Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 23, 2025

By Thomas Mason, Zain Tariq, and Ronamil Portes

US banks have eased off the breakneck pace of securities portfolio restructurings, but surgical trades continue, often triggered by mergers and acquisitions.

The big, pandemic-era bet — parking massive amounts of cheap deposits in long bonds — left banks exposed when rates rose. Many institutions have spent the last three years patching the resulting paper losses by reclassifying securities between available-for-sale (AFS) and held-to-maturity (HTM), selling underwater assets, and redeploying proceeds into shorter-duration, higher-yielding securities. By the end of 2024, the most frenetic activity had receded, but a steady drumbeat of targeted transactions and accounting moves continues as banks nudge their balance sheets toward improved liquidity, capital and earnings profiles.

M&A drives restructurings in 2025

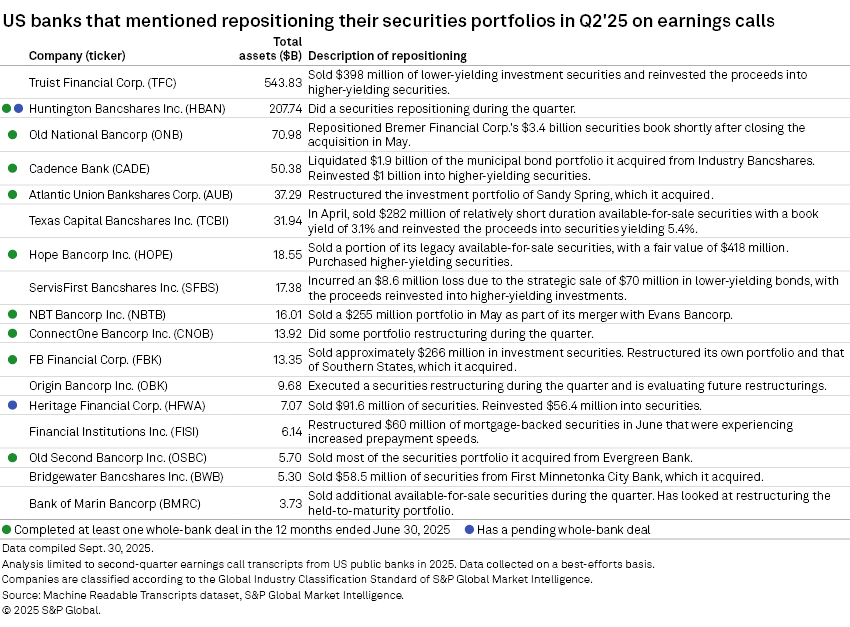

Many recent securities portfolio restructurings are tied to banks that have completed mergers. Of the 17 publicly traded US banks that mentioned securities restructurings during their second-quarter earnings calls, nine have completed a whole-bank deal this year and two others announced deals in the third quarter, an S&P Global Market Intelligence analysis found.

These banks often described repositioning as part of the post-merger cleanup process, which includes shedding inherited, low-yielding portfolios and reinvesting into shorter-duration, higher-yielding assets, or using the proceeds to pay down borrowings and optimizing capital.

FB Financial Corp. said during its second-quarter earnings call that it will restructure the portfolio of Southern States Bancshares Inc., which it acquired July 1, using the proceeds to pay down brokered funding, optimize capital and grow loans.

Cadence Bank, which completed two acquisitions this year, noted during the second-quarter earnings call that it liquidated $1.9 billion of municipal securities it inherited from the acquisition of Industry Bancshares Inc., reinvesting the proceeds into higher-yielding securities and lowering wholesale funding.

During the Covid-era, many banks absorbed a massive inflow of low-cost deposits, parking excess liquidity into long-duration Treasuries and mortgage-backed securities when yields were near historic lows. But as the Federal Reserve tightened policy and long-term yields spiked, the market value of those fixed-rate securities fell sharply, creating large unrealized losses on bank balance sheets. By year-end 2024, the most dramatic repositioning moves had already been taken, but banks remain in cleanup mode, managing losses and rebalancing portfolios for better income and liquidity.

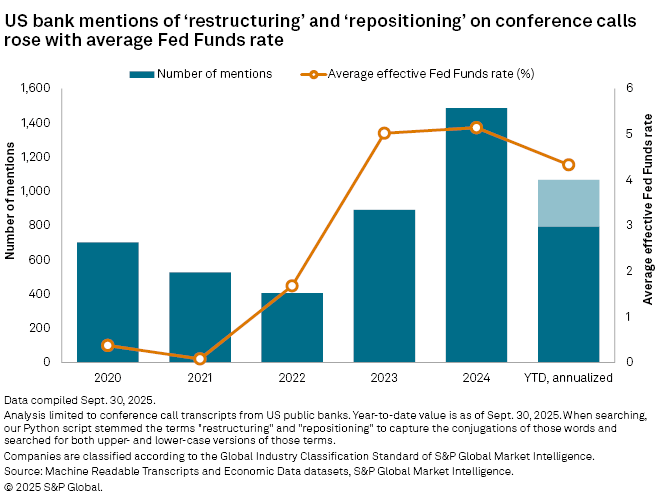

Mentions of "restructuring" or "repositioning" on US bank earnings calls have slowed in 2025 after spiking following the spring 2023 liquidity crisis. So far this year, 116 banks have cited the terms 795 times, down from 140 banks with nearly 1,500 mentions in 2024 and 892 in 2023, according to the Market Intelligence analysis. By comparison, mentions were lower in the years before the crisis — 406 across 93 banks in 2022, 527 across 114 banks in 2021 and 701 across 133 banks in 2020.

Banks scale back HTM securities

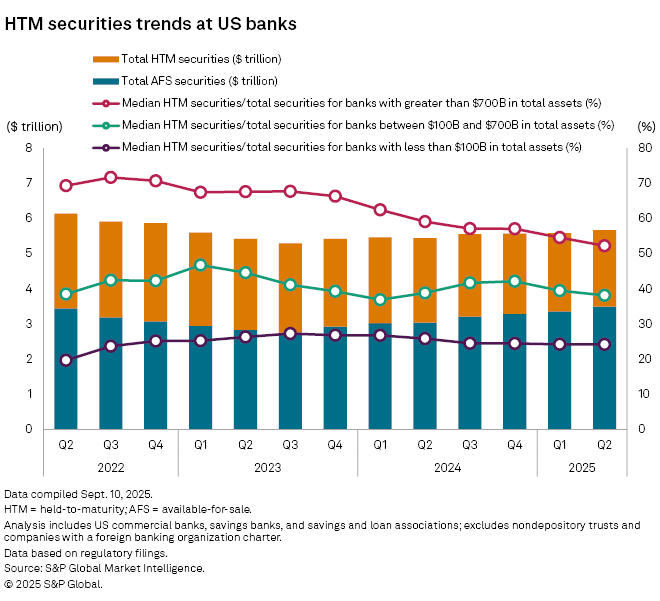

HTM securities were down for the 10th straight quarter to $2.172 trillion as of June 30, representing 38.2% of total securities, the lowest level since the end of 2021.

While banks have scaled back on HTM securities across the industry, bigger banks — those with more than $700 billion in total assets — have seen their median HTM securities declining from the peak of 71.7% at the end of the third quarter of 2022 to 52.2% as of June 30, as they opt for higher-yielding short-term AFS securities.

Regulators and investors watched marks on both AFS and HTM securities closely, especially for the larger and more complex banks. Unrealized losses on AFS securities also impact the regulatory capital for these banks, which rely more heavily on HTM securities as these bonds are recorded at amortized cost, offering stability and insulation from mark-to-market capital volatility. However, the implied losses on these bonds have surged as the yields on the securities remain well below current market levels, serving as a drag on institutions' profitability.

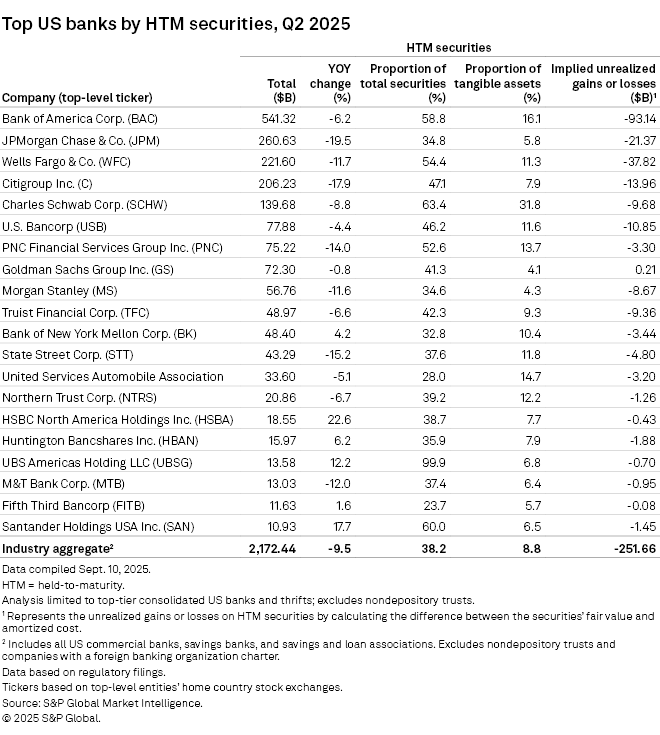

Fourteen of the 20 largest banks by HTM securities reported a decline in HTM balances in the second quarter compared to the first quarter. JPMorgan Chase & Co. led the group with its HTM securities balance down 19.5% quarter over quarter to $260.63 billion.

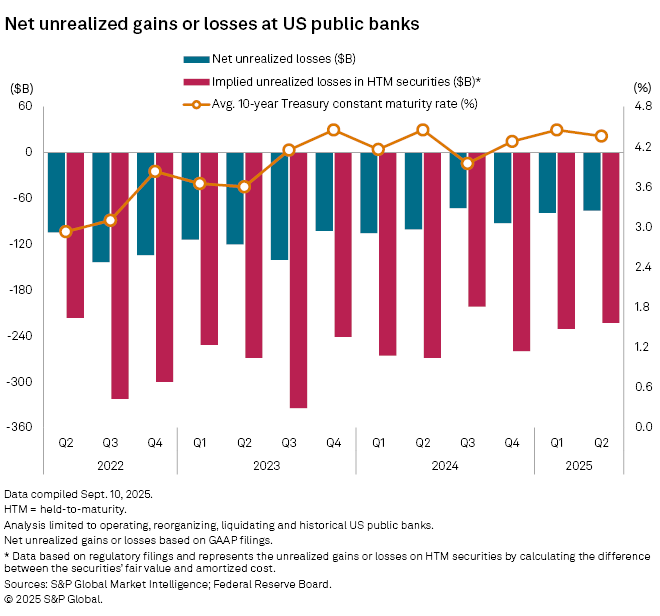

Meanwhile, implied unrealized losses on HTM securities at publicly traded US banks dropped to $222.82 billion during the second quarter from $230.71 billion in the linked quarter, down sharply from the $334.60 billion peak in the third quarter of 2023. Losses on AFS securities also moderated to $76.15 billion but remain historically high.

From fire sales to fine-tuning

With the Fed's recent rate cut easing pressure on long-term yields, banks are less likely to face forced sales as they did in 2023–24, when rising rates drove sweeping portfolio overhauls. Many institutions have already absorbed their largest losses and offloaded the most underwater assets.

But the underlying economics of seeking higher yields and lower duration exposure remain intact. The aggregate drag from unrealized losses has moderated from its peak, but it remains large enough that continued repositioning, especially by regional banks that entered the interest-rate cycle with heavier long-duration inventories, will be part of balance-sheet playbooks for the foreseeable future.

Looking ahead, activity is expected to be more selective than sweeping. Management teams are likely to continue opportunistic sales — especially in the wake of M&A — while reinvesting into shorter-duration, higher-yielding assets that benefit from a more favorable rate environment. Incremental trimming of HTM portfolios should also continue as banks weigh near-term earnings pressure against the long-term goal of improving margin and liquidity profiles.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.