Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 20, 2025

By Ehteesham Ansari, Manan Tulsian, Pooja Parmar, and Jigar Saiya

Coinbase Global Inc. (NASDAQ: COIN) is steadily reshaping its business model, shifting from a heavy reliance on trading fees to a more diversified and recurring revenue base.

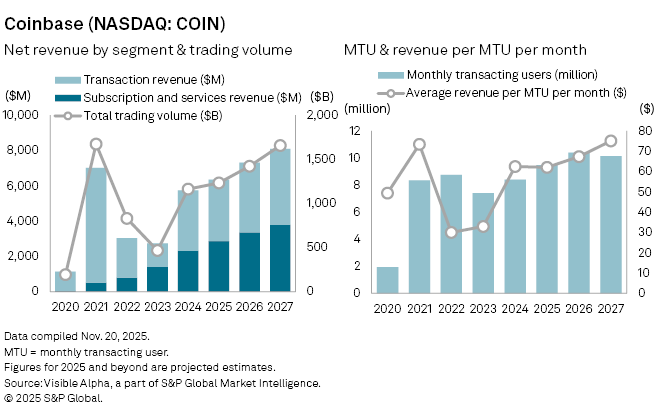

The company, which became the first major crypto exchange to list in the US in 2021, derived nearly all its income from user trading activity. But transaction revenue is expected to account for 59% of total revenue in 2025, down sharply from 96% in 2020 and 63% last year, according to Visible Alpha consensus.

Instead, Coinbase’s subscription and services business — including interest earned on USDC stablecoin reserves, blockchain staking rewards, institutional custody fees and its Coinbase One membership — has become an increasingly important driver of growth. This segment is forecast to see revenue rise 24% year-on-year to $2.9 billion in 2025, making up 41% of revenue, compared with just 4% five years ago. Within this, USDC or stablecoin-related revenue is projected to jump 49% to $1.4 billion, while staking rewards are expected to reach $723 million.

By contrast, transaction fees are set to grow only 5% in 2025 to $4.2 billion, reflecting a slowdown in trading activity following a period of sharp volatility. Trading volumes are expected to rise 6% to $1.2 trillion, while monthly transacting users are forecast to edge up to 9.5 million. Average revenue per user is anticipated to remain broadly stable at about $62 a month.

Overall revenue is projected to grow 12% to $7.4 billion in 2025, supported by Coinbase’s acquisition of derivatives exchange Deribit earlier this year and the launch of its token-sales platform. Together, these moves push the company further toward its stated ambition of becoming an “everything exchange”, a one-stop shop for a broad suite of blockchain-based financial services.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings