Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 16, 2025

By Adam Wilson

Transmission and distribution, or T&D, constraints — once considered the primary concern for developers and grid operators — have seemingly taken a backseat in the face of drastic reversal of energy policy at the federal level and rising electricity demand driven largely by AI data center expansion efforts. Interconnection queues remain overcrowded despite efforts to clear project backlogs, and large load facilities, namely data centers, are also facing increasing interconnection timelines. As a result, transmission upgrades remain a critical point emphasis as US grid infrastructure struggles to keep pace with a rapidly changing energy landscape.

Despite the increasing demand for electricity driven by AI data center expansions, curtailment of wind and solar generation is on the rise across multiple independent system operators. This is primarily due to the insufficient grid infrastructure to transport excess renewable generation to load centers due, in part, to a disconnect between areas of high renewable output and data center and other large load concentrations.

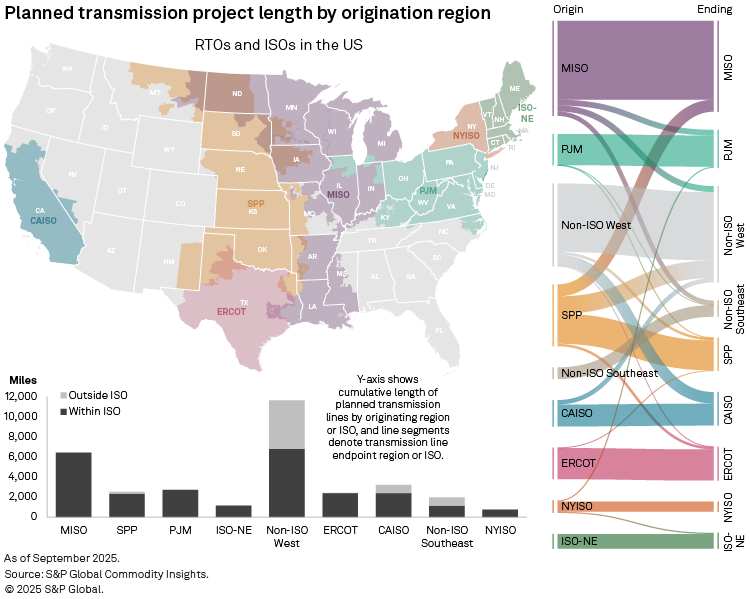

Planned transmission projects in the US have increased 25% from 2024 levels. Regions like MISO and the non-ISO West are leading in planning substantial transmission projects to accommodate new generation anticipated to come online to power data centers.

Utility investment in T&D infrastructure is rapidly increasing, with utility combined capital expenditure of $84.9 billion in 2025. This reflects a significant rise in spending, driven by the need to support the expanding data center market and the overall demand for reliable energy infrastructure, despite some uncertainties in federal support for grid upgrades.

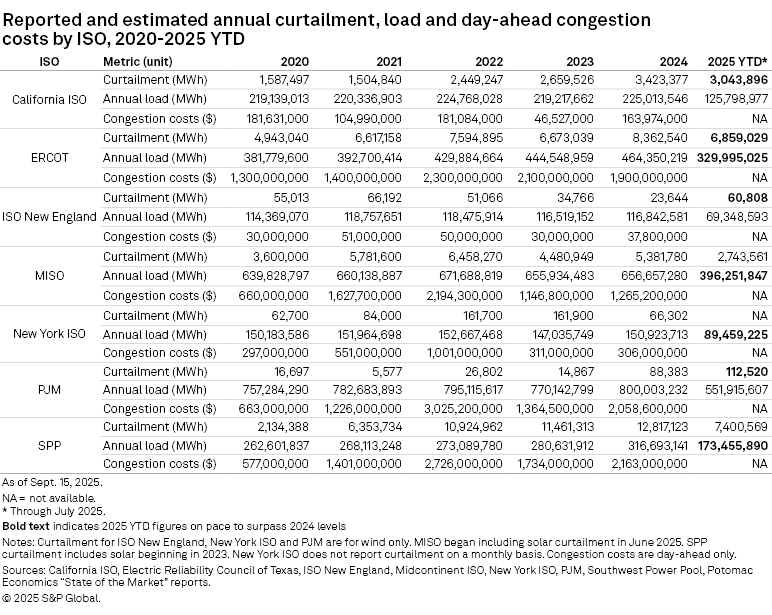

Curtailments rise across most ISOs

Curtailment, which is the purposeful reduction of power output from power plants as mandated by grid operators, can serve as a valuable indicator of regional T&D constraints as grid infrastructure is not sufficient to transport excess generation to more distant load centers. The intermittent and unpredictable nature of wind and solar generation results in these resources being subject to curtailment. There are multiple reasons for curtailment, but simply put, it is primarily a result of wind or solar plants producing more power than what is needed at a given time.

Despite increasing demand due to energy-intensive AI data centers, curtailment of wind and solar generation continues to rise in many regions. While data center owners and hyperscalers are making efforts to build new facilities in proximity to wind and solar plants, there remains a disconnect between areas of strong renewable generation and areas of high data center concentration. Four of the seven ISOs — California ISO, Electric Reliability Council of Texas Inc., PJM Interconnection LLC and Southwest Power Pool — set records for annual curtailment in 2024.

Curtailment in SPP, which comes almost entirely from wind generation, has risen sixfold from 2020 to 2024. Through July 2025, curtailment is on pace to fall just short of the 2024 level, so it may be beginning to level out in the region. SPP has experienced notable load growth as well, with the 2024 annual load up almost 21% from 2020. However, nearly 14 GW of wind power has been installed in SPP since the beginning of 2020.

ERCOT surpassed 8 million MWh of combined solar and wind curtailment in 2024, breaking the mark set two years prior. Load in ERCOT has also jumped over 20% since 2020, but renewable growth has seemingly outpaced it with 41 GW of wind and solar capacity installed since 2020. Curtailment in 2025 is on track to set another annual record in ERCOT. In PJM, curtailment historically has been minimal, but 2024 figures jumped nearly six times the 2023 level and 2025 has already surpassed the 2024 high.

Congestion costs are another reliable metric for grid congestion as it indicates the inability to access lower-priced generation further away from load centers, resulting in closer but higher-priced generation being utilized instead. Unlike curtailment, however, congestion costs across all ISOs have seemingly leveled out. Cumulative congestion costs peaked in 2023 at $11.5 billion. Congestion costs in 2024 rose slightly after falling substantially in 2023, reaching $7.9 billion in total. Similar to curtailment, SPP leads all ISOs in annual congestion costs, followed by PJM and SPP.

Planned transmission increasing

Planned transmission projects in the US has increased substantially from 2024 with nearly 26,700 miles of transmission and distribution lines in development according to Market Intelligence data, a 25% increase from 2024. Midcontinent ISO leaped ahead of the non-ISO West region in miles of intraregional transmission projects in planning, with just under 5,600 miles of transmission lines planned within the ISO territory. MISO is three years into its $10.3 billion grid investment effort. Another 2,000 miles of transregional projects are planned to either originate or end in MISO.

Despite a slight regression from 2024, the non-ISO West region remains highly active in transmission planning with over 4,800 miles in planning. Not surprisingly, given the region's large, sparsely populated footprint, the non-ISO West is the origination or destination of 12 transmission lines of 200 miles or longer. The West is home to multiple data center growth centers, including Phoenix, Reno and rural Oregon. Further, there are currently 175 GW of wind, solar and battery storage in development across the non-ISO West as it remains one the hot spots for clean energy development despite shifting federal support. Long-distance transmission lines are crucial to transport this power to major load centers.

SPP has boosted its transmission project pipeline considerably with over 2,100 miles of intraregional power lines now planned, adding nearly 1,000 miles since 2024. This is following the ISO's massive investment in regional grid upgrades and expansion totaling $7.7 billion. No ISO, however, has seen their T&D pipeline grow more than ERCOT as the development pipeline within and interconnecting to ERCOT totaled less than 500 miles in 2024. That figure has nearly quintupled in 13 months to over 2,400 miles. ERCOT has a staggering 197 GW of wind, solar and battery storage in development, with another 28 GW of natural gas to support it. This impressive pipeline of energy infrastructure is in line with the significant amount of data center load growth expected in Texas. Recent projections from 451 Research indicate that Texas' data center electricity demand is expected to grow from 7.7 GW in 2025 to 14.5 GW by 2030 — the second largest increase behind Virginia.

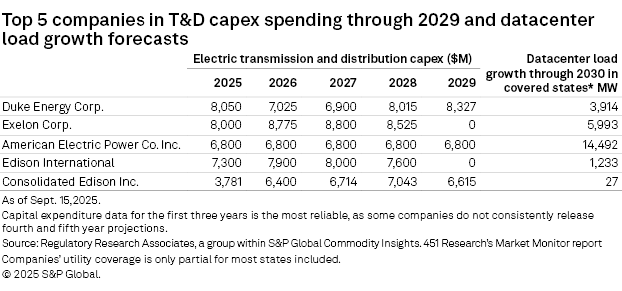

T&D capex surging

Combined utility investment in T&D infrastructure continues to increase at a blistering pace. T&D capex in 2025, according to the Fall 2025 utility capex outlook, is $84.9 billion, up more than $12 billion from 2024 levels. The cumulative five-year T&D spending through 2029 is $436 billion among major utilities. This is a 46% increase from the 2023 T&D capex projections. The distribution side of T&D spending accounts for roughly two-thirds of the overall total. Top electric utilities in T&D spending typically have two common denominators — large geographic footprints across their subsidiaries and coverage in growing markets for data center development.

Duke Energy Corp. leads all utilities in five-year T&D spending at $38.3 billion through 2029. Duke Energy subsidiary territories include most of North Carolina, South Carolina and Indiana, which are all emerging data center markets, with 451 Research projecting nearly 4 GW of data center growth in these three states by 2030.

Behind Duke Energy in five-year T&D capex spending is Exelon Corp. at $34.1 billion. Exelon subsidiaries include Commonwealth Edison Co. covering northeast Illinois and multiple utilities across Delaware, Maryland, New Jersey, Pennsylvania and Washington, DC. Major data center growth is expected, particularly in Illinois and Pennsylvania. American Electric Power Co. Inc. is close behind at $34 billion and ranks first in transmission spending at $20.6 billion. AEP has subsidiaries in major data center markets including Louisiana, Ohio, Indiana and Texas. These four markets have a combined data center forecast growth of over 14 GW.

This increase in T&D infrastructure investment is more than four years removed from the Biden administration dedicating $10.5 billion in grid upgrades and expansion. Certain grid upgrade efforts, however, face significant uncertainty after the Energy Department announced contract cancellations totaling $7.6 billion, which include 26 grants issued by the DOE's Grid Deployment Office. In January 2025, the Trump administration promoted a multibillion-dollar private investment effort called Stargate for developing US-based AI infrastructure over the next four years.

Data visualization by Qaiser Ali and Cat Van Vliet. Map Flourish visualization by Jonathan Paul Lalgee.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Regulatory Research Associates is a group within S&P Global Commodity Insights; 451 Research is part of S&P Global Market Intelligence. S&P Global Commodity Insights and S&P Global Market Intelligence are divisions of S&P Global Inc.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Content Type

Theme

Products & Offerings

Segment

Language