Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 25, 2025

By Melissa Otto, CFA

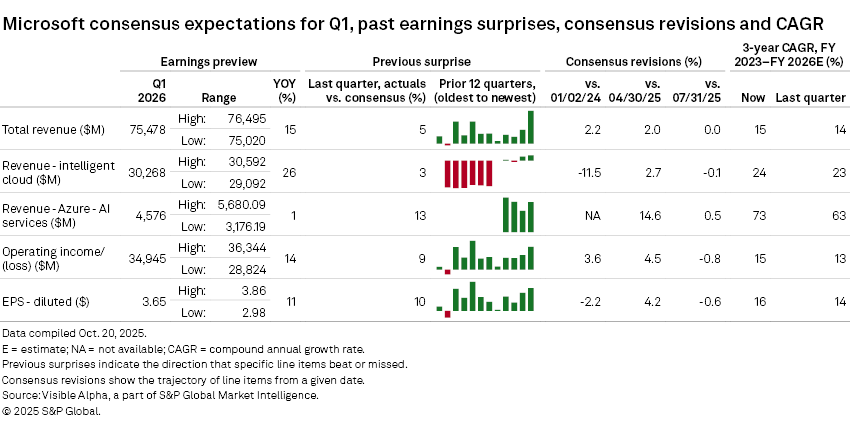

Microsoft Q1 2025 earnings preview: AI to drive upside?

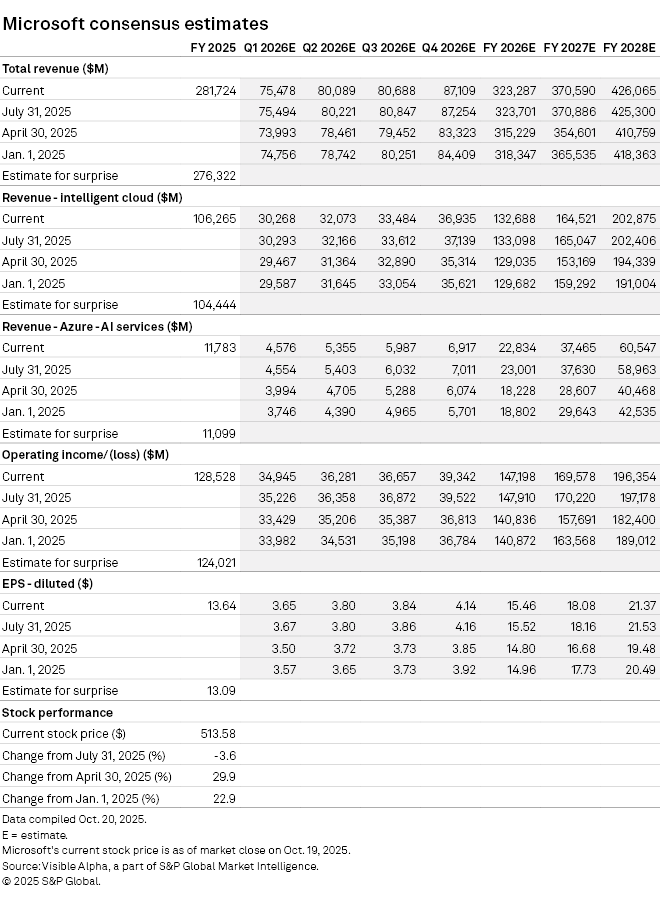

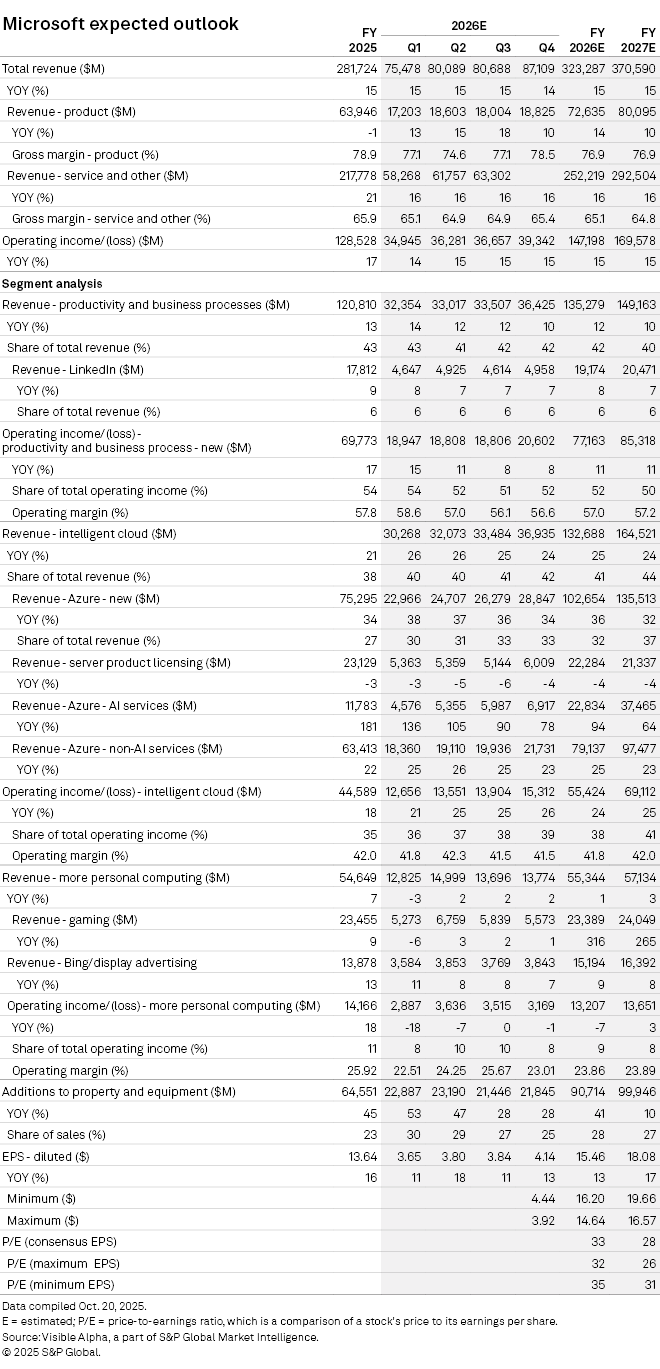

According to Visible Alpha consensus, Microsoft Corp.'s (NASDAQ: MSFT) total revenues expected for Q1 have edged up to $75.5 billion since April, driven by resilience in its core business segments. In particular, the Intelligent Cloud segment, which makes up over 40% of total revenues, is projected to remain solid, with consensus estimates now expecting $132.7 billion for FY2026, driven by Azure’s expected 36% revenue growth. The profitability of this segment is a source of debate among analysts. Currently, the Q1 2026 consensus of 11 analysts for the Intelligent Cloud business’s operating profit is $12.7 billion, but ranges from $10.8 billion to $13.5 billion, suggesting this segment could deliver a surprise in the Q1 release.

We are closely watching what the company will say about the outlook for AI and Copilot, as Microsoft’s FY 2026 CapEx numbers have continued to increase steadily since last year. According to consensus projections, CapEx estimates have doubled from $44.5 billion in FY 2024 to currently $90.7 billion in FY 2026 and estimated to hit $100 billion by FY 2027.

Microsoft stock has traded up 29.9% since the April earnings release, and is up 23.9% ytd, outperforming the 14.8% delivered by the S&P 500, but has been underperforming since the summer. The consensus P/E for 2027 is 23.9x, lower than the historic 30x levels. Could the Q1 earnings release and Q2 outlook drive continued outperformance in the stock this year?

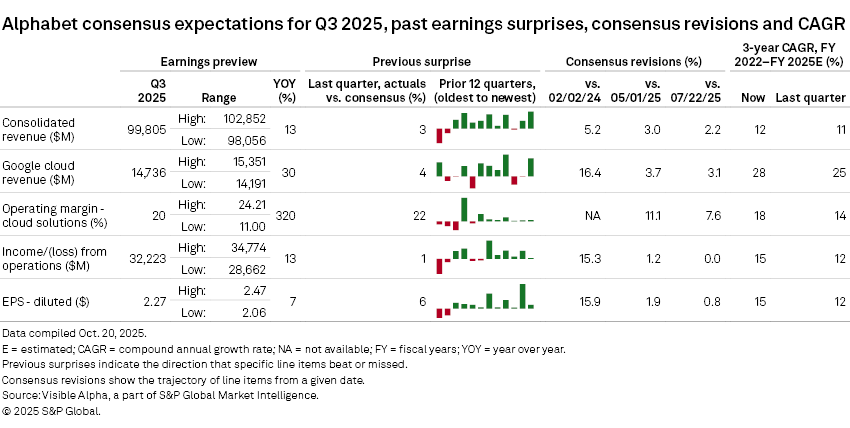

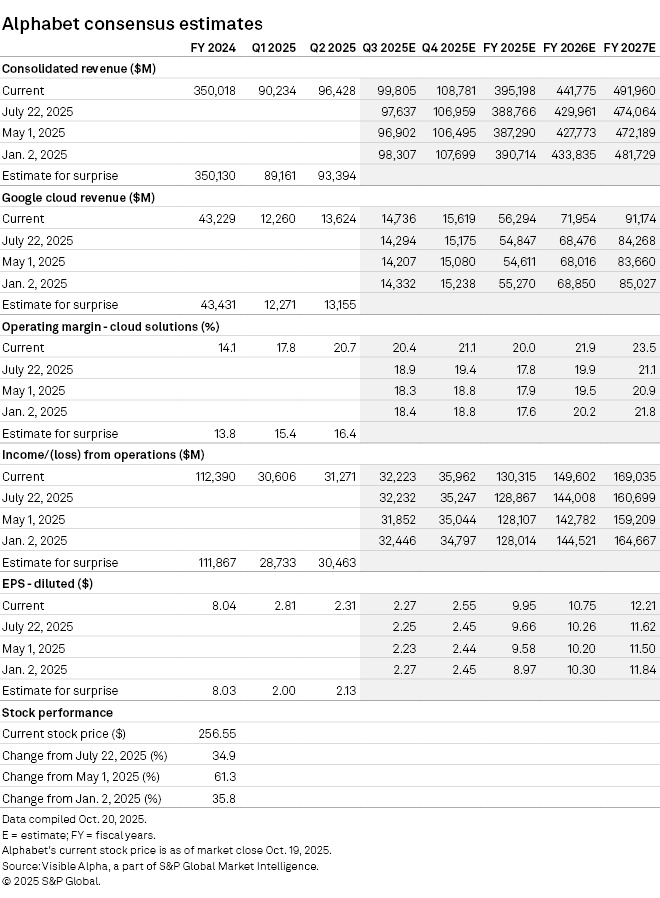

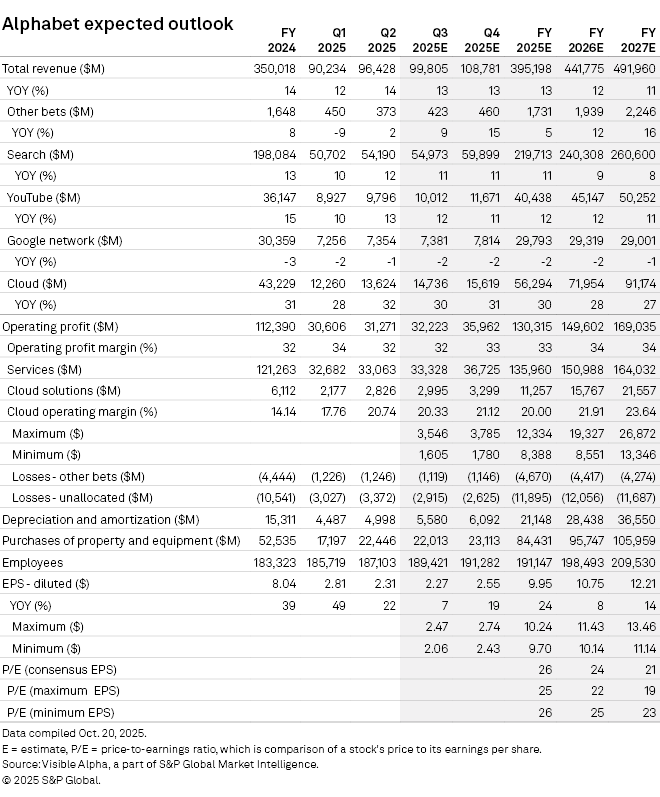

Alphabet Q3 earnings preview: What’s happening to margins?

According to Visible Alpha consensus, Alphabet Inc.'s (NASDAQ: GOOG) total revenues expected for Q3 2025 have increased to $99.8 billion from $$97.6 billion last quarter, driven by resilience in its ad business. In addition, the Q3 consensus expectations for operating income and EPS remained around $32.2 billion and $2.27/share from the beginning of the year. Questions have been emerging about the impact of AI on its core search business but have not impacted consensus revenue estimates for Q3 or the full year. However, consensus EPS of $2.27/share ranges from $2.06 to $2.47 for Q3, driven by differing assumptions around costs, particularly in its Cloud business. It will be interesting to hear what Alphabet says about the outlook.

We are closely monitoring the trend of the Cloud business. The operating profit margin has been trending better. Looking ahead to Q3 2025, analysts now expect the Cloud business to generate a 20.4% operating profit margin, up 150 bps since last quarter. However, the estimates range from 11.0% to 24.2%, signaling divergent views about the performance of this business. Longer term, analysts are also split in their views. For the Cloud business, Visible Alpha consensus expects the operating profit margin to hit 21.9% in FY 2026 but ranging from 12.0% to 26.4%. If the core Search and Ads business remains resilient, the performance of Alphabet stock is likely to be driven by the Cloud segment.

We are closely watching what the company will say about its investments into AI, as Alphabet’s FY 2026 CapEx numbers have continued to increase. According to consensus projections, CapEx estimates have nearly tripled from $32.3 billion in FY 2023 to $95.8 billion in FY 2026.

Alphabet stock has traded up 57.2% since the May release and up 33.9% in 2025, outperforming the S&P 500’s 14.8% return. The consensus P/E for 2026 is 24x. The stock has remained resilient, driven by margin expansion in its Cloud business. Could the Q3 release provide more visibility into the trajectory of 2025 and 2026 profitability and give shares a further boost?

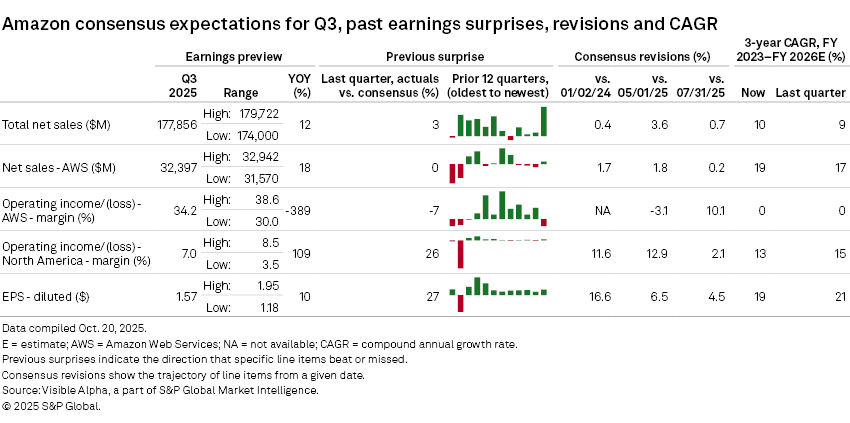

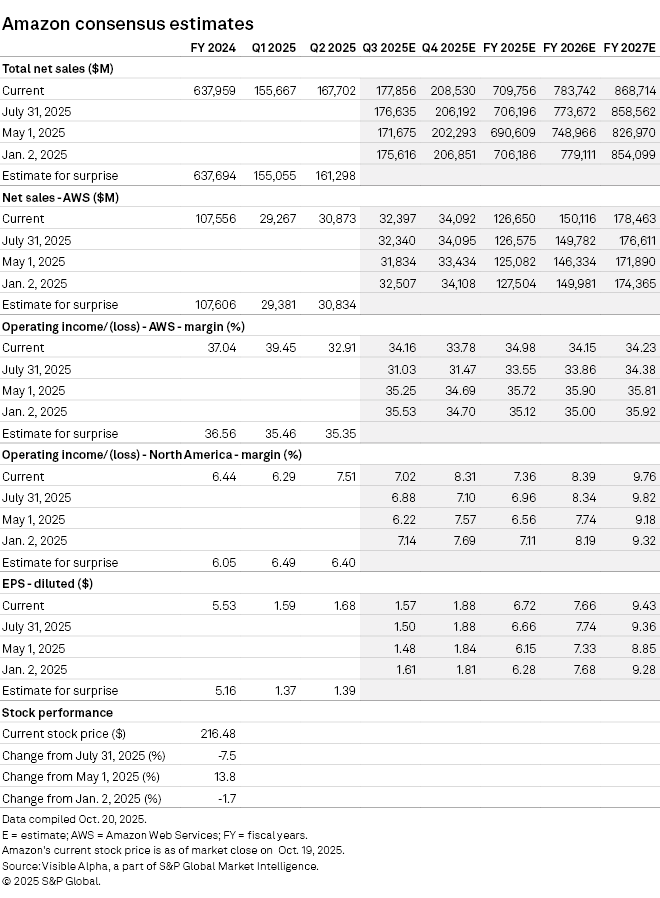

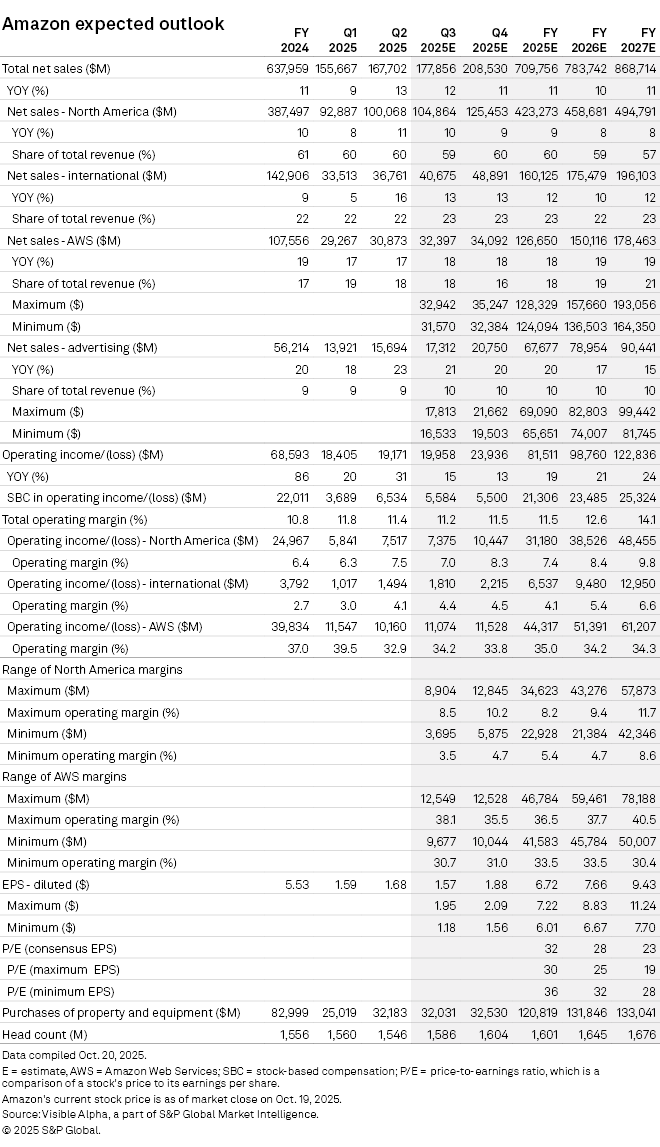

Amazon Q3 earnings preview: What’s happening to margins?

According to Visible Alpha consensus, Amazon.com Inc.'s (NASDAQ: AMZN) total revenues expected for Q3 have come up, from $171.7 billion in spring to now $177.9 billion, driven by strength in Amazon’s online retail business. Consensus expectations for AWS expectations have remained around $32 billion. The focus will likely be on the Q3 performance and Q4 holiday outlook for the online retail and AWS margins and their impact on EPS.

The North America retail operating profit margin has increased significantly from losses a few years ago to an estimated 7.0% for Q3. Operating margin expectations for North America have edged higher since spring but are lower than the 7.1% margin initially targeted in January this year. For Q3, the estimated margin range has widened to 3.5% to 8.5%, with consensus at 7.0%.

AWS margin came in at 32.9% last quarter, and for Q3, has increased since last quarter up to an expected 34.2% level but still below the over 35% level expected earlier in the year. There is a significant range of estimates for the Q3 AWS margin into the upcoming release, with analysts expecting from 30.7% to 38.1%.

We are closely watching what the company will say about its investments into AI, as Amazon’s FY 2026 CapEx numbers have continued to increase. According to consensus projections, CapEx estimates have more than doubled from $52.7 billion in FY 2023 to currently $120.8 billion in FY 2025.

The stock has traded up 12% since spring but id down -3.3% year to date, significantly underperforming the S&P 500’s 14.8% return. The consensus P/E for 2026 is 28x. Could the Q3 release provide a positive catalyst for the stock?

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment