Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 27, 2025

By Sanket Gawali

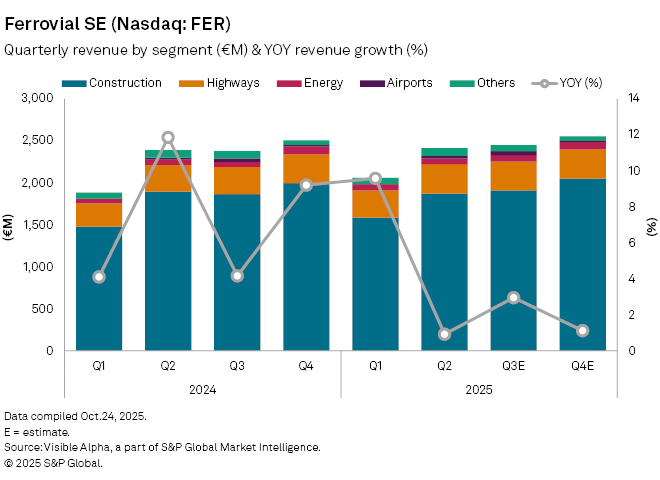

Spanish infrastructure operator Ferrovial SE (NASDAQ: FER) is expected to report modest revenue growth when it releases third-quarter 2025 results on Tuesday, October 28. Visible Alpha consensus estimates point to Q3 revenue of €2.5 billion, up 3% year-on-year, reflecting steady performance across its key divisions.

The construction segment, Ferrovial’s largest revenue contributor, is forecast to see revenue rise 2% to €1.9 billion in Q3, with an EBIT of €84.6 million. This is compared to a revenue decline of 1% in the last quarter and an EBIT of €67 million, suggesting margins are under less pressure than in previous quarters.

The highway division is projected to see Q3 revenue grow 7% year-on-year to €342 million, supported by strong traffic on US express lanes and Canada’s 407 ETR. US revenue is projected to climb 11% to €300 million, led by strong traffic and dynamic toll pricing on key assets such as the North Tarrant Express, LBJ Express, and I-66 Outside the Beltway. Growth of 51% in headquarter operations and steady performance at Canada’s 407 ETR—where revenue is expected to rise 7% to €345 million—are seen offsetting sharp declines in Spain (–34%) and Portugal (–30%).

Meanwhile, Ferrovial’s energy and airport segments are forecast to grow 26% and 13%, to €75 million and €50 million, respectively, aided by new project ramp-ups and continued momentum at New Terminal One (JFK).

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment