Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 17, 2025

Netflix Inc. (NASDAQ: NFLX) will report third-quarter 2025 results on Tuesday, Oct. 21, 2025. Here are the key numbers that we're watching.

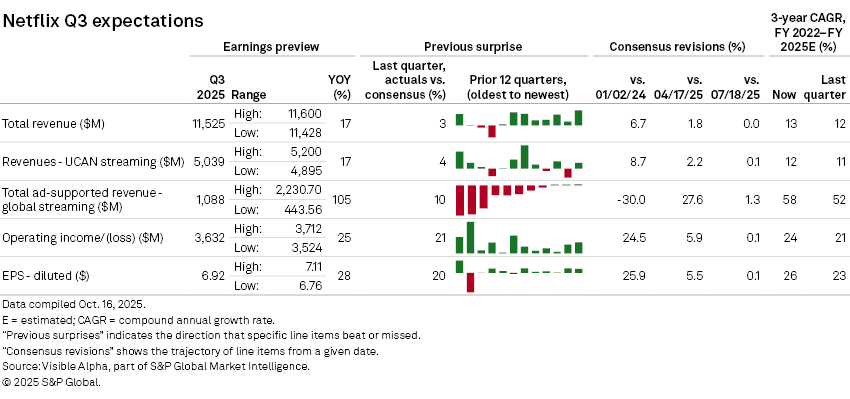

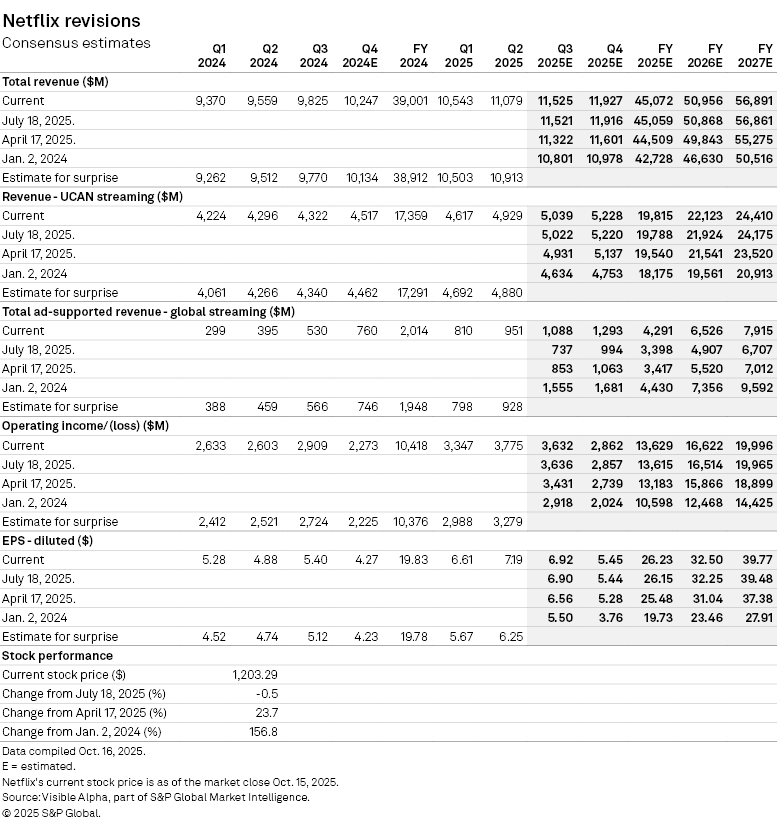

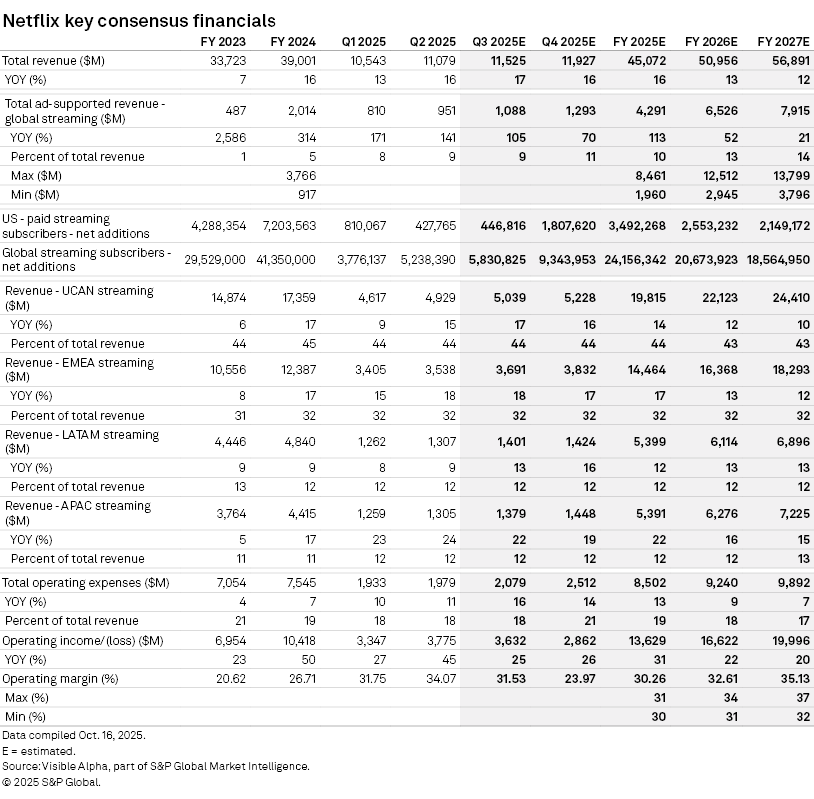

Expectations have remained stable throughout the third quarter. In the previous three-month period, the company provided guidance for a stable outlook, in line with consensus. Visible Alpha consensus expects $11.5 billion in revenue for the third quarter and $45.1 billion for full year 2025. Revenue is expected to be supported by continued new membership and monetization. Offering a range of pricing and plans, combined with continuing growth in the ads business, is expected to further increase monetization. Consensus expects the operating margin to increase to 31.5% in the third quarter and to 30.3% for full year 2025.

The company expects to grow revenue by increasing engagement trends and reducing churn while offering more diverse entertainment products. Gaming and the growth of ads could be key drivers in 2025. According to consensus, analysts now expect the company to generate a 30.3% margin, up from 29.6% in previous estimates, on expected revenue of $45.1 billion and $13.6 billion in operating profit in full year 2025.

In the spring, management highlighted that the Ad Tier enables lower prices. The company stated in the earnings call that they expect ad revenue to roughly double year over year again in 2025. Since early 2025, the ad-supported revenue estimate has been moving higher into the third-quarter earnings release. While expectations are still below the initial forecast of $1.6 billion back in early 2024, the trend is improving and is now at $1.1 billion.

Netflix remains upbeat about the long-term opportunity, given the size of its user base. Co-CEO Gregory Peters explained that 2025 will be the year that the ads business will step up to the plate to swing. Currently, consensus projects total ad-supported revenue for full year 2027 to expand to $6.5 billion, but down from the expected $7.4 billion in 2024. There is a significant range of views on the magnitude of growth. For full year 2027, the analyst estimates range has widened from $3.5 billion to $9.2 billion to between $3.8 billion and $13.8 billion.

Based on Visible Alpha consensus, the operating profit margin is expected to grow from 26.7% in full year 2024 to 35.1% in full year 2027, an increase of 70 basis points since last quarter. Currently, consensus estimates the operating margin to exceed 32% by the end of 2026. There is significant debate among analysts with respect to full-year 2027 margin estimates, which range from 32% to 37%. This margin growth is expected to take full-year 2024 expected diluted EPS from $20.22 to $39.77, or 30x the full-year 2027 P/E, significantly higher than the 25x it traded in spring. The current consensus target price has ticked up to $1,400 or nearly 17% upside from the current levels.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment