Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 23, 2025

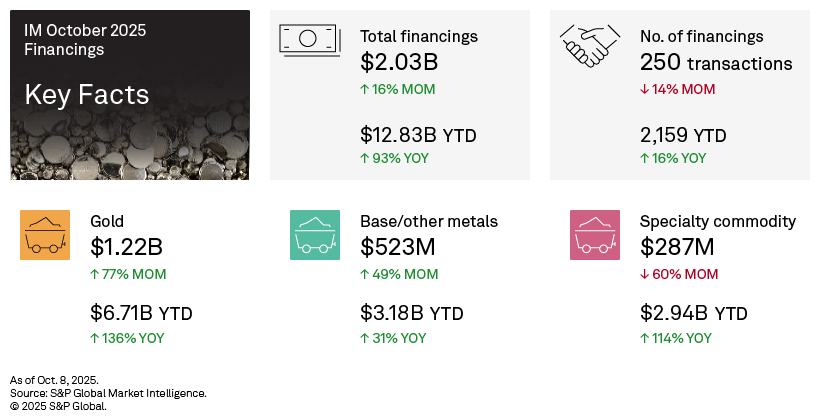

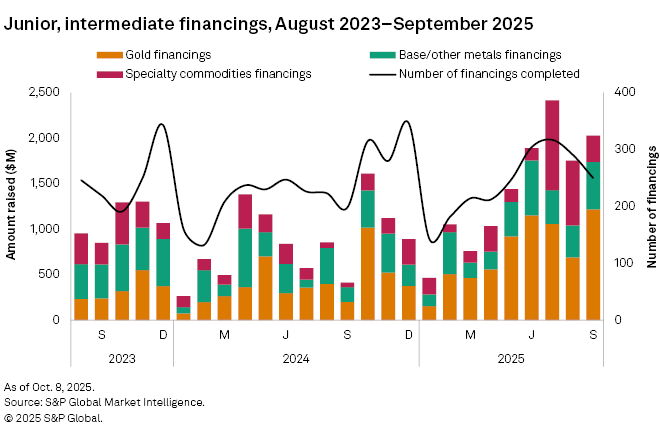

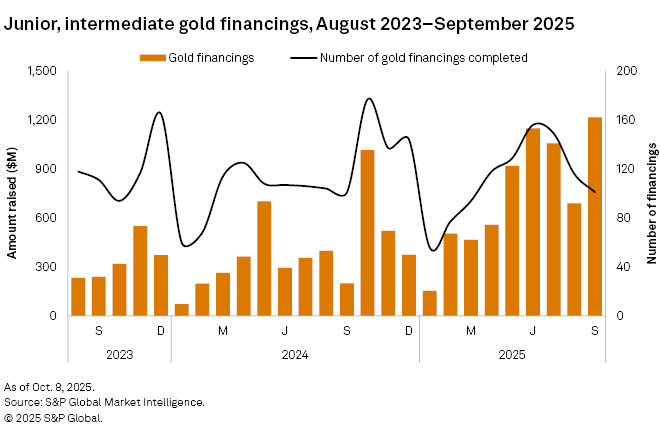

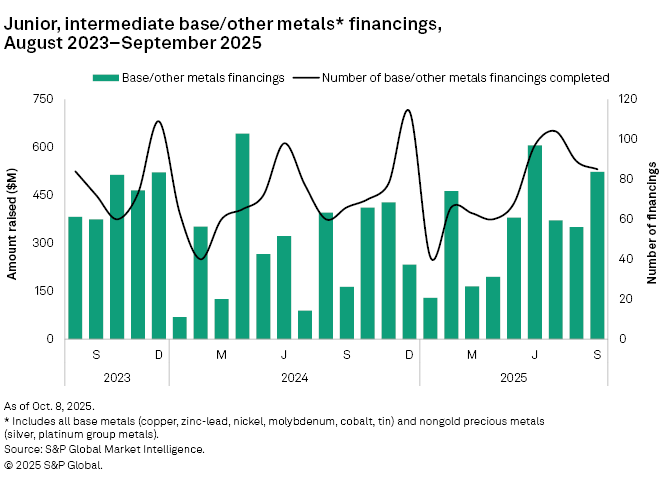

Funds raised by junior and intermediate companies rose 16% to $2.03 billion in September after a one-month decline that followed four consecutive months of increase, peaking at $2.42 billion in July. Two of the three commodity groups posted gains, led by gold, which rebounded strongly after hitting a four-month low in August. The number of transactions in September fell to 250, 14% lower than August's 291. Significant financings — transactions valued at over $2 million — rose to 117, compared to 107 in August. There were 10 transactions valued at over $50 million, up from six in August.

September 2025 financing data is available in the accompanying databook.

Gold fundraisings surge to historic high

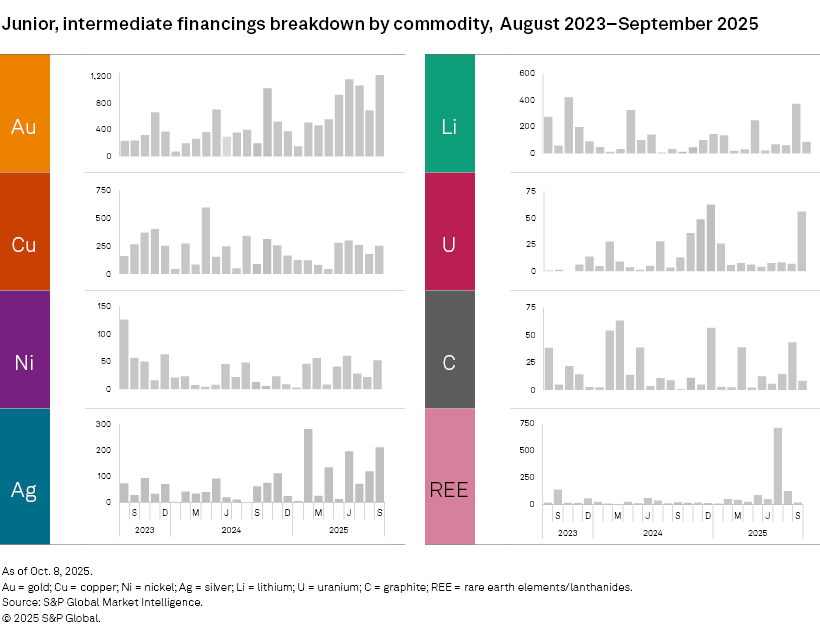

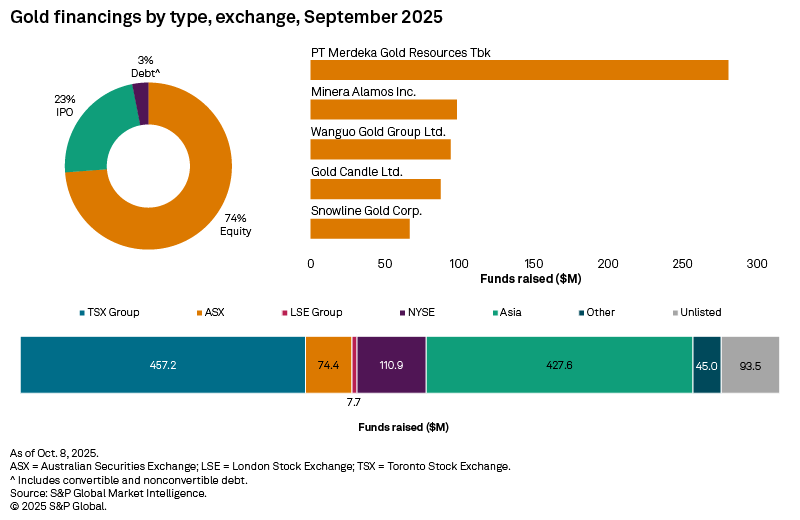

Gold financings rebounded sharply, rising 77% month over month to $1.22 billion, reaching a new all-time high in our records dating back to January 2014. The total number of transactions decreased to 101 from 116, while the number of significant transactions rose to 52 from 45. There were seven transactions valued at over $50 million, up from three in August.

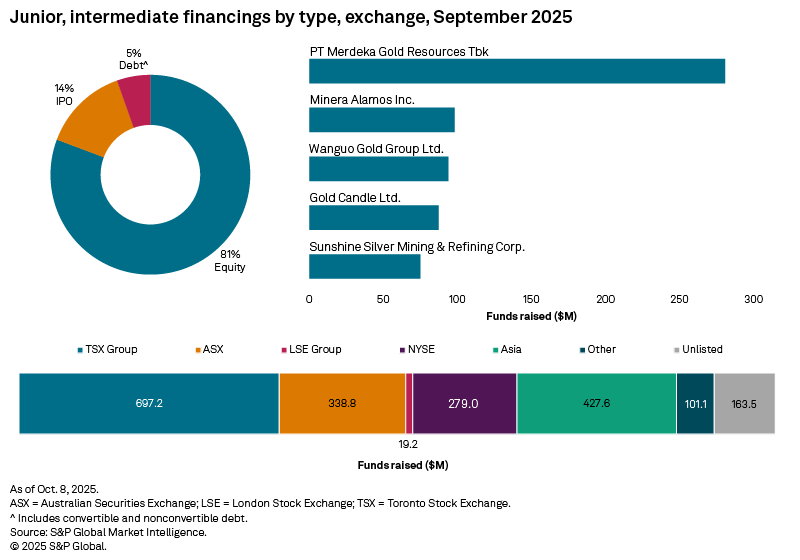

The largest gold financing and the largest overall was a $280.7 million IPO by Indonesia-based PT Merdeka Gold Resources Tbk. The company was officially spun off from PT Merdeka Copper Gold Tbk and listed on the Indonesia Stock Exchange in September 2025. The transaction is part of a broader capital program to support the company's gold development initiatives, notably the Pani gold project in Indonesia's Gorontalo province.

Copper, silver, nickel lift base, other metals group

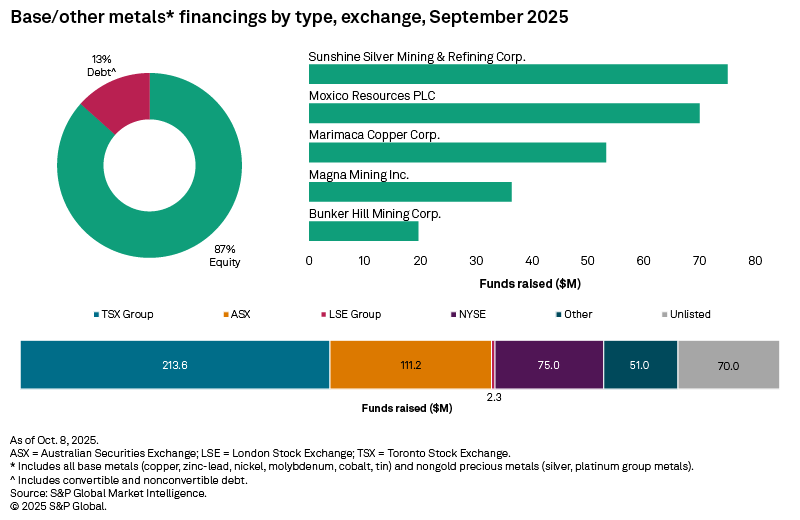

Funds raised for the base and other metals group rose 49% to $523 million in September. While not all major commodities in the group increased, copper, silver and nickel drove the gains. The number of transactions in this category slightly declined 4%, to 85 from 89 in August, while the number of significant financings rose to 43 from 30. There were three transactions valued at over $50 million, up from one in August.

The largest financing in this category and the fifth-largest overall was a $75 million private placement by the unlisted Colorado-based Sunshine Silver Mining & Refining Corp. Proceeds from the fundraising will be used to develop the Sunshine critical minerals mine in Idaho.

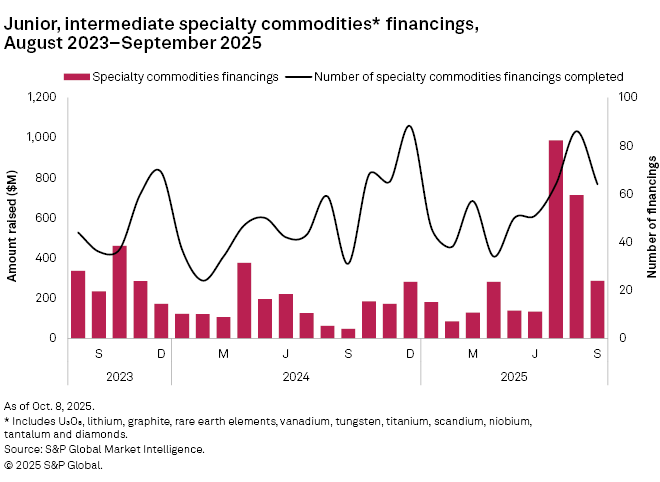

Specialty group hit again as lithium, tungsten, rare earths fall

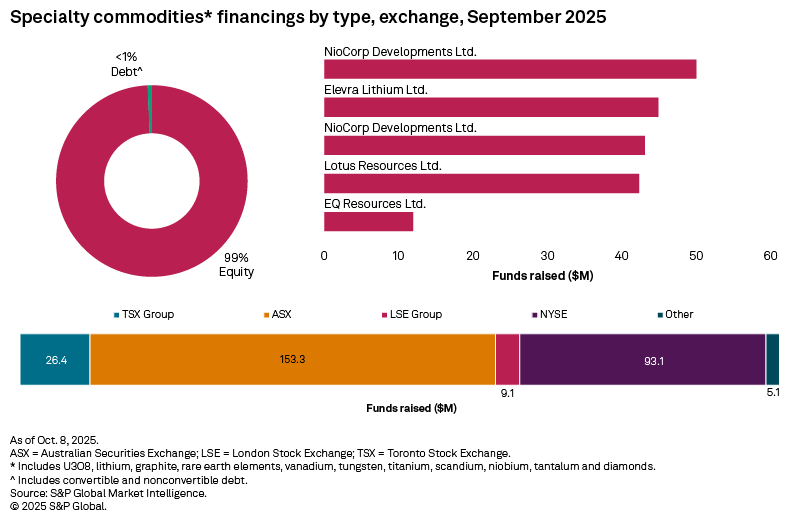

Funds raised for specialty commodities dropped for the second consecutive month, falling 60% to $287 million from $715 million in August. Lithium, tungsten and rare earth elements posted sharp declines, while uranium and niobium increased notably. The total number of transactions decreased to 64 from 86, and the number of significant financings fell to 22 from 32. There were no transactions valued at over $50 million, compared to two in August.

The largest specialty financing was a $50 million private placement of common stock by Colorado-based NioCorp Developments Ltd. Proceeds from this transaction will support the continued development and construction of NioCorp's Elk Creek niobium project in Nebraska.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.