Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 27, 2025

By Nitin Mirajkar

Volkswagen AG (FWB: VOW3) is expected to post a sharp decline in third-quarter 2025 operating profitability when it reports results on Thursday, October 30, as its luxury subsidiary Porsche absorbs the fallout from strategic changes to its electric vehicle roadmap.

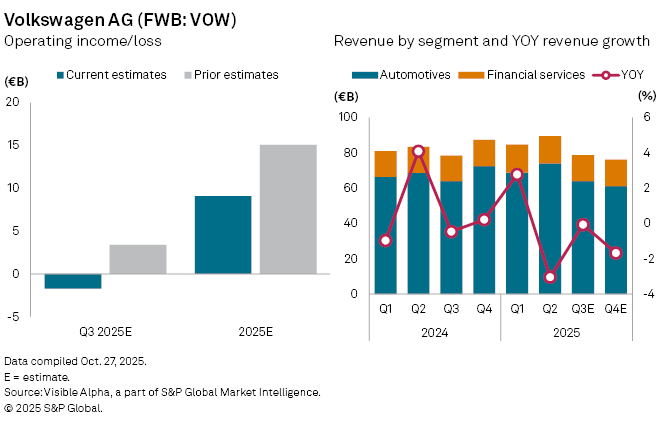

Porsche’s September decision to postpone several electric models and refocus on hybrid and combustion-engine cars triggered a €3 billion non-cash goodwill impairment and a further €2.1 billion in one-off project charges. The €5.1 billion hit has upended expectations for Volkswagen’s quarterly performance, with analysts now forecasting an operating loss of €1.7 billion—compared with prior estimates of a €3.4 billion profit before the announcement.

For the full year, Visible Alpha consensus shows forecasts have been cut to €9.1 billion in operating income from €15.1 billion previously, underlining the depth of the revision. Q3 sales are projected at €78.4 billion, down 0.1% year-on-year, while full-year revenue is expected at €324 billion, marginally lower than 2024 levels as sales remain subdued compared to the post-pandemic highs.

Within its core divisions, automotive revenue is forecast to edge down 0.1% to €64.1 billion in Q3, reflecting a 5% drop in commercial and power engineering sales and a modest 2% rise in passenger cars. Meanwhile, financial services revenue is expected to climb 3% to €14.8 billion, offering some cushion against the broader slowdown.

The downgrade highlights the financial cost of Porsche’s pivot, but it also reflects the wider pressures facing Europe’s traditional carmakers. Intensifying competition from Chinese electric vehicle producers, softening demand in Europe, and the prospect of new US import tariffs are all squeezing profitability. Premium brands such as Audi and Porsche—without major US production bases—face additional strain as they juggle high electrification costs with the need to preserve margins.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment