Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 03, 2025

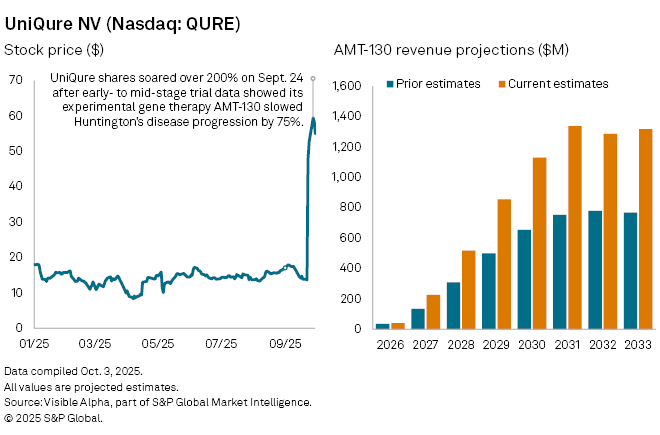

Shares of Netherlands-based uniQure NV (NASDAQ: QURE) jumped more than 200% on September 24 after the company reported positive topline results from its Phase I/II trial of AMT-130, an experimental gene therapy for Huntington’s disease. The stock has continued to climb in the weeks since, reflecting rising optimism that AMT-130 could become the first therapy to slow the progression of the neurological disorder.

Huntington’s disease, a hereditary condition that gradually destroys nerve cells in the brain, leads to severe movement, cognitive, and psychiatric impairments. Current treatments address only symptoms; AMT-130 aims to fill the unmet need for a disease-modifying therapy.

Following the trial results, analysts increased the probability of success for AMT-130 to 61%, up from 57% prior to the announcement. uniQure plans to engage with the FDA in the coming months, targeting a Biologics License Application (BLA) filing in early 2026. The therapy has already been granted Regenerative Medicine Advanced Therapy (RMAT) designation and, in December 2024, uniQure agreed with the FDA on an Accelerated Approval pathway, providing a clear regulatory roadmap.

Analyst expectations for AMT-130 have been sharply revised upward. Visible Alpha consensus shows analysts now forecast $40 million in sales in 2026, its first potential year on the market, rising to $226 million in 2027—up 68% from previous estimates of $134 million. Peak sales are now projected at $1.34 billion by 2031, with AMT-130 accounting for up to 87% of uniQure’s total revenue at that stage. If approved, the therapy could transform both the treatment landscape for Huntington’s and uniQure’s long-term growth trajectory.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment