Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 10, 2025

By Manan Tulsian and Jigar Saiya

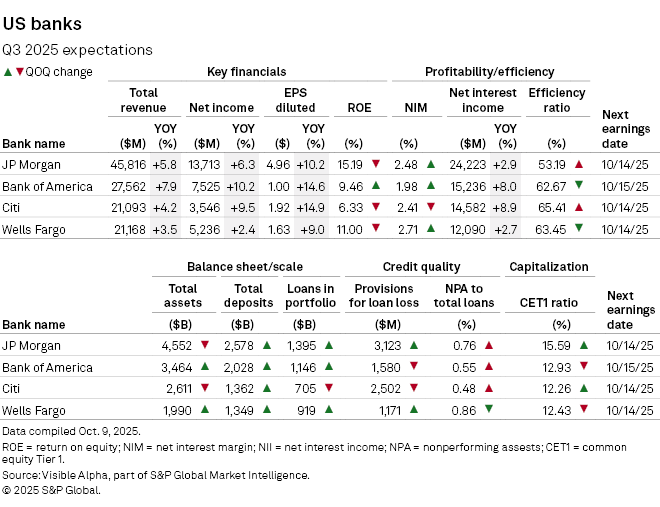

US big banks kick off third quarter earnings season on Tuesday, October 14, with JP Morgan, Citi, and Wells Fargo, reporting first, followed by Bank of America on Wednesday, October 15.

Based on Visible Alpha consensus, the overall outlook for the major US banks is positive, with analysts expecting strong year-over-year earnings growth. This optimism is driven by healthy loan demand and a robust environment for investment banking and capital markets. The key uncertainty is the potential economic impact of new tariffs, and management commentary on this topic will be closely watched.

JPMorgan Chase & Co. (NYSE: JPM) and Bank of America Corp. (NYSE: BAC) are projected to lead earnings growth, supported by higher net income and resilient consumer banking. JPMorgan’s net income is set to climb 6% year-on-year to $13.7 billion, with diluted EPS up 10% to $4.96, while Bank of America’s profit is expected to grow 10% to $7.5 billion, aided by a 14.6% jump in EPS.

In contrast, Wells Fargo & Co. (NYSE: WFC) and Citigroup Inc. (NYSE: C) are likely to post modest revenue growth of around 3–4%, weighed by softer loan growth and lower returns on equity. Both banks are pursuing strategic restructuring initiatives, aimed at improving efficiency and streamlining operations. Analysts will be looking for signs of sustained loan growth and improved efficiency as the banks moves past legacy challenges.

All four banks have announced sizeable share buybacks this year, helping lift EPS growth above the pace of net income expansion.

Credit quality is expected to remain broadly stable, with non-performing assets (NPAs) holding below 1% of total loans for all major lenders, though JPMorgan and Wells Fargo are seen to be building reserves. Capital ratios remain healthy, particularly at JP Morgan (15.6%) and Citi (12.3%), signaling strong capital buffers. Bank of America and Wells Fargo show slight declines, though ratios remain above regulatory requirements.

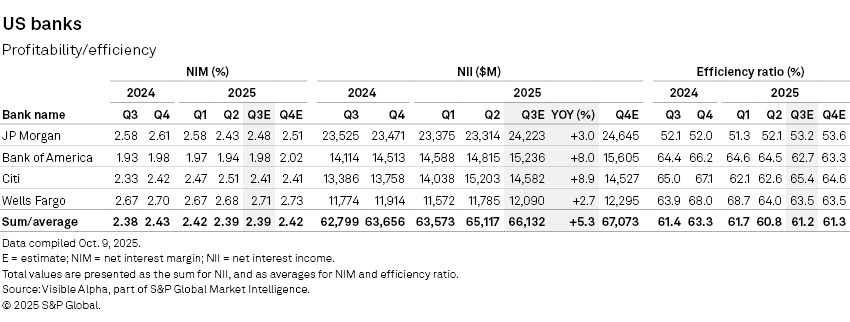

Profitability and efficiency

Net interest margins (NIMs) for the major US banks appear to have stabilized after several quarters of compression, signaling that the worst of the rate pressure may be behind them. Across the group, the average NIM is projected to hold steady at around 2.39% in Q3 2025, roughly flat from the prior quarter.

Efficiency is broadly stable across the major lenders. The group’s average efficiency ratio is expected to hold near 61.2% in Q3, little changed from the prior quarter and slightly above the 61.4% recorded a year ago. JPMorgan is expected to continue to lead with the lowest estimated ratio at 53.2%, though this marks a modest increase from both the prior quarter and last year. Meanwhile, Wells Fargo and Bank of America — which have higher efficiency ratios — are expected to show sequential improvement.

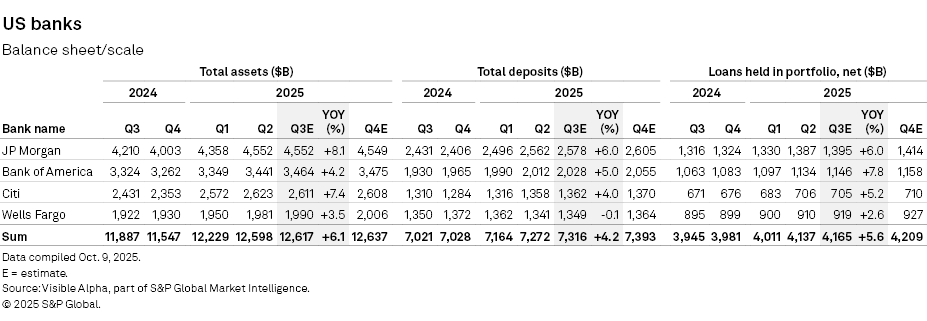

Balance sheet/scale

The balance sheet trends point to steady scale expansion, supporting ongoing revenue growth while maintaining manageable risk exposure.

Total assets across the group are projected to rise 6.1% YoY to $12.6 trillion, driven by JPMorgan Chase and Citi which are each seeing 6–8% asset growth. Deposit balances are also rising, though at a slightly slower pace.

Loans held in portfolio are expected to expand 5.6% YoY to $4.17 trillion, driven by steady consumer and commercial lending.

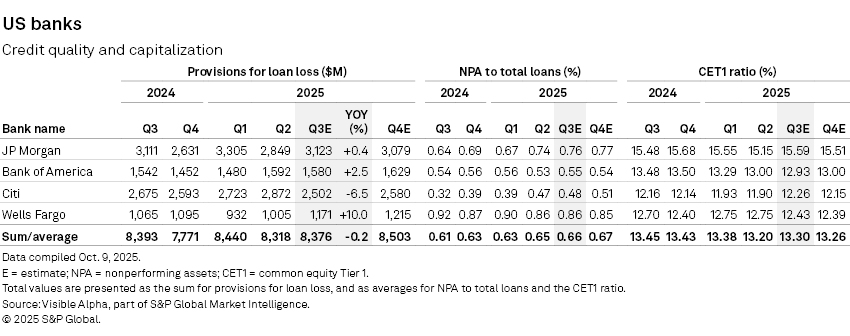

Credit quality and capitalization

The four banks are expected to report broadly stable credit quality in Q3 2025, with provisions for loan losses totaling $8.38 billion, roughly flat year-on-year.

A combination of stable provisions, low NPAs, and robust capital ratios suggests that major US retail banks have resilient balance sheets and strong capacity to absorb credit shocks.

The third-quarter results are likely to reinforce the resilience of the leading banks. While macroeconomic uncertainties—ranging from tariffs to interest rate pressures—remain a watchpoint, robust capital buffers, stable credit quality, and active capital return strategies suggest the major banks are well-positioned to navigate challenges.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.