Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 16, 2025

By Tim Zawacki

Mutual of Omaha Insurance Co. intends to convert to a stock insurer in a mutual insurance holding company structure in 2026, according to newly released documents, in what would be the largest such reorganization by a US life insurer in decades.

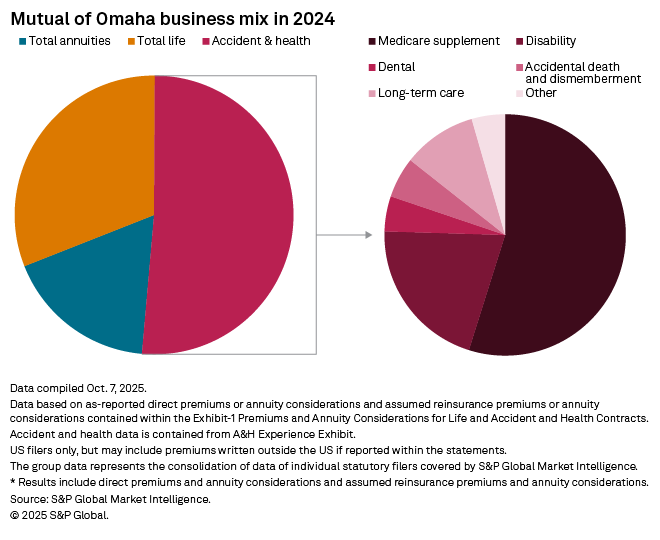

A growing number of mutual property and casualty insurers have converted to mutual insurance holding company (MIHC) structures in recent years, motivated by the additional strategic and financial flexibility the structure affords. Mutual of Omaha's rationale for a conversion is substantively similar, according to a review of the reorganization plan posted Oct. 6 by a provider of Medicare supplement, life insurance and select other products and services.

Subject to regulatory and policyholder approval, Mutual of Omaha Mutual Holding Co. would become the second-largest US life MIHC by gross premium volume behind only Pacific Mutual Holding Co., the ultimate parent company of Pacific Life Insurance Co. Of the 33 US life groups with at least $10 billion in 2024 gross premiums and considerations, 18 were organized as stock insurers with publicly traded ultimate parents, not including three groups with publicly traded alternative asset manager ultimate parents. By life insurance group asset size, Mutual of Omaha would rank as the fifth largest MIHC behind the entities that control Pacific Life, Western & Southern Financial Group Inc., Securian Financial Group Inc. and OneAmerica Financial Partners Inc.

We expect the structure to continue to appeal to mutual insurers wishing to preserve their independence and their cultures of mutuality against an increasingly competitive business landscape.

MIHC conversions among life insurers took center stage in the late 1990s as a number of state legislatures passed legislation to facilitate that activity. In Nebraska, where Mutual of Omaha is based and domiciled, the Mutual Insurance Holding Company Act was signed into law in 1997.

Many large mutual life insurers, including Mutual of Omaha, weighed MIHC conversions and full demutualizations during that era. Several of the largest mutual life insurers ultimately opted for initial public offerings within the construct of full demutualizations, including the likes of MetLife, Inc. and Prudential Financial Inc. The organization, now headed by Principal Financial Group Inc., first converted to an MIHC structure, then ultimately engaged in a full demutualization and IPO. Nebraska life insurers to have completed MIHC conversions in the late 1990s included Ameritas Life Insurance Corp. and the former Security Financial Life Insurance Co.

Since 2020, more than two dozen P&C insurers have completed or are in the process of executing MIHC conversions, including the Nebraska-domiciled entity that became known as FMNE Insurance Co. upon completion of its reorganization on April 1. MIHC conversions by life companies have been much more sporadic as strategic transformations in the sector have generally taken on other forms, but the Wisconsin-domiciled National Guardian Life Insurance Co. Inc. is joining Mutual of Omaha in reorganizing with its transaction subject to a policyholder vote on Nov. 5.

Like in other states, the Nebraska statute provides capital-raising flexibility wherein an intermediate holding company generally has equity and debt issuing capabilities, subject to certain specified limitations. In Mutual of Omaha's case, the reorganization plan allows for the issuance of capital stock by intermediate holding company Mutual of Omaha Financial Group Inc. or other stock subsidiaries of the new MIHC through actions that could include a public offering, private placement, contribution to one or more qualified employee retirement plans, or employee stock ownership plans. But, the plan states, "there is no present plan to conduct such an offering." The membership interests currently held at the mutual insurance company will shift to the MIHC, and members will retain at least a majority of the voting securities in the intermediate holding company were it to raise equity.

"Approval of the change will enable Mutual of Omaha to have greater organizational flexibility to raise additional capital, if needed, and to continue to provide high quality products and services to, and financial security for, all of its policyholders," the company said in a draft of a proposed letter to policyholders. The additional flexibility comes in the form of the prompt ability to raise capital in the event of changing economic or business conditions and the means to generate additional capital to support organic and/or inorganic growth.

"At present, Mutual can increase its statutory capital and surplus only through earnings generated by its operating businesses, the use of surplus enhancing reinsurance arrangements, the issuance of surplus notes or the sale of all or a portion of its equity interest in subsidiaries or other investments," the plan states. "However, these methods have certain limitations as a source of permanent capital to allow Mutual to expand its business and policyholder base, develop new products, make acquisitions and ultimately provide greater stability and protection for policyholders."

The Nebraska Department of Insurance will hold a public hearing on the reorganization plan on Nov. 20. Mutual of Omaha policyholders will vote on the plan during the company's annual meeting at a date to be determined in 2026.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.