Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 15, 2025

By Manan Tulsian, Pooja Parmar, and Jigar Saiya

UniCredit SpA (BIT: UCG) will open Italian bank’s earnings season on Tuesday, October 21 with expectations for a subdued third quarter, as higher funding costs and easing short-term rates weigh on profitability.

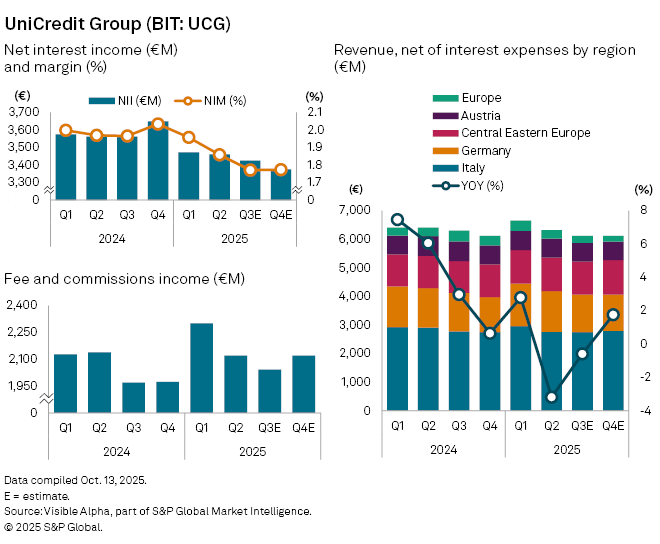

According to Visible Alpha consensus, the lender’s net interest margin (NIM) is forecast to narrow to 1.77%, from 1.97% a year earlier, marking a second consecutive quarterly decline. Net interest income (NII) is expected to fall 3.8% year-on-year to €3.4 billion, dragging overall revenue, net of interest expenses, down 1% to €6.1 billion.

Regionally, Italy and Germany—UniCredit’s two largest markets—are each set for modest revenue declines of 1% and 3%, respectively, while Austria is expected to see a 3% decline. Russia remains a drag, with a 39% drop expected as the company actively winds down its business in the country. By comparison, Central and Eastern Europe is expected to continue to deliver growth, up 4% year-on-year. Fee and commissions income is expected to provide some cushion, rising 3% after a weak second quarter, supported by resilient commercial activity and stronger trading. Total operating expenses are seen edging up 2% to €2.3 billion, reflecting cost pressures from inflation and digital investments.

Credit quality remains stable, with the non-performing loan ratio expected to improve to 1.43%, while the CET1 ratio is expected to moderate to 14.5% from 16% last quarter, reflecting UniCredit’s increased stake in Commerzbank.

For the full year, analysts expect 2025 revenue to hold broadly flat at €24.9 billion, following strong expansion in 2023 and 2024. NII is forecast to decline 4%, offset by a 5% rise in fees and commissions to €8.6 billion. The bank’s strategic moves—ranging from investments in Alpha Bank and Commerzbank to the acquisition of BBPM Life dac—signal management’s push to diversify earnings and sustain long-term profitability.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment