Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 06, 2025

By Hardik Savla

Under Armour Inc. (NYSE: UAA) is bracing for another year of falling sales before a return to growth in 2027, highlighting the pressures facing the US sportswear brand as it attempts to revive its flagging performance.

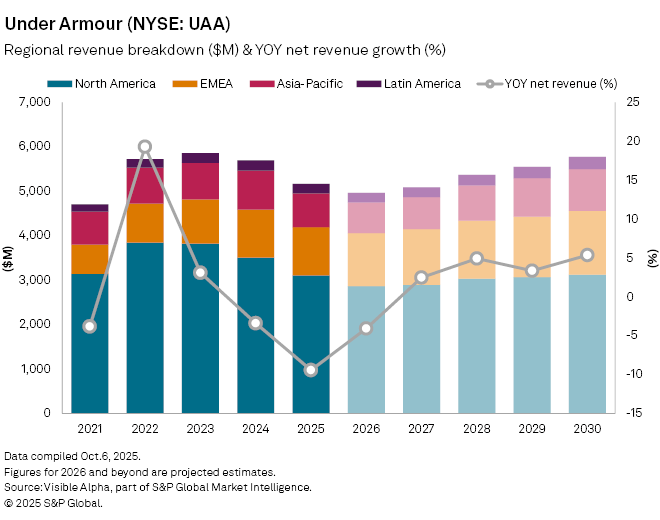

Visible Alpha consensus shows net revenue expected to drop 4% in fiscal 2026 to $5 billion — the third consecutive annual decline after a 9% fall in 2025 and a 3% dip in 2024. The company has struggled to regain momentum in its home market, while recent shifts in US tariff policies and intensifying competition from Nike, Adidas and fast-growing challengers such as On and Hoka have added to the strain.

North America, which generates more than half of Under Armour’s sales, is expected to contract 8% in 2026 to $2.9 billion. By contrast, EMEA is forecast to grow 10% to $1.9 billion, but Asia-Pacific and Latin America are projected to decline 8% and 3% respectively.

Across product lines, apparel — the company’s largest category — is set to slip 3% to $3.3 billion, while footwear is expected to fall 9% to $1.1 billion. Accessories stand out as the only bright spot, with a 3% rise to $423 million.

Despite the top-line weakness, losses are forecast to narrow sharply as management pushes ahead with its “Brand First” restructuring plan, which prioritizes profitability and operational efficiency over near-term revenue expansion. Analysts expect net losses to shrink from $201 million in 2025 to just $23 million in 2026, before swinging back to profit in 2027 with net income of $89 million. Revenue is also expected to stabilize, rising 2% to $5.2 billion in 2027.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment