Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 14, 2025

By Yamini Sharma

Capgemini SE (EPA: CAP) acquisition of Indian outsourcing firm WNS marks the latest move by the French technology services group to sharpen its focus on artificial intelligence and data-driven operations. The deal, completed on October 17, is intended to strengthen Capgemini’s position in “Agentic AI-powered Intelligent Operations”, a field that automates complex business processes using AI agents capable of reasoning and decision-making.

The acquisition brings together Capgemini’s strength in AI, cloud and digital transformation with WNS’s deep expertise in business process outsourcing and data analytics. Headquartered in Mumbai, WNS adds a large offshore delivery base, a growing roster of US clients, and higher-margin digital process services — all of which could help lift Capgemini’s profitability and expand its footprint in the US.

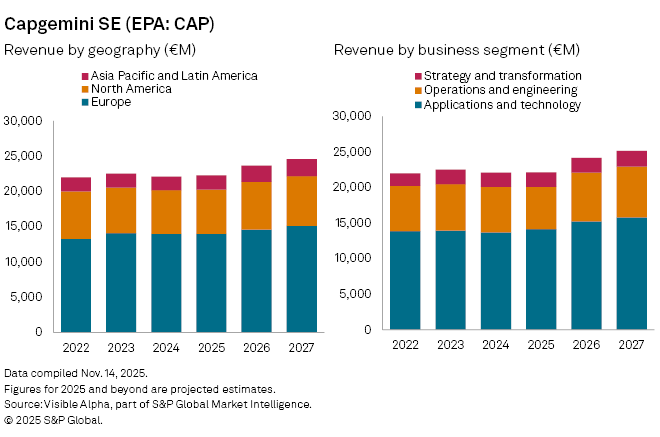

Analysts expect the acquisition to support a gradual recovery in Capgemini’s growth trajectory after a weak 2024. Consensus estimates from Visible Alpha show analysts project group revenue to edge up 0.9% to €22.3 billion in 2025, following a 1.9% decline last year. Growth is expected to be strongest in Asia Pacific and Latin America, rising 5.5% to €2 billion, while North America is forecast to increase 1.4% to €6.3 billion. Europe, which accounts for nearly two-thirds of total sales, is set to remain flat at €14 billion.

By business line, the Application and Technology Services division is expected to expand 3.2% to €14.1 billion, supported by ongoing demand for cloud migration and software modernization. In contrast, Operations and Engineering, which now incorporates WNS, is projected to contract 7% to €6 billion in 2025 before rebounding with a 15% increase in 2026 as integration benefits materialize. The Strategy and Transformation unit is expected to rise 2.6% to €2 billion.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment