Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 17, 2025

By Santosh Saha

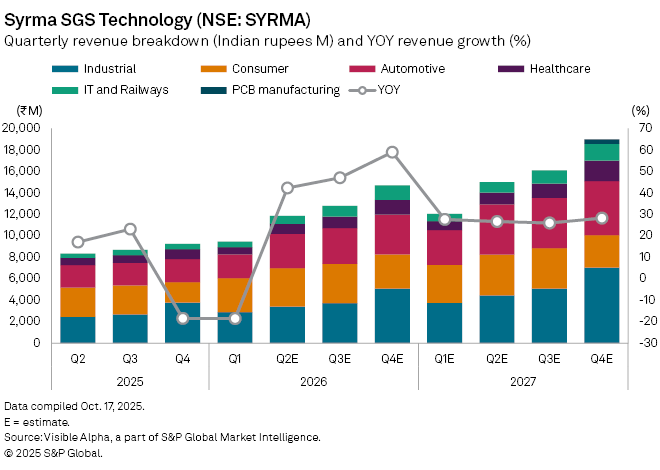

Indian electronics manufacturer Syrma SGS Technology Ltd. (NSE: SYRMA) is expected to post a sharp rebound in second-quarter fiscal 2026 results, helped by recovering demand in its key end markets and a strategic shift toward higher-margin businesses. The company will report earnings on Thursday, October 23.

Visible Alpha consensus estimates point to revenue of ₹7.5 billion, up 42% year-on-year, signaling a strong recovery after consecutive quarterly declines of 19% in Q1 FY26 and 18% in Q4 FY25.

Much of the rebound is expected to come from the consumer electronics segment, Syrma’s second-largest business, where revenue is projected to jump 33% year-on-year to ₹3.6 billion. That marks a significant turnaround from the 48% decline recorded in the previous quarter and the 64% fall in Q4 FY25. The recovery reflects renewed demand from home appliance and personal electronics clients, following an extended period of inventory corrections across the sector.

The industrial division, which remains Syrma’s largest contributor, is forecast to expand 39% year-on-year to ₹3.4 billion, driven by rising adoption of automation and control systems across Indian manufacturing. Meanwhile, the automotive electronics business is set to surge 52% to ₹3.2 billion, supported by higher electronic content per vehicle and a steady inflow of new orders from domestic automakers.

Meanwhile, healthcare electronics revenue is projected to grow 37% to ₹909 million. The company’s IT and railways segment is also expected to stage a strong comeback, with revenue expected to climb 85% to ₹750 million, reversing a 39% drop in the prior quarter. The improvement is being fueled by India’s ongoing rail digitalization and modernization drives, including PM GatiShakti, the National Rail Plan, and KAVACH, the government’s indigenous train collision avoidance system.

Syrma is also investing heavily in PCB (printed circuit board) manufacturing, establishing the country’s largest facility in Andhra Pradesh under India’s product-linked incentive scheme for electronics manufacturing. The plant will produce single-layer, multilayer, HDI, and flexible PCBs, essential for consumer electronics, automotive, telecom, and renewable energy applications. The PCB business is projected to generate ₹406 million in revenue by Q4 FY27, with potential to contribute 10% of total revenue by 2030.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment