Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 14, 2025

By Trishit Mukherjee and Muskan Abbi

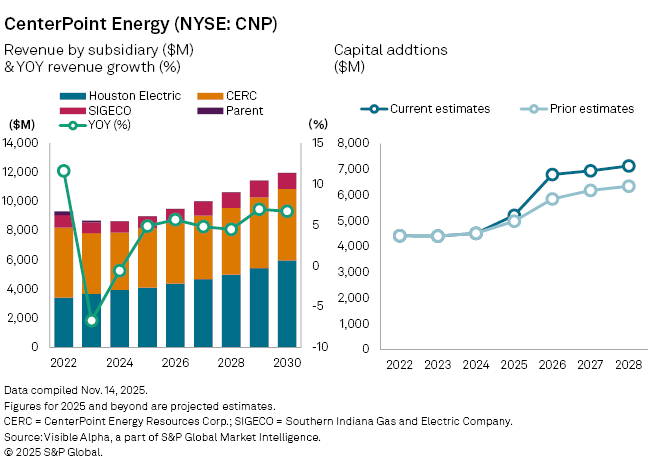

CenterPoint Energy Inc. (NYSE: CNP), the Houston-based electric and natural gas utility, is set for a turnaround in fiscal 2025 with revenues projected to rise 4.8% to $9.1 billion, reversing two consecutive years of decline. The recovery is expected to be fueled by higher customer rates and rising electricity demand from data centers, petrochemical facilities, and port electrification projects.

Analysts forecast that most of the growth will come from CenterPoint’s natural gas arm, CenterPoint Energy Resources Corp (CERC), which serves customers across the Midwest and South. CERC’s revenues are expected to climb 3% to $4 billion in 2025, after contracting 5.4% last year and 14% in 2024. The company’s Houston Electric subsidiary, which manages power transmission and distribution in the Houston area and accounts for nearly half of total revenue, is forecast to post a 4.5% rise to $4.1 billion. Meanwhile, Southern Indiana Gas and Electric Company (SIGECO), which handles both electricity and gas services, is projected to grow 7.2% to $826 million.

The outlook is underpinned by a $65 billion capital expenditure program announced in September aimed at building what CenterPoint calls “the most resilient coastal grid” in the US. The initiative targets 11% annual growth in the company’s regulated rate base through 2030, positioning it to capture expanding power demand from industrial and digital infrastructure. Analysts have responded by lifting capital spending forecasts, with Visible Alpha consensus showing analysts now expect $5.2 billion in 2025, alongside upward revisions of 16% and 12% in 2026 and 2027 respectively.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment