Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 14, 2025

By Nitesh Shetty

The Sherwin-Williams Co. (NYSE: SHW) is expected to post muted third-quarter results on Tuesday, October 28, as a sluggish housing market and elevated borrowing costs continue to weigh on paint and coatings demand.

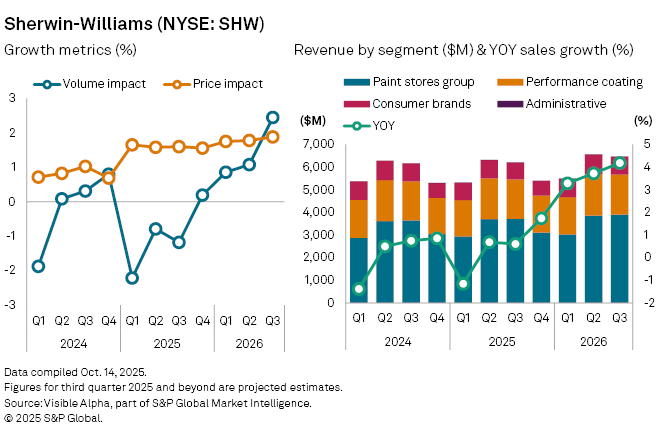

Visible Alpha consensus estimates point to Q3 revenue of $6.2 billion, up just 0.6% year-on-year, extending a streak of weak growth following a 0.7% rise in the previous quarter. The company’s core Paint Stores Group — which caters to professional contractors and accounts for nearly 60% of sales — is forecast to grow 1.9% to $3.72 billion, supported by commercial repaint activity. However, this is likely to be offset by weakness in its Consumer Brands division, where revenue is projected to fall 6% to $740 million amid softer DIY demand and a slowdown in residential construction.

Performance Coatings, which supplies industrial clients, is expected to edge up 0.8% to $1.7 billion, reflecting tentative recovery in automotive and aerospace end-markets. Pre-tax income is forecast to slip 1% to $1.02 billion — a smaller decline than the 16% drop in the previous quarter — as input cost pressures ease. Diluted EPS from operations is expected to reach $3.50.

The company’s strategic expansion into Latin America could help offset North American softness. In October, Sherwin-Williams completed its $1.15 billion all-cash acquisition of BASF’s (FWB: BAS) Brazilian architectural paints brand Suvinil, following regulatory approval in August. The deal strengthens Sherwin-Williams’ foothold in the region’s fast-growing decorative coatings market and is expected to deliver operational synergies over the medium term.

Analysts see potential for a turnaround from late 2025, with the Consumer Brands Group — which has seen revenue declines since 2023 — anticipated to return to positive growth from 2026 as housing conditions stabilize and interest rate cuts eventually filter through.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment