Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 26, 2025

By Sonam Sidana

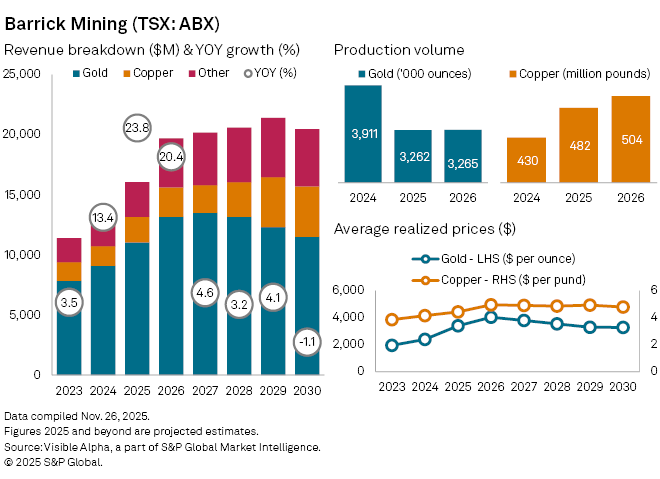

Canadian miner Barrick Mining Corp. (TSX: ABX) is positioned for a stronger 2025, supported by higher commodity prices and rising copper output.

Visible Alpha consensus points to 2025 revenue rising 24% year-on-year to $16 billion, driven largely by higher realized gold prices. Barrick’s gold division, which is its core profit engine, is expected to deliver 21% revenue growth to $11.1 billion in 2025, supported by a 42% jump in average realized gold prices to $3,402 an ounce.

But the price windfall masks softer production trends. Gold output is projected to fall 17% to 3.26 million ounces, with sales volumes down 15%, driven by the suspension of operations at the Loulo-Gounkoto mine amid Barrick’s dispute with the Malian government over dividing the economic benefits, as well as lower production across Barrick’s Nevada and other gold mines.

Copper, however, remains a bright spot. Copper production is forecast to climb 12% year-on-year to 482 million pounds in 2025, lifted by a 21% increase at the Lumwana mine in Zambia. Sales volumes are expected to rise 22%, helping copper revenue expand 29% to $2.1 billion, with average realized copper prices of $4.4 per pound, up 7% year-on-year.

Barrick has also recently removed a major overhang after reaching a settlement with the government of Mali, ending a two-year dispute over the flagship Loulo-Gounkoto complex. The resolution has eased concerns over political risk in one of Barrick’s most important gold assets and provided a lift to its share price.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment