Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 24, 2025

By Husain Rupawala and Tim Zawacki

At the recent Monte Carlo reinsurance summit, the use of AI and aerial imagery emerged as key tools for homeowners' risk assessments. As insurers adopt these technologies, they face pressing questions about their efficacy, fairness, and compliance with regulatory standards. Increased innovation in the property insurance business has invited new public scrutiny and, in turn, raises prospects for additional regulatory oversight.

The use of AI and aerial imagery is gaining traction among insurers looking to enhance their risk assessment processes and reduce financial volatility even beyond the array of capabilities offered by catastrophe models. Our anecdotal analysis of rate and product filings reveals that regulatory questionnaires in select states now require insurers to disclose their methodologies regarding AI usage in actuarial computations. Despite the potential benefits of these technologies, insurers are facing scrutiny from regulators and stakeholders concerned about biases, data quality, and the implications of relying on automated systems for critical underwriting decisions.

As innovation accelerates in the property insurance industry, it brings with it heightened public interest and headline risk among a populace that has grown weary of mechanisms that could lead to further pressure on homeowners insurance availability and affordability, leading to discussions around the need for strengthening regulatory frameworks. Integrating aerial imagery into risk assessment presents both opportunities and challenges. While it offers detailed evaluations of property conditions, such as roof integrity and tree overhang, certain regulators have questioned its application in risk assessment. Concerns about the accuracy and fairness of automated assessments arise, particularly regarding potential biases that could influence underwriting outcomes. Additionally, the deployment of drones for property assessments raises privacy and regulatory concerns, prompting some states to consider more closely regulating their use through legislation.

As insurers adopt next-generation technologies, adhering to regulatory requirements and best practices for integrating AI and aerial imagery is essential for ensuring compliance and maintaining trust with a wide range of constituencies. Proactive outreach regarding the nature and benefits of these technologies is a critical component of that effort.

State insurance regulators have embraced the application of catastrophe models for perils such as hurricanes, severe convective storms and wildfires at varying paces and levels of enthusiasm. Carriers' addition of new layers of analysis through aerial imagery to optimize underwriting and pricing functions has attractive a growing amount of attention from regulators and elsewhere.

The Connecticut Insurance Department, for example, has taken a proactive stance, introducing a checklist for insurers about their methodologies for incorporating AI and/or machine learning into risk assessments. This has led to a demand for detailed disclosures regarding the specific methodologies employed and the third-party vendor partnerships utilized in these assessments. For instance, New London County Mutual Insurance Co. when selecting "yes" to the use of AI in a recent rate filing, has been required to clarify how its models differ from those previously approved by the department, ensuring that its practices adhere to established regulatory standards. This additional layer of scrutiny reflects a broader trend among regulators to ensure that the adoption of advanced technologies in insurance underwriting maintains fairness and accuracy, ultimately safeguarding consumer interests while fostering innovation within the industry.

Certain subsidiaries of The Allstate Corp. have integrated aerial imagery into their underwriting processes through the introduction of Roof Condition and Tree Overhang parameters. These parameters evaluate the roof's condition and the percentage of tree overhang affecting the insured property, assigning scores based on aerial assessments.

But as correspondence between Allstate and Indiana state regulators highlights, the introduction of this technology can prompt concerns. The regulators raised objections regarding usage of roof condition and tree overhang, questioning the fairness of penalizing insureds when aerial images are unobtainable due to factors beyond their control, such as tree cover. The regulators are emphasizing that the insurers must demonstrate that their reliance on aerial imagery does not unfairly disadvantage policyholders, particularly when it comes to assigning roof condition scores based on incomplete data.

A rate filing in Connecticut by Milliman Inc. on behalf of Nearmap US Inc., a provider of high-resolution aerial imagery, shows that its Nearmap AI System Gen 6 Model can clearly identify various features of structures, roofs, and properties from aerial imagery. This model utilizes a vast dataset of over 1.7 million examples, significantly expanding upon previous versions and incorporating more current data from multiple states. Its proprietary aerial imagery is captured using advanced aircraft equipped with sophisticated camera systems, ensuring high-quality visuals for analysis. As insurers increasingly rely on the services of vendors like Nearmap, they can enhance their underwriting processes while addressing regulatory concerns about accuracy and fairness, ultimately leading to more informed risk assessments and improved policyholder outcomes.

Similar analysis of filings in Michigan and California also show how regulators are examining the implications of using aerial imagery in property assessments. Insurers in these states are introducing checklists regarding the methodologies used for evaluating roof conditions and other property attributes. The introduction of the ISO Roof Condition Report, for instance, has emerged as a key reference point for insurers to benchmark their practices against established industry standards. As more states implement similar regulatory frameworks, insurers must be prepared to demonstrate the robustness of their AI models and the accuracy of their aerial assessments, ensuring compliance while maintaining the integrity of their underwriting processes.

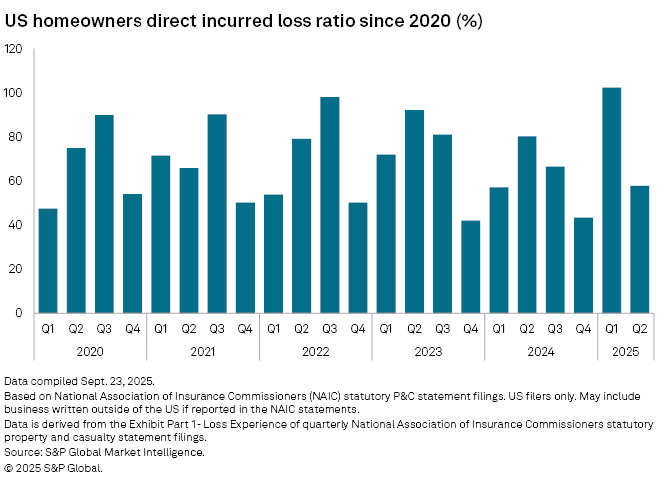

We discussed the significant impact of climate change on the insurance industry, necessitating new strategies and practices to effectively assess these risks. As the stakes rise, particularly in the US homeowners insurance market, insurers are actively revising policy forms and rules to address climate-induced risks, making the integration of new technologies essential to their efforts. Allstate's subsidiaries' revisions to their homeowners manuals now explicitly mention the use of aerial imagery for assessing roof conditions and tree overhang, which are critical factors in underwriting decisions.

Despite the potential advantages, insurers must address critical questions regarding the validity of their data sources and the processes employed to analyze aerial imagery. The reliance on third-party vendors mentioned in the rate filings raises important questions about the transparency and reliability of the data being utilized. Insurers are expected to provide evidence that their AI systems have been thoroughly vetted to eliminate biases and ensure equitable treatment of policyholders.

With the increase of AI in the insurance sector, the regulatory framework will be subject to further adaptation. While some insurers have embraced AI for underwriting and risk assessment, regulators are acutely aware of the potential for bias in these assessments, leading them to seek assurances from insurers about the fairness and accuracy of their models. A growing number of reports by local television news programs, radio networks and consumer advocates highlighting the use of drones in the underwriting process may not accurately or completely portray how the technology is being applied, which may in turn prompt public calls for legislators and regulators to consider cracking down.

Insurers must be prepared to engage with regulators on the use of AI-driven assessments, address concerns about data quality and bias, and demonstrate the effectiveness of their methodologies. They also should consider more proactively and transparently educating their customers on how underwriting, pricing and risk-sharing elements of homeowners insurance are rapidly evolving to ensure their continued ability to offer coverage, pay claims and mitigate risk in ways that may be as beneficial for customers as carriers themselves.

As the world moves toward artificial intelligence, the successful adoption of AI in insurance will depend on transparency, accountability, and a commitment to fair and equitable practices.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.