Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — October 06, 2025

Snowflake Inc. (NYSE: SNOW) hosted their Snowflake World Tour event in NYC on Thursday, October 2, 2025. Here are the key highlights and a preview of the numbers into Q3 2025.

At the Snowflake Summit 2025 this summer and the Snowflake World Tour on October 2, 2025, CEO Sridhar Ramaswamy emphasized the company’s mission to simplify enterprise AI, making it accessible, secure, and scalable. “We’re not just building AI; we’re building AI that anyone can use - safely, reliably, and at scale,” according to Ramaswamy. At the summer Summit, Snowflake highlighted Cortex AI, its LLM-powered solution for building intelligent applications, recorded over 90% accuracy in enterprise environments—underscoring the potential value of AI agents transitioning from assistive to autonomous roles.

At the October 2 event, Ramaswamy built on the vision of Cortex AI, and two notable insights emerged from the presentation about context AI and the partnership with Microsoft.

First, he emphasized the importance of context engineering and how critical it is to recall the right data. Meta’s CEO Mark Zuckerberg also highlighted context AI and how key it is for delivering high-quality output at the recent Meta Connect event. There seems to be an increasing focus on context and ensuring that models deliver the correct output, especially in agents. Deep understanding of the domain must be at the core of this context AI. There also needs to be an openness and interoperability in the enterprise to develop the context and extract value from the data.

Ramaswamy was also joined virtually on-stage by Microsoft CEO Satya Nadella. The pair discussed their partnership and the importance of bringing both human and knowledge capital together in an organization. Snowflake Management explained how the connected data cloud and ecosystem can unlock new insights to create new opportunities. Financial services firms featured prominently throughout the keynote and developer sessions and discussed how they are using Snowflake and Microsoft to bring structured and unstructured data together to support the investment process.

The role of context AI will be critical in bringing these two data types together for specific persona workflows. In tandem with the Microsoft and Snowflake partnership, geographic and sector expansion could support upside to the current product revenue consensus in the longer term.

Snowflake CEO Sridhar Ramaswamy

Source: Snowflake World Tour, October 2, 2025.

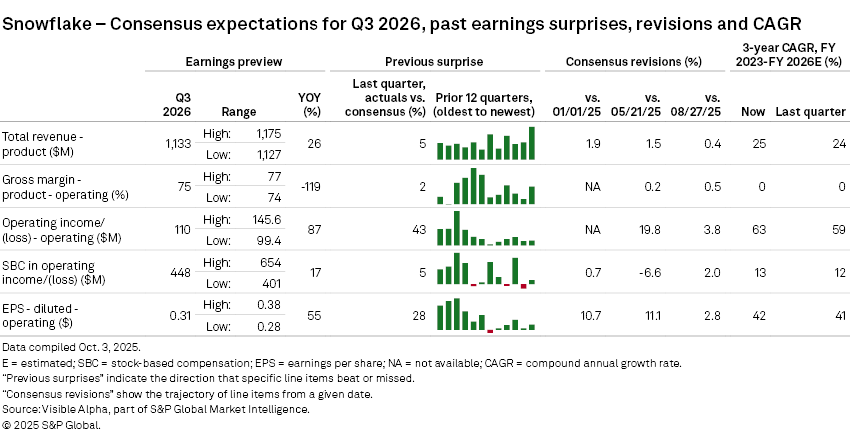

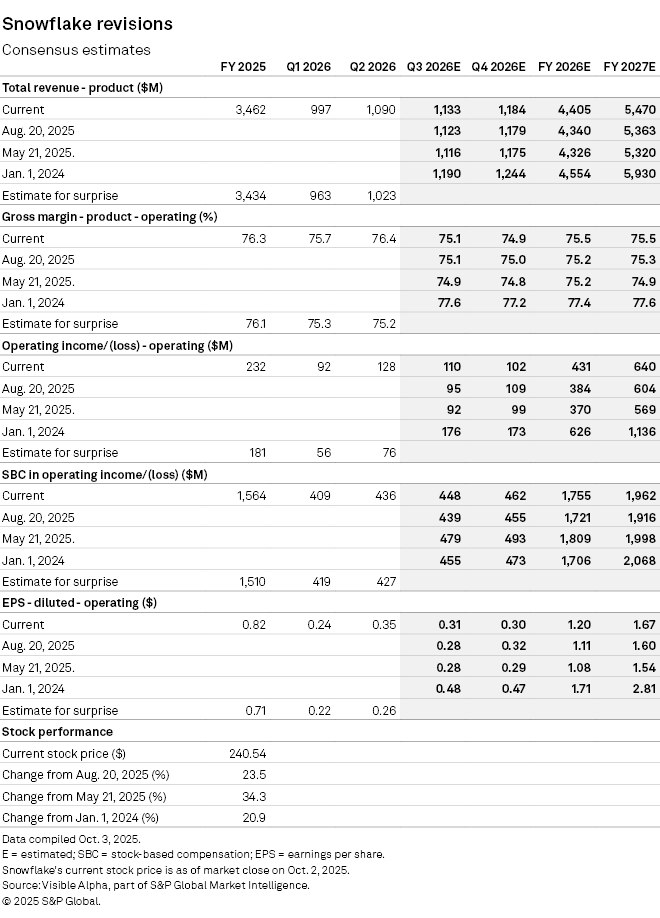

According to Visible Alpha consensus, total revenue of $1133 million and operating income of $110 million are expected for Q3 2026. Operating profit expectations for the quarter have moved up from $105 million in spring 2025. The estimates remain significantly lower than the initial $176 million estimate in January 2024. Profitability expectations for FY 2026 continue to move higher, and overall revenue has also edged up from $4.3 billion to $4.4 billion, driven by the strength of Snowflake’s data platform. Coming out of the Snowflake World Tour, it will be interesting to see if their AI-related products exceed expectations to both revenue and gross margin.

There is a debate about the gross margin performance. Based on Visible Alpha consensus, the non-GAAP gross margin estimates range from 74% to 77% for Q3 2026. For FY 2026 and FY 2027, Visible Alpha consensus for gross margin has edged up and is now at 75.5% since last quarter, but remains below the 77.5% levels expected in January 2024. There are questions about whether the new AI-related products will contribute to an overall higher gross margin in H2 2026 and longer term.

When compared to the index, the stock was a significant underperformer for most of 2024, but this year it has been outperforming and is up nearly 30% since May on an improved revenue and profit outlook. Could the Q3 release provide another positive catalyst for the stock into H2 2026?

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment