Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 18, 2025

By Ehteesham Ansari and Kanika Garg

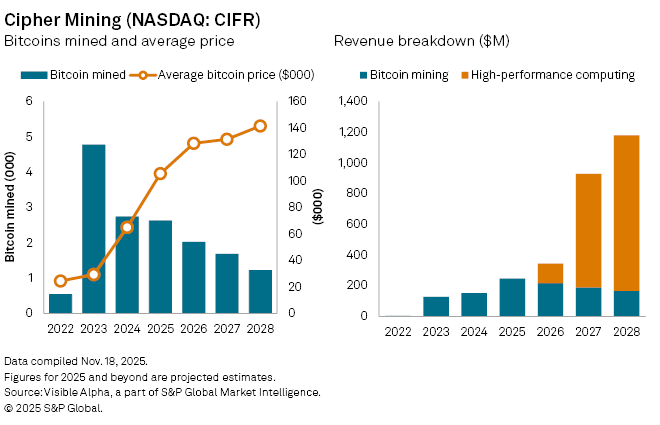

Cipher Mining Inc. (NASDAQ: CIFR) is accelerating plans to diversify beyond bitcoin mining, positioning high-performance computing (HPC) as a core revenue engine from 2026 onward. The shift comes as the company benefits from higher bitcoin prices and increased output from its Black Pearl facility, which became fully operational in Q3 2025.

The bitcoin miner has secured two long-dated HPC hosting agreements that effectively reshape its earnings profile. In its latest quarterly results, Cipher unveiled a 15-year data-center campus lease with Amazon Web Services, under which it will deliver 300MW of HPC capacity in 2026. The project will be built in two phases beginning in July, with rent starting in August 2026.

Cipher has also signed a 10-year, 168MW AI hosting agreement with Fluidstack and Google, broadening its exposure to demand for compute capacity from cloud providers and AI developers.

While HPC is expected to drive revenues from 2026, Visible Alpha consensus estimates point to a strong momentum for the legacy mining business in 2025. Revenue is forecast to rise 62% year-on-year to $246 million, supported by a strong growth in bitcoin prices — average prices are expected to climb 62% to $105,503 per bitcoin. This is set to offset a projected 4% decline in production to 2,617 bitcoins. Cipher’s self-mining hash rate is expected to reach 19.9 exahash per second in 2025, up from 11.2EH/sec last year, reflecting ongoing fleet expansion.

From 2026, however, HPC is expected to dominate the company’s top line. Analysts project $127 million in HPC revenue that year, rising to $739 million by 2027, far surpassing the estimated $190 million from bitcoin mining. The transition could help reduce earnings volatility tied to bitcoin’s price cycles and develop a secure, stable, infrastructure-like revenue stream.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment