Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — NOVEMBER 13, 2025

By Santosh Saha and Soumya Khandelwal

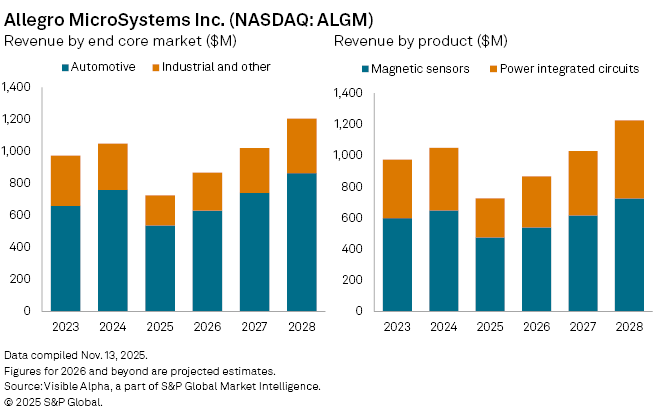

Allegro MicroSystems Inc. (NASDAQ: ALGM) reported stronger-than-expected results for its recent September quarter, signaling continued recovery from last year’s semiconductor downturn. Analysts expect Allegro to benefit from structural growth in EVs, clean energy, and data center infrastructure.

Based on Visible Alpha consensus, the supplier of sensors and analog power chips to the automotive and industrial sectors is expected to see revenue of $867 million in fiscal 2026, up 20% year-on-year, after a steep 37% revenue decline in fiscal 2025.

The rebound is expected to be driven by renewed momentum across Allegro’s core markets. Automotive sales — its largest segment — is projected to see sales climb 17% to $630 million, buoyed by growing adoption of electric vehicles where Allegro’s magnetic sensors and power chips enhance efficiency and safety systems. Industrial revenue is expected to advance 27% to $237 million, supported by improving macro conditions and easing inventory headwinds.

From a product perspective, both of Allegro’s core lines are expected to see recovery. Revenue from magnetic sensors is forecast to rise 14% to $540 million, while power integrated circuits (ICs) are projected to stage a stronger rebound, climbing 30% to $326 million.

Net income is projected to recover to $15 million from a $73 million loss last year. Profitability is expected to strengthen as demand for Allegro’s power integrated circuits rises, particularly in high-voltage gate drivers used in next-generation AI server systems.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment