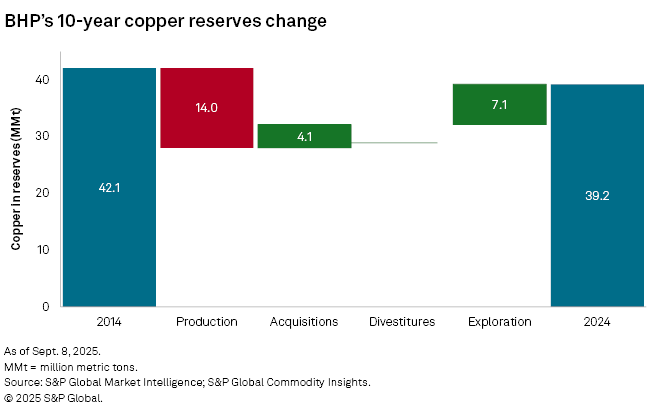

➤ Between 2015 and 2024, BHP replaced 80% of its copper reserves lost to production primarily through exploration, which accounted for 64% of its reserves growth during the period.

➤ Based on 2024 fiscal year data, BHP held 39.2 MMt of attributable proven and probable copper reserves, equivalent to 27 years of projected future output.

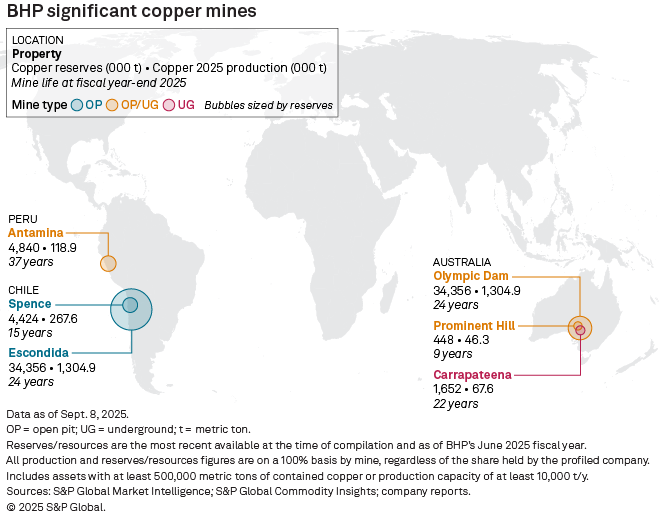

➤ The Escondida and Spence mines continue to drive near-term copper production despite declining grades pressuring future output. Thus, BHP is investing further in brownfield projects to offset losses and sustain long-term growth.

➤ BHP's acquisition of OZ Minerals Pty. Ltd. in 2023 brought 4.1 MMt of copper reserves through properties such as Carrapateena and Prominent Hill, while the recent acquisition of the Filo del Sol and Josemaria projects further strengthens its reserves base.

Access the BHP Copper RRS databook here.

BHP has reinforced its status as a leading copper producer by expanding its reserves portfolio through exploration, early-stage project development and strategic acquisitions. From 2015 to 2024, BHP replaced a total of 11.2 MMt of copper reserves, or 80% of reserves depleted by production over the decade. As of fiscal year 2024, the company held 39.2 MMt of attributable proven and probable copper reserves, representing the fifth-largest copper reserve base globally and providing approximately 27 years of projected future output.

Near-term growth supported by acquisitions

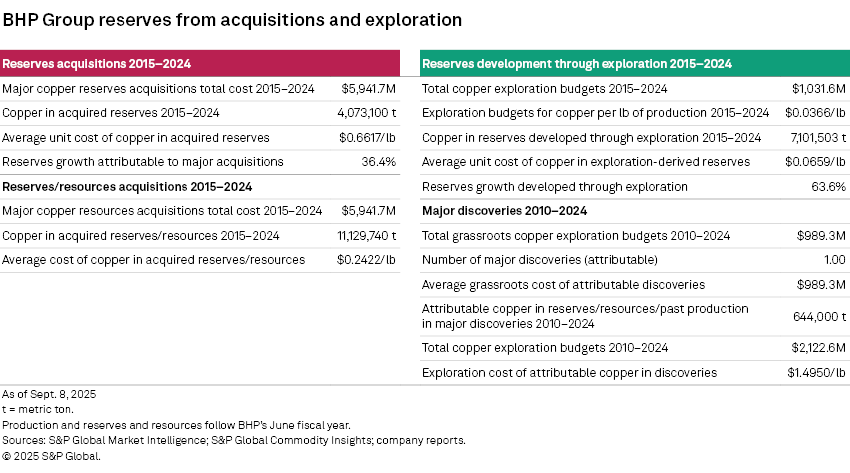

In May 2023, BHP completed its acquisition of Australia-based OZ Minerals for $5.94 billion, turning over 4.1 MMt of copper reserves at an average cost of 66 US cents/lb. This big-ticket acquisition, which was the only copper-focused acquisition completed by BHP between 2015 and 2024, represented 36% of BHP's reserves growth over the period.

In 2024, BHP made a $33.39 billion bid for Anglo American PLC, which holds 48.4 MMt of attributable copper reserves from its Chilean copper assets Collahuasi, El Soldado and Los Bronces. The offer was ultimately rejected after several rounds of bidding.

In January 2025, BHP and Lundin Mining Corp. jointly acquired Toronto Stock Exchange-listed Filo Corp. and formed the joint venture Vicuña Corp. to manage the early-stage projects Filo del Sol and Josemaria in the Vicuña district of Argentina and Chile. With the stake split evenly, the $3.71 billion partnership brought over a total of 2.02 MMt of copper in reserves to BHP.

More recently, in August 2025, BHP announced the sale of its smaller Carajás copper assets in Brazil to CoreX Holding BV for $465 million, allowing BHP to reallocate capital to its higher-margin, larger-scale copper assets in favorable jurisdictions.

BHP turns to strategic exploration to support its long-term reserve base

Exploration activities contributed the most to BHP's reserves growth between 2015 and 2024, accounting for about 64% of the total, or 7.1 MMt of copper in reserves. Over the 10-year period, BHP allocated a cumulative $1 billion to its copper exploration budget, putting average cost for attributable copper produced at 4 cents/lb. Of the total budget, 57% targeted grassroots copper exploration. In 2024, the company reported exploration success when it disclosed the maiden resource estimates for the Oak Dam and OD Deeps deposits at Olympic Dam in Australia.

Since 1990, BHP has been credited with 16 copper discoveries, totaling 123.8 MMt of copper in reserves, resources and past production. However, the company made no new copper discoveries between 2021 and 2024 and instead focused on advancing its latest find, West Musgrave (Succoth) in Australia. Discovered in 2013, West Musgrave was regained through the OZ Minerals acquisition.

To expand its reach beyond internal exploration, BHP established Xplor, a six-month accelerator program that provides non-dilutive grants to exploration companies targeting critical minerals. Project locations of recently announced partners include Argentina, Canada, Germany, Peru, Saudi Arabia and the US.

Development projects continue to support BHP's production growth

BHP owns 57.5% of Escondida, the world's largest copper mine by output. Escondida produced 647,100 metric tons of copper in fiscal year 2024, up 7% year over year. BHP announced in the fourth quarter of fiscal year 2025 that its Full SaL leaching technology — designed to simplify leach operations and improve metal recoveries and cycle time — delivered its first production at Escondida. This innovation is expected to produce 410,000 metric tons of copper cathodes over a 10-year period. In fiscal year 2025, Escondida copper production grew 16% year over year to 750,300 metric tons, its highest output in 17 years.

BHP's wholly owned Spence mine in Chile, its second-largest copper mine and part of the Pampa Norte operations, saw output rise 6% year over year to 254,500 metric tons in 2024 on the back of better concentrator performance and feed grades. Cerro Colorado, also part of Pampa Norte, entered temporary care and maintenance in December 2023 due to mine depletion. BHP is exploring a potential restart for Cerro Colorado through the application of its SaL 1 leaching technology.

Following the OZ Minerals deal, the Carrapateena and Prominent Hill mines were incorporated into BHP's Copper South Australia operations — contributing 16% to its total concentrate production in the 2023–24 period. BHP is also leveraging cost-effective synergies and expecting improvements, including concentrate processing and expanded ore pass capacity at Olympic Dam, as well as the completion of the Wira Shaft at Prominent Hill.

Meanwhile, development at BHP's non-operated Resolution copper mine in Arizona is facing delays due to an injunction by the US Court of Appeals. This halts the transfer of federal lands held sacred by tribal nations.

In the near term, BHP expects that lower grades from its Chilean mining operations will pressure overall copper output. Despite these challenges, BHP remains focused on maintaining strong output through targeted operational improvements and strategic developments, supported by its robust reserves base. As of fiscal year 2025, the company is targeting 2 MMt per annum of attributable copper production by 2030.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language