Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 07, 2025

Ionis Pharmaceuticals, Inc. (NASDAQ: IONS) secured US regulatory approval for its hereditary angioedema (HAE) drug, marking another milestone in the biotech group’s transition from a research-focused company to a commercial player. The treatment, donidalorsen — to be marketed as Dawnzera — won approval from the US Food and Drug Administration in August 2025, becoming the first RNA-targeted therapy cleared for the rare genetic condition.

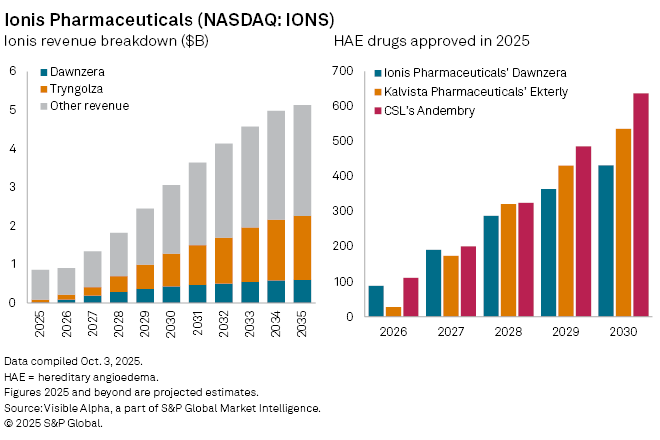

Analysts expect Dawnzera to generate sales of $13 million in 2025, climbing to $84 million in 2026 as adoption grows among US patients. Revenue is projected to reach $434 million by 2030, with peak global sales estimated at $567 million by 2035. The therapy’s contribution to Ionis’s total revenue is forecast to expand from 2% in 2025 to 16% by 2028.

The market for HAE therapies has become increasingly crowded. Dawnzera follows approvals of KalVista Pharmaceuticals Inc. (NASDAQ: KALV) Ekterly in July and CSL Ltd. (ASX: CSL) Andembry in June, while Takeda Pharmaceutical Co. Ltd. (TSE: 4502) Takhzyro, launched in 2018, remains the established therapy for this indication. Emerging competitors, including Intellia Therapeutics Inc. (NASDAQ: NTLA) gene-editing candidate, are also vying for future market share.

Dawnzera is only the second medicine Ionis will commercialize independently, following Tryngolza, approved in December 2024 for familial chylomicronemia syndrome. That drug is expected to generate $75 million in 2025 sales and achieve blockbuster status — surpassing $1 billion annually — by 2031.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment