Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 01, 2025

Workday Inc. (NASDAQ: WDAY) is to acquire Sana, a Swedish artificial intelligence company that develops workplace tools, in a $1.1 billion deal as it seeks to strengthen its AI capabilities across human resources and finance software.

The transaction, expected to close in the fourth quarter ending January 31, 2026, will expand Workday’s offering of AI agents that automate routine tasks, search across company data and generate documents and presentations. Sana’s technology will also enhance Workday’s training platform, allowing businesses to create courses and provide personalized AI tutoring to support workforce upskilling.

The acquisition comes as Workday pushes deeper into AI amid intensifying competition from peers such as Oracle, SAP and Microsoft. It follows two smaller deals earlier this year: the July purchase of Paradox, a conversational AI platform for recruitment, and the August acquisition of Flowise, a builder of low-code AI agents.

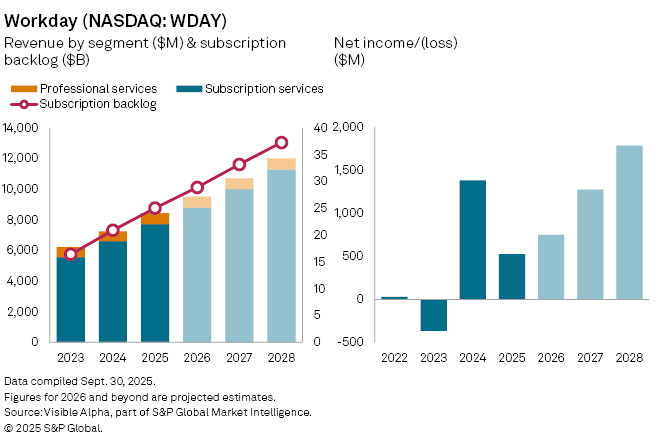

Analysts expect the AI push to be central to sustaining Workday’s growth. Visible Alpha consensus estimates show revenue is projected to rise 13% year-on-year to $9.5 billion in fiscal 2026, after 16% growth in 2025. Subscription revenue — more than 90% of total — is forecast to grow 14% to $8.8 billion, while professional services revenue is expected to decline 4% to $701 million. Workday’s backlog of subscription contracts, measured as remaining performance obligations, is forecast to climb 15% to $29 billion, underlining strong underlying demand.

Profitability, hit in 2025 by higher investment and integration costs, is set to recover strongly. Net income is projected to increase 43% to $752 million in 2026, before jumping a further 66% to $1.2 billion in 2027. Operating income is expected to nearly double in 2026 to $792 million.

The company has also struck a partnership with Microsoft to enable customers to securely manage AI agents across platforms, while unveiling Workday Build, a developer platform for building custom AI tools within its ecosystem.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment