Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 15, 2025

By Mrunalini Mandore

Kuehne + Nagel International AG (SIX: KNIN) is expected to post a quarterly drop in earnings when it reports third-quarter results on Thursday, October 23, as weakness across global freight markets continues to weigh on the Swiss logistics group.

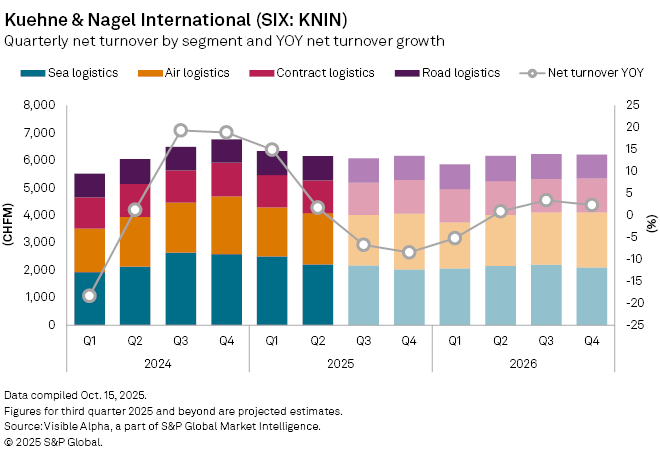

According to Visible Alpha consensus, net turnover is projected to fall 7% year-on-year to CHF 6.1 billion in the three months to September, dragged lower by soft sea freight rates and muted booking volumes. The slowdown follows a weak second quarter and is expected to persist through the end of the year, with turnover forecast to decline 8% in the fourth quarter before stabilizing in early 2026. Analysts anticipate a gradual recovery thereafter, with revenue growth returning to 1–3% by mid-2026.

The company’s Sea Logistics division is likely to remain the main pressure point, with turnover expected to drop 18% to CHF 2.2 billion. Container volumes are projected to be broadly flat at 1.12 million TEUs (twenty-foot equivalent units), reflecting subdued demand and lower pricing on major trade lanes. In contrast, Air Logistics is forecast to hold steady, with turnover rising 1.2% as resilient demand from the healthcare and e-commerce sectors offsets weaker industrial shipments. Air volumes are expected to increase 8% year-on-year to about 568,000 tons.

Road and Contract Logistics are expected to post modest growth of 3% and 1%, respectively, supported by steady European transport activity and warehouse utilization.

On the bottom line, net income is forecast to fall 32% to CHF 221 million, while gross profit is seen down 3% to CHF 2.1 billion. Diluted earnings per share are projected at CHF 1.8, compared with CHF 2.0 in the prior quarter. Profitability is expected to remain under pressure into early 2026, constrained by a mix of weak freight pricing, adverse currency movements, and sluggish global trade volumes.

Analysts note that the near-term outlook for global logistics remains uncertain amid rising protectionist measures and ongoing disruptions in shipping routes. However, they expect gradual normalization in trade flows and inventory restocking in the second half of 2026 to underpin a moderate recovery in margins.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment