Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct. 24, 2025

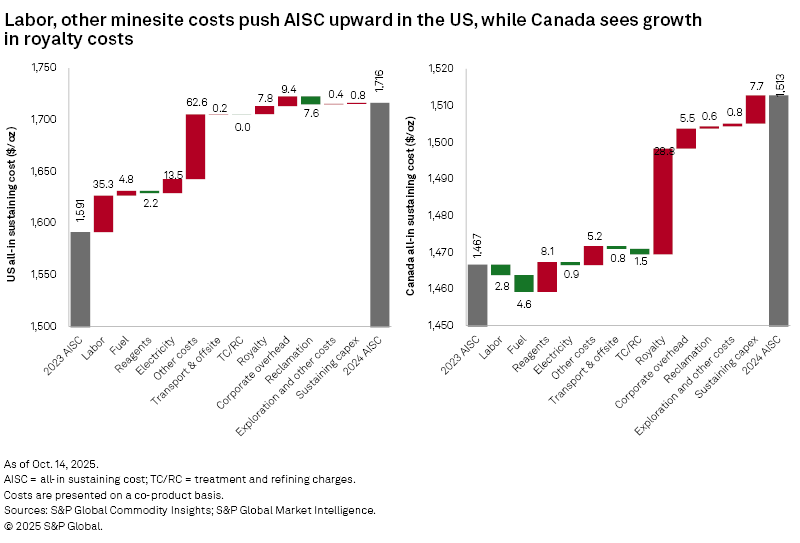

The average all-in sustaining cost for gold production on a co-product basis rose in the US and Canada by 7.85% and 3.14% year over year, respectively, in 2024. While both countries had rising minesite costs for the period, it is higher in the US, with costs increasing 10.58% year over year, mainly driven by higher labor, electricity and other minesite costs. On the other hand, Canada's increase in all-in sustaining cost (AISC) is largely attributable to rising royalty costs, up 36.11% year over year. This is further exacerbated by an increase in reagents and other minesite costs, coupled with increased sustaining capital spending.

– In 2024, the average AISC rose 7.85% in the US and 3.14% in Canada year over year, reaching US$1,716.15 and US$1,512.76, respectively.

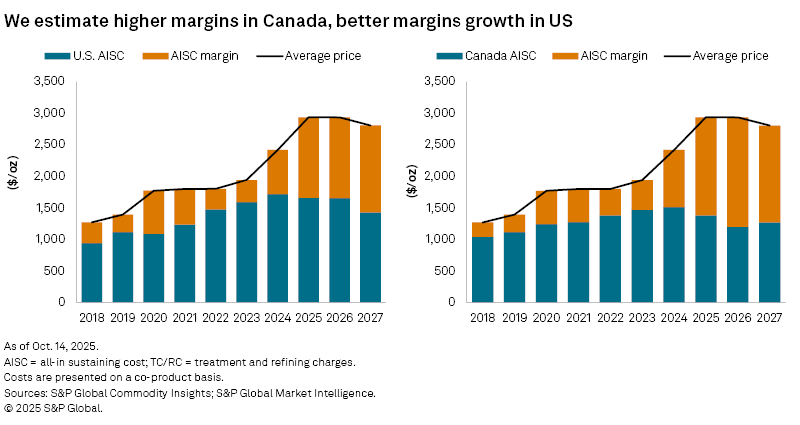

– From 2024 to 2027, margins are expected to rise at a compound annual growth rate (CAGR) of 18.41% in the US and 14.12% in Canada.

– Over the same period, the average AISC is forecast to decline at a CAGR of 4.52% in the US and 4.26% in Canada.

The average AISC in the US jumped 7.85% year over year in 2024 to US$1,716.15/oz on the back of rising minesite costs, most notably at Nevada Operations. The decline in gold production from NGM is mainly attributable to the pit wall failure of the Gold Quarry open pit in Carlin in the first quarter of 2024, coupled with lower grades and recoveries, higher refractory ore processed, and the autoclave shutdown in Turquoise Ridge. Moreover, higher maintenance costs of underground and process facilities added upward pressure on other minesite costs related to equipment and spares. Other minesite costs rose 13.15% year over year, increasing average AISC by US$62.63/oz. Given Nevada Operations' significant production, changes in the mine's costs can greatly impact the average US AISC.

Additionally, lower production impacted labor and electricity costs when expressed in US$/oz terms. Labor costs increased 10.77% and electricity costs went up 15.9% year over year, adding US$35.29/oz and US$13.54/oz, respectively, to average AISC. This was further exacerbated by 5.53% year-over-year growth in local power cost, combined with 93% of production sourcing power from the national grid. Labor, electricity and other minesite costs make up 58.03% of average AISC in the US.

Meanwhile, average AISC in Canada rose 3.14% year over year to US$1,512.76/oz, mainly attributed to increasing royalty costs, reagents and other minesite costs, and to increased sustaining capital spending. Royalty cost drove most of the increase, up 36.11% year over year, adding US$28.80/oz to average AISC. Note that royalty taxes in Canada are based on profits and margins, translating to higher royalty costs when metal prices increase and operating costs remain steady or vice versa. Other minesite costs rose 1.35% year over year, adding US$5.21/oz to average AISC.

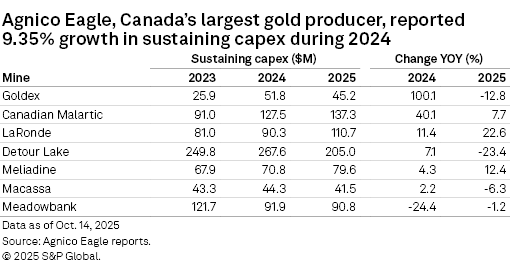

Canadian gold producers have also increased their sustaining capital spending 2.69% year over year, adding US$7.72/oz to average AISC.

Wide margins in the medium-term outlook

From 2024 to 2027, we estimate average AISC decline at a CAGR of 4.52% in the US and 4.26% in Canada, based on consensus macroeconomic forecast. This is on the back of declining minesite costs and tight sustaining capital spending. We estimate labor and other minesite costs to be the main drivers of decreasing minesite costs in both regions, while fuel costs will add downward pressure in the US.

The decline in sustaining capital spending is in line with the guidance reported by major gold company producers. Agnico Eagle Mines Ltd. provided sustaining capital guidance of US$710 million in 2025 for its operating mines in Canada, down 4.60% year over year. While Barrick Mining Corp. and Kinross Gold Corp. did not report sustaining capex guidance for their mines in the US, their reported second-half 2025 sustaining capex was down 5.26% and 28.80%, respectively, compared to the same period in 2024.

In 2024, margins doubled year over year in the US and Canada on the back of the 25% increase in average gold price. We estimate a slowdown in margin growth in the US in 2026, followed by a rebound in 2027, while Canada's margin will widen until 2026 but decline in 2027. Overall, margins will increase in the US and Canada at a CAGR of 18.41% and 14.12%, respectively, from 2024 to 2027, remaining healthy on the back of declining average all-in sustaining cost amid steady average gold prices.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.