Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 13, 2025

By Himani Tyagi

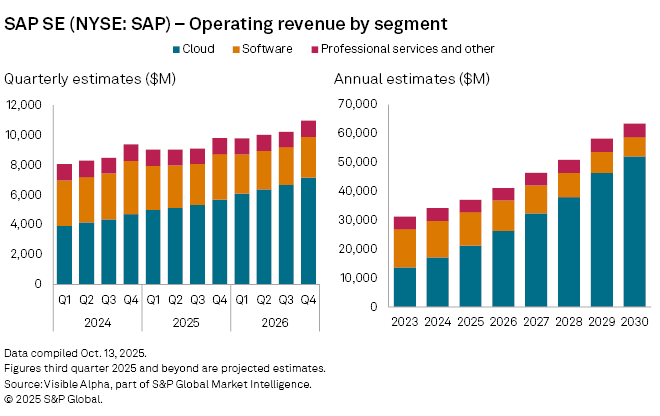

European software group SAP SE (NYSE: SAP) is expected to post solid third-quarter results on Wednesday, October 22, underlining its steady pivot to cloud-based services. Analysts expect operating revenue of €9.1 billion for the quarter, up 7% year-on-year, driven by strong demand for the company’s cloud applications and platforms.

Cloud revenue is projected to surge 22% to €5.3 billion in Q3, now accounting for more than half of SAP’s total sales, according to Visible Alpha consensus. This growth is set to more than offset continued declines in traditional software licenses and support revenue, which is forecast to fall 11% to €2.7 billion, and in professional services, down 2% to €1 billion. The company’s strategic shift away from one-off software sales toward subscription-based models continues to reshape its earnings mix.

Within cloud, SAP’s software-as-a-service and platform-as-a-service (SaaS/PaaS) segment remains the main growth driver, with revenue expected to climb 24% to €5.3 billion. Within that, its flagship cloud ERP product — sold through the “RISE with SAP” program — is forecast to expand 28% to €4.6 billion, highlighting strong enterprise demand for integrated cloud solutions. Infrastructure-as-a-service (IaaS), by contrast, remains a weak spot, with revenue expected to contract 22% to €91 million in Q3.

For the full year, SAP’s operating revenue is projected to increase 8% to €37 billion, after 10% growth in 2024. Operating profit is forecast to more than double to €9.8 billion in 2025, rebounding sharply from two consecutive years of declines, as the company benefits from a higher-margin cloud business. Analysts expect diluted earnings per share to recover to €5.73, up from €2.66 in 2024.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment