Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 16, 2025

By Akash Sawant

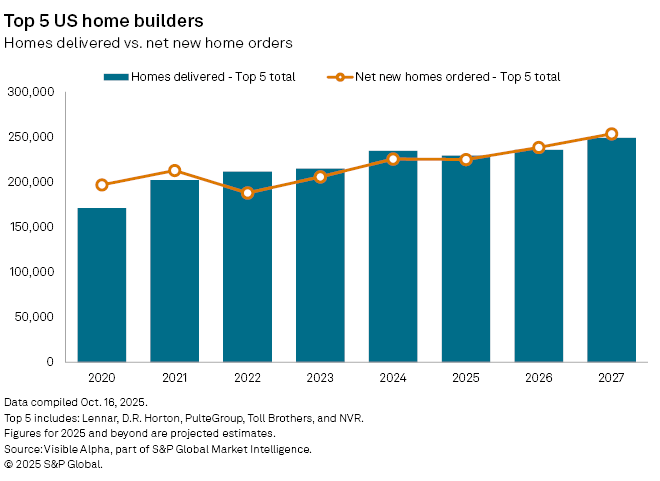

The US homebuilding industry is expected to enter a cyclical trough in 2025. Based on Visible Alpha consensus estimates for the five largest US home builders — D.R. Horton Inc. (NYSE: DHI), Lennar Corp. (NYSE: LEN), PulteGroup Inc. (NYSE: PHM), Toll Brothers Inc. (NYSE: TOL) and NVR Inc. (NYSE: NVR) — growth in new orders and deliveries is expected flatten in 2025, while profitability slips amid weaker pricing power.

Net new orders across the top five is expected to drop 0.2% year-on-year to roughly 225,000 homes in 2025, following a 9.6% rise in 2024. D.R. Horton, the largest US homebuilder, is forecast to see orders fall 3.9% as higher mortgage rates and home prices constrain entry-level buyers. In contrast, Lennar is projected to gain market share, with orders rising 9.6%, driven by aggressive pricing and incentives. PulteGroup and Toll Brothers are each expected to see mid-single-digit declines, reflecting challenges for mid- and high-end buyers, while NVR is likely to see its weakest order volume since 2022, with a near 10% drop.

Deliveries are also set to moderate, reflecting cautious production schedules and slower housing turnover. Mortgage rates, although lower than their 2023 peaks, remain high enough to dampen affordability and temper demand recovery. Lennar stands out as the exception, with deliveries forecast to rise 2.3% to 82,015 homes.

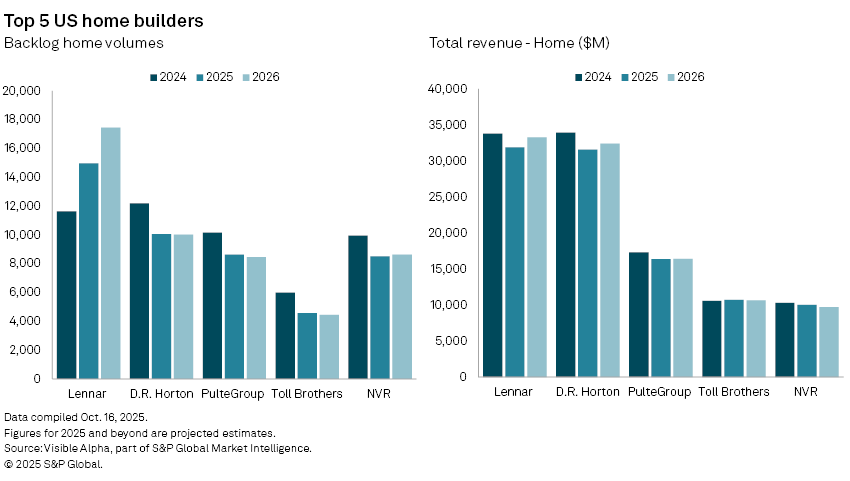

Backlog volumes — a key near-term revenue indicator — remain below post-pandemic highs. With the exception of Lennar, all major builders are expected to see backlog volumes decline further in 2025, highlighting the broader market pause and potential pressure on near-term cash flows.

Home revenue across the top five builders is projected to fall around 5% in 2025, as slower deliveries and easing average selling prices weigh on the top line. D.R. Horton and Lennar — accounting for nearly two-thirds of the top 5 total revenue — are both expected to post mid-single-digit declines despite maintaining market share through pricing incentives. PulteGroup is also expected to see revenue slip, while Toll Brothers could see modest growth, supported by its premium segment positioning.

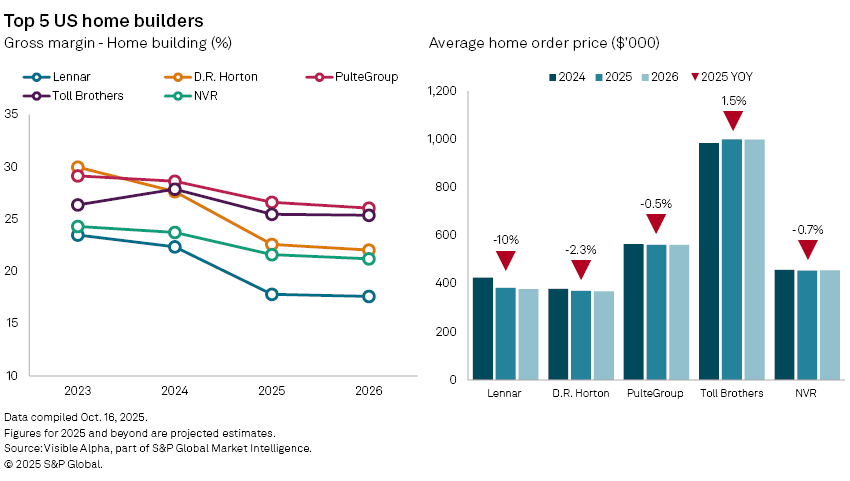

Profit margins are expected to tighten significantly. Gross margins across the leading builders are projected to decline 450–800 basis points from 2022 peaks, averaging 21–22% in 2025, pressured by elevated input costs and incentives needed to move inventory.

Looking further ahead, analysts anticipate a gradual recovery from 2026, with new orders and deliveries picking up and margins stabilizing in the low-20% range as input cost pressures ease.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment