Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 28, 2025

By Santosh Saha

US chip design software provider Synopsys Inc. (NASDAQ: SNPS) is expected to see strong revenue momentum in 2026, as its $35 billion acquisition of engineering simulation firm Ansys begins to take effect, and demand rises for AI-enhanced design tools.

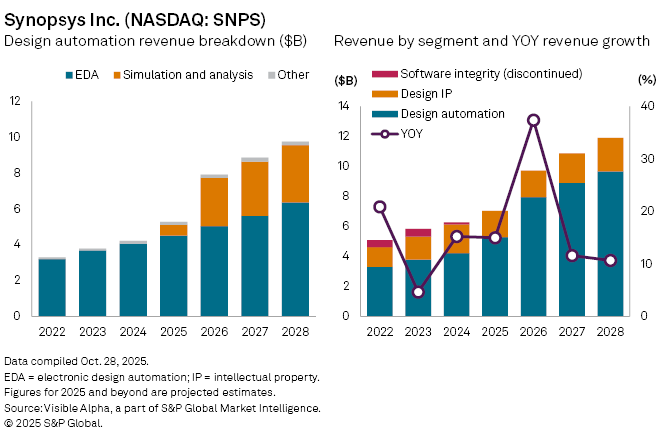

Visible Alpha consensus shows analysts expect fiscal 2025 revenue of $7 billion, up 15% year-on-year, with net income expected to decline 52% to $1.1 billion, reflecting integration and acquisition-related costs. However, growth is projected to accelerate sharply in fiscal 2026, with revenue up 37% to $9.5 billion and net income rebounding 45% to $1.6 billion.

The Ansys acquisition, completed in July 2025, transforms Synopsys from a traditional electronic design automation (EDA) company into a “silicon-to-systems” solutions provider, extending its capabilities from chip-level design to full-system simulation and verification. The integration introduces a new Simulation & Analysis division within the company’s Design Automation segment, with revenue forecast to rise from $599 million in 2025 to $2.3 billion in 2026.

The broader Design Automation business is expected to benefit significantly from the deal, with revenue forecast at $5.3 billion in 2025, up 25% year-on-year, and a further rise to $8 billion in 2026. Within this, EDA tools are expected to generate $4.5 billion in 2025, up 11% from the prior year, while other revenues contribute $172 million.

Beyond Design Automation, the Design IP segment is expected to decline 6% in 2025 amid cyclical licensing weakness, while Synopsys has exited its software integrity unit to focus on higher-value engineering platforms.

The expansion into simulation and multiphysics design broadens Synopsys’s total addressable market across automotive, aerospace, and industrial sectors, reducing reliance on semiconductor cycles and strengthening its position in AI and high-performance computing markets.

Still, geopolitical risks remain a drag. Tighter US export controls on semiconductor design software are expected to weigh on Chinese sales, with analysts projecting a 21% drop in China revenue to $786 million in 2025.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment