Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 30, 2025

By Digvijay Todkar

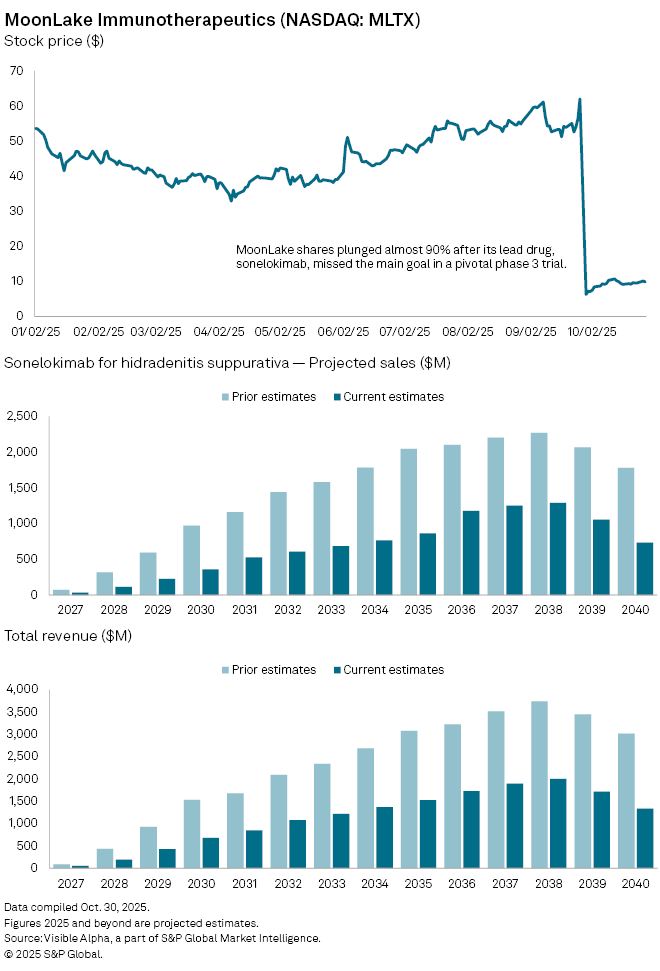

MoonLake Immunotherapeutics (NASDAQ: MLTX) lost nearly 90% of its market value late last month after its experimental inflammatory disease drug, sonelokimab, failed to meet the main goal in one of two pivotal phase 3 studies—undermining confidence in one of the biotech’s most promising assets.

The company has been testing a single 120 mg dose of sonelokimab—an IL-17 inhibitor—in two identical late-stage trials involving 838 patients with moderate to severe hidradenitis suppurativa (HS), a chronic skin condition that causes painful lesions and scarring. Only one of the two studies, VELA-1, met its primary endpoint, while VELA-2 narrowly missed statistical significance due to what the company described as a “higher-than-expected” placebo response rate.

Although MoonLake highlighted consistent efficacy trends and supportive pooled analyses across both studies, investors reacted sharply, questioning whether regulators will now require an additional confirmatory trial.

According to Visible Alpha consensus, analysts have since slashed the probability of success (POS) for sonelokimab in HS to 53%, down from 73% previously, and cut risk-adjusted revenue forecasts. Sales projections for the drug in HS have been revised down to $34 million in 2027 from $73 million, and to $113 million in 2028 from $317 million. Long-term peak sales estimates have been reduced by 43% to $1.3 billion, from $2.3 billion in 2038.

The fallout has not been limited to market value. A securities class action lawsuit was filed in mid-October, after shareholder rights firm Hagens Berman launched an investigation into whether MoonLake misled investors about its trial design and management of intercurrent events—factors that may have influenced the results.

Despite the setback, sonelokimab continues to be tested in several other inflammatory conditions, including psoriatic arthritis, psoriasis, palmoplantar pustulosis, and axial spondyloarthritis. However, analysts have revised total peak global sales for the drug down to $1.5 billion by 2038, from $2.8 billion previously, reflecting a diminished growth outlook for the company.

MoonLake’s pipeline is currently centered almost entirely on sonelokimab, leaving the clinical-stage biotech without any approved or revenue-generating products — a concentration risk that now weighs heavily on investor sentiment.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment