Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 07, 2025

By Santosh Saha

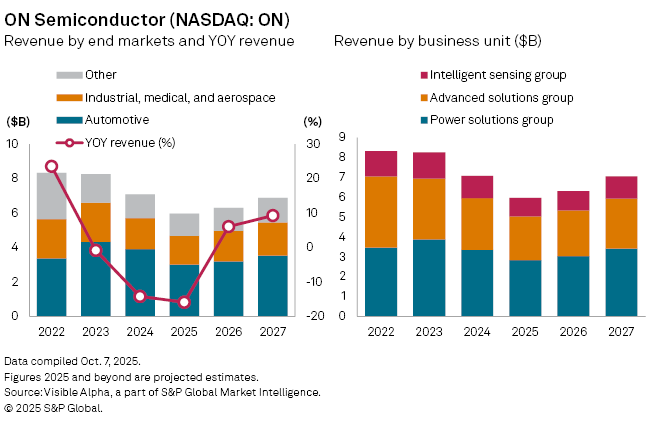

ON Semiconductor Corp. (NASDAQ: ON) is grappling with a sharp cyclical slowdown as weakness in automotive and industrial demand weighs on results. Visible Alpha consensus estimates show revenue falling 16% year-on-year to €6 billion in 2025, following a 14% decline in 2024 — reflecting supply chain constraints, pricing pressure, and muted global demand for electric vehicles.

The downturn is set to hit the company’s automotive business hardest, with revenue forecast to drop 23% to €3 billion in 2025 amid a slower-than-expected shift to EVs in China. Industrial, medical, and aerospace revenue is projected to fall 7% to €1.7 billion, as softer capital spending and inventory corrections ripple through the sector.

By segment, silicon carbide (SiC) revenue is expected to decline 18% in 2025, while non-SiC revenue will fall 17%. ON’s three main business units — Power Solutions, Advanced Solutions, and Intelligent Sensing — are all projected to see double-digit declines, led by a steep 18% drop in the Intelligent Sensing Group to €923 million.

The earnings impact is expected to be severe. Net income is forecast to slump 92% to €120 million in 2025, with diluted earnings per share plunging to €0.48 from €3.63 in 2024. Analysts, however, anticipate a sharp rebound in 2026, with net income rising more than sevenfold to €1.1 billion and EPS reaching €2.67 as end markets recover and efficiency measures take hold.

ON Semiconductor continues to invest heavily to position itself for the next growth cycle. In January 2025, it acquired Qorvo’s silicon carbide JFET technology to bolster its portfolio in power management for EVs, renewable energy, and AI data centers. In September, it announced the purchase of Vcore Power Technologies from Aura Semiconductor, expanding its AI data center offerings. The company is also executing its “Fab Right” strategy to optimize manufacturing and maintain tighter inventory control.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment