Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 02, 2025

By Akash Jishnu and Bhavik Jain

In a landmark transaction, gaming giant Electronic Arts Inc. (NASDAQ: EA) has agreed to be acquired in an all-cash deal worth $55 billion by a consortium led by Saudi Arabia’s Public Investment Fund (PIF), Silver Lake and Affinity Partners. Once the deal is finalized, EA will cease to trade publicly and become a private company. The closing is expected in the first quarter of fiscal 2027, subject to regulatory and shareholder approval.

The deal comes at a at a testing time as EA faces headwinds including tepid consumer spending and shifting preferences. EA has leaned heavily on its stalwart franchises—sports titles, action shooters, and live-service games—to stabilize growth. The take-private offer allows EA to pivot strategy without quarterly earnings scrutiny.

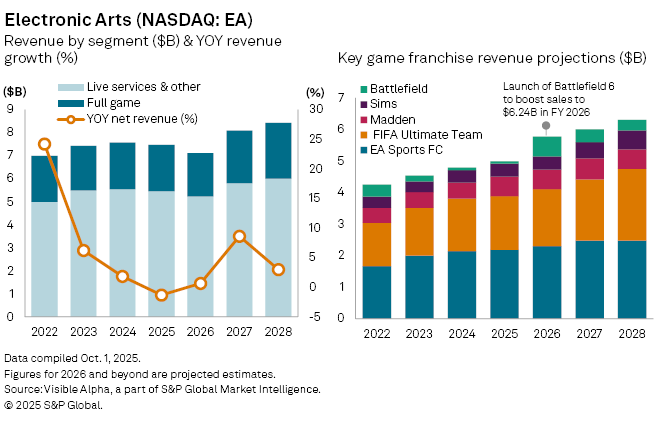

According to Visible Alpha consensus, EA’s net revenue is estimated to grow a modest 0.7% to $7.5 billion in 2026, following a 1.3% drop in 2025. Growth is expected to accelerate to +9% in 2027, reaching $8.2 billion. Meanwhile, net bookings are forecast to rise 8% to $7.9 billion in 2026, driven in part by the upcoming launch of Battlefield 6.

Franchise-level forecasts show a mixed picture. EA Sports FC (+5.3% year-on-year), FIFA Ultimate Team (+6.3%) and The Sims (+5.8%) are expected to post steady gains, while Battlefield is set for a sharp rebound with unit sales jumping to 12.1 million, driving an 820% revenue surge to $624 million. Other franchises such as Madden, Apex Legends and Star Wars are projected to see revenues decline.

Profitability, meanwhile, is set to dip in the near term. Net income is forecast to fall 12% to $991 million in fiscal 2026, with EPS at $3.90, before rebounding to $1.4 billion and $5.61 a share in 2027.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment