Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Dec. 2, 2025

By Zain Tariq and Nathan Stovall

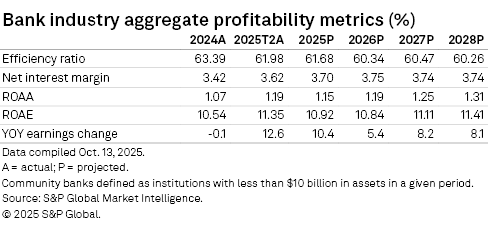

Strong net interest margins have supported earnings at US community banks' in 2025 and earnings growth should continue in the coming quarters, even as credit costs continue to migrate higher.

Community bank margins have expanded as the benefit from fixed-rate assets repricing has overshadowed modest increases in funding costs. Community banks in aggregate reported strong earnings growth in 2025, but the pace of earnings growth is anticipated to moderate in 2026 due to the higher credit costs. Credit quality is expected to slip as the lagging impact of tariffs could slow economic growth, impact consumer spending and increase delinquencies, necessitating higher reserve builds.

Click here to access data exhibits and the US community bank aggregate's projections template.

Credit in focus but holding up despite uncertainty

Many investors have been waiting for the credit shoe to drop but asset quality remains benign. While a handful of regional banks reported issues related to loans to nondepository financial institutions, most community banks have little to no exposure to that asset class.

Most regional and community banks, in a variety of geographies, reported little to no deterioration in their credit quality in the quarter. For instance, banks such as Grand Rapids, Mich.-based Mercantile Bank Corp., Kalispell, Montana-based Glacier Bancorp Inc., Cincinnati-based First Financial Bancorp., Olympia, Wash.-based Heritage Financial Corp., Novato, Calif.-based Bank of Marin Bancorp., Chicago-based Byline Bancorp Inc. and Houston-based Stellar Bancorp Inc. noted on their respective third-quarter earnings calls that asset quality generally was "excellent" or "stable to improving," though a few institutions reported challenges with a single relationship.

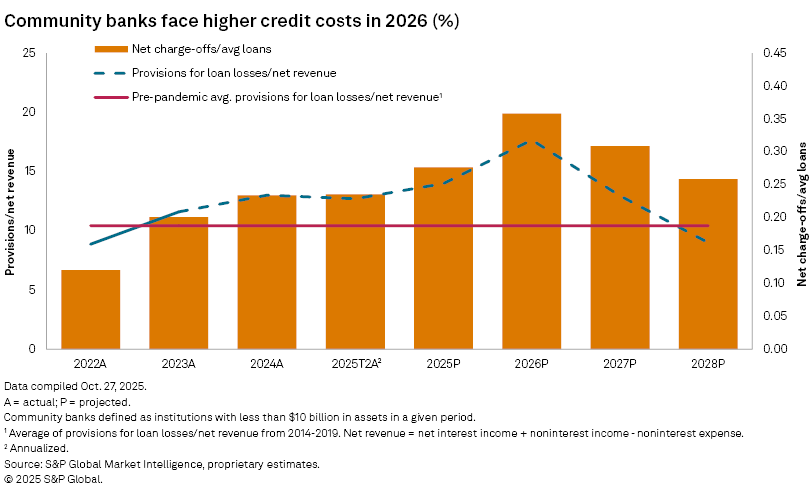

We expect credit quality to normalize from current levels due to weakness in the US consumer and some stress in commercial real estate portfolios, leading to a higher level of losses. Consumer delinquencies have risen from historical lows and student loan delinquencies have jumped back near pre-pandemic levels now that the moratorium on payments is several quarters in the rear-view mirror. Community banks generally do not have direct exposure to those credits, but the deterioration offers another indicator that the US consumer is stretched, marked by slower savings rates and recent weakness in the labor market.

Thankfully, consumer balance sheets remain in relatively strong shape, with household debt to income tracking near long-term averages. Many borrowers took advantage of historically low rates to refinance their mortgages before the Fed began raising rates, reducing the impact that rate hikes would have on their debt service. Consumers and other borrowers are also expected to receive more relief in the form of additional rate cuts.

Community banks face potential loss content in other areas, including their commercial real estate portfolios, which faced intense regulatory and investor scrutiny in 2023 and 2024. Banks have reduced their exposure to CRE and have arguably benefited from private credit firms growing their market share and helping support the asset class.

Some skeptics argue that lenders have downplayed credit quality deterioration by modifying loans and extending maturities further out the horizon, invoking the phrase "extend and pretend." There is evidence that extensions have occurred in the CRE market, with the number of CRE mortgages estimated to mature declining in 2025 when compared to estimates a year earlier. What remains to be seen is whether those extensions offered borrowers enough breathing room to weather the storm and if recent rate declines position them to service their debts.

We do expect higher loss content in the future, but to date, nonaccrual loans have risen modestly. Community banks have proactively increased reserves in anticipation of potential credit stress.

Provisions for loan losses are projected to rise to 14.0% of net revenue in 2025 from 13.0% in 2024. That ratio is expected to increase to 17.7% in 2026 as community banks prepare for tougher sledding ahead. The higher level of provisioning will serve as a headwind to earnings but returns should remain favorable.

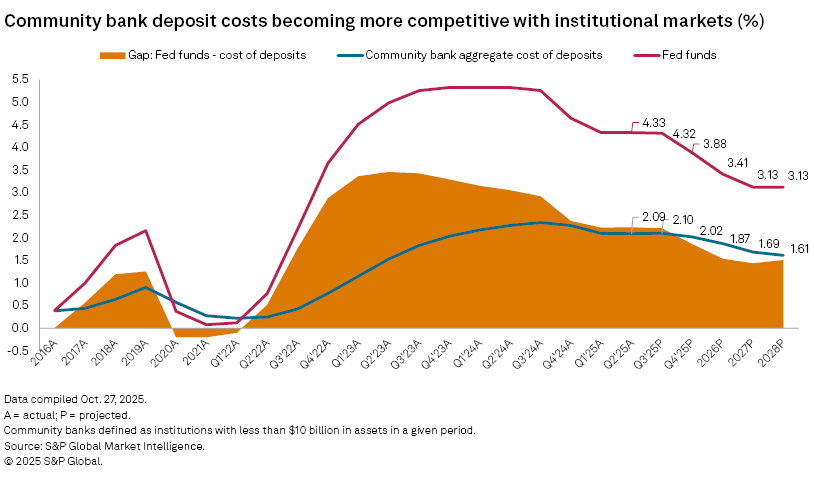

Margins set for further expansion

While funding costs have held steady in recent quarters, community banks continue to benefit from lower-yielding assets originated during 2020 and 2021 rolling off their books and being replaced by higher-yielding alternatives. Deposit costs held steady for community banks in the second quarter and actually inched higher in the third quarter, even as the Fed cut rates toward the end of the period. But, community banks should report declines in deposit costs in the coming quarter as the benefit of rate cuts take hold.

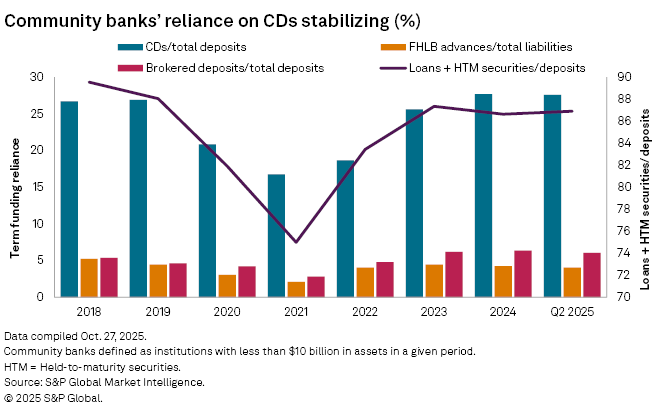

Community banks' funding costs continued to grind higher in the third quarter, in part due to the group's reliance on certificates of deposit (CDs) for funding. CDs are no longer growing at the same pace when the Fed aggressively raised rates but remain larger portions of community banks' deposit bases compared to pre-pandemic levels.

CD rates have fallen from the peak the spring of 2024 but remained relatively expensive for institutions. As CDs matured, banks had to offer competitive rates to retain these deposits.

CD rates began declining late in the third quarter of 2024 and far fewer institutions are offering the products at rates over 4%, but there was less movement around the 3.5% level through the end of the third quarter of 2025. The number of banks marketing one-year CDs over 3.5% included 938 institutions as of Oct. 17, down from 1,054 at Aug. 29, 1,048 as of June 27 and 1,079 as of March 28.

Loan growth remains subdued as businesses and consumers adjust to new trade and immigration policies and economic uncertainties. The impact of tariffs has not been fully realized, with businesses initially increasing inventories to mitigate cost pressures. However, as these inventories deplete, the true impact on operating costs and pricing could become more apparent.

Looking ahead

M&A activity has rebounded from lows and the pace of deal activity seems poised to increase further.

A friendlier regulatory environment has brought back serial acquirers and larger regional banks into the M&A game, increasing the number of potential buyers in the industry. The combination of modestly higher credit costs and slower loan growth could create more willing sellers.

Investment bankers focused on the depository space say their pipelines are as strong as they have ever been and the drivers of deals are broad based whether institutions are trying to resolve management succession, expand into new markets or gain scale. They also note that executives seem to have a greater sense of urgency to pursue transactions while the deal window remains open.

However, lower valuations remain a governor on bank M&A activity. Dedicated bank investors are frustrated with current values and argue that they do not match fundamentals in the industry. Our outlook suggests that their angst is not misplaced and continued earnings growth for community banks — which we expect — would only shine a brighter light on the disconnect between actual fundamentals and valuations in the marketplace. If that gap is narrowed, stronger valuations would offer another tailwind for deal activity.

Scope and methodology

The outlook discussed in this article is based on a proprietary S&P Global Market Intelligence model that utilizes the actual results of nearly 10,000 active and historical commercial and savings banks and savings and loan associations. The outlook is based on management commentary, discussions with industry sources, regression analysis, and asset and liability repricing data disclosed in banks' quarterly call reports. While taking into consideration historical growth rates, the analysis often excludes the significant volatility experienced in the years around the credit crisis.

The outlook is subject to change, perhaps materially, based on adjustments to the consensus expectations for interest rates, unemployment and economic growth. The projections can be updated or revised at any time as developments warrant, particularly when material changes occur.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language