Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 16, 2025

By Alice Yu and Jomar Camposano

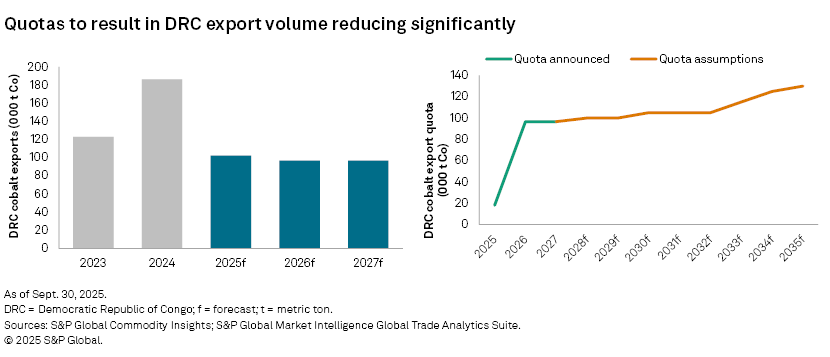

➤ The DRC will transition to an export quota system on Oct. 16, with 2026 and 2027 annual quotas capped at 96,600 metric tons, around half of the exports in 2024.

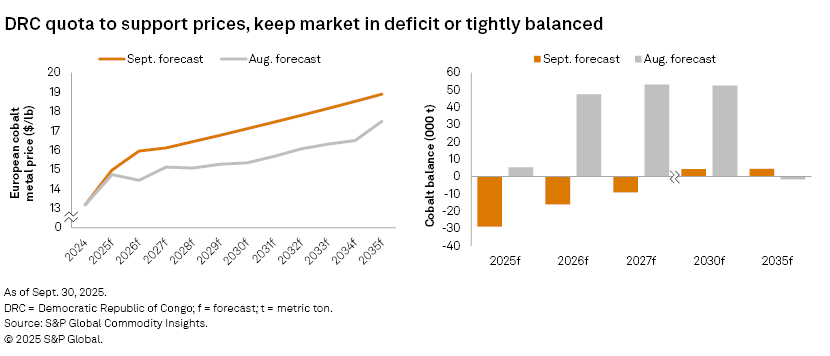

➤ The cobalt market is likely to be in a deficit in 2026–27. We expect quotas to rise thereafter, leading to a tightly balanced market.

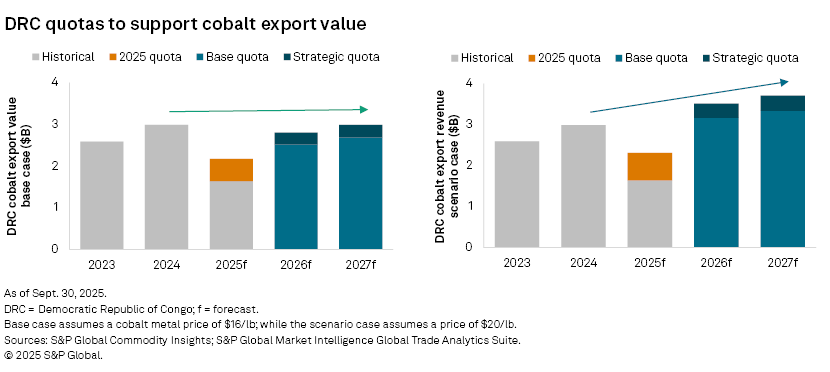

➤ The deficit could support an increase in cobalt prices. Under a $20/lb scenario, the DRC's cobalt export value would rise 24% in 2027, compared to 2024 levels. The export value remains flat at the base case $16/lb price.

➤ The exact quota assignments remain unclear and could jolt the profitability of companies. Stockpiling excess cobalt is also challenging, given the large expected volume.

➤ The DRC will likely make quota adjustments as it seeks to balance supply in light of demand and protect export value amid changing market conditions. This could increase price volatility.

Background

The DRC implemented a cobalt export ban in February 2025 to address a nine-year low in prices amid oversupply. On June 21, the initial four-month ban was extended for an additional three months. ARECOMS, the DRC’s regulatory body for minerals, announced Sept. 21 that the ban will be replaced with a quota system. ARECOMS sits under the Ministry of Mines and was established in November 2019 to formalize artisanal mining activities. Up to 18,125 metric tons can be exported from Oct. 16 through the end of the year. Up to 96,600 metric tons can be exported per year in 2026 and 2027, made up of an 87,000-metric-ton base quota allocated to companies and a 9,600-metric-ton strategic quota for projects of national strategic importance. While the exact requirements to qualify as a project of national strategic importance remain unclear, it appears to point to projects that deepen local processing capabilities and create greater value-add domestically. ARECOMS will reallocate any unused volumes from the base quota to the strategic quota.

The DRC government has made previous attempts to limit cobalt exports. As early as 2013, the government sought to ban the exports of copper and cobalt concentrates to promote the building of downstream processing capabilities. The ban was flexible in practice, as repeated waivers were issued to miners, due to a lack of downstream capacities partly attributed by unstable power supply in the country. The 2013 ban coincided with a shift in the cobalt product mix since the early 2010s, as miners ramped up primary processing capacities to produce cobalt hydroxide, a more value-adding intermediate product, from concentrates. In August 2020, the government then granted indefinite waiver for the export of cobalt hydroxide, which has become the primary form of cobalt exports from the country. The recent export controls since February have superseded prior waivers and exemptions.

DRC quotas to deepen market shortage, supporting prices

The export quota volumes announced through to 2027 are forecast to move the market into a deficit, compared to our August forecast of market surpluses. The 2026 and 2027 quota volumes, capped at 8,050 metric tons per month, represent a 48% drop compared to the exports in 2024. This also implies more than 100,000 metric tons of additional excess production will need to be stored inside the DRC for each of the next two years if cobalt supply does not fall.

Our base case assumption includes the DRC export quota rising from 2028 onward to keep the market in a tight balance. We forecast the DRC's cobalt export value in 2027 to match the level seen in 2024, assuming the European cobalt metal price averages $16/lb through 2027. Under a $20/lb price scenario, the export value will jump 24% in 2027.

Quota allocation still unclear

Questions remain as to how the DRC will implement the quota system to achieve the intended target of higher cobalt price and export value. ARECOMS said it will allocate base quotas based on a company's historical export volumes, but the base year (or years) used in the calculation is highly consequential, especially given CMOC Group Ltd.'s rapid output expansion in 2024. When considering the full production volume of the company's assets, CMOC's share of DRC cobalt supply rose to 57% in 2024 from 36% in 2023. Glencore PLC, meanwhile, could receive a higher quota allocation if the base year is 2023. As companies with higher cobalt export quotas will reap more benefits from the potentially elevated cobalt prices, quota allocations will significantly alter the economics of owning and operating copper-cobalt assets in the DRC.

Managing excess production

The byproduct nature of cobalt production from copper-cobalt deposits will make it challenging for miners to reduce output to match quotas. The DRC is one of the two main refined copper producers in Africa, and it shows healthy long-term growth prospects, especially as an emerging key copper supplier to the US. Cobalt production will continue apace with copper production, as it is difficult to remove only the cobalt recovery circuit from existing process flows.

Once extracted, copper-cobalt ore undergoes beneficiation and primary extraction processes, which could be either pyrometallurgical or hydrometallurgical. At this point, it is extremely difficult to stockpile mid-process cobalt without further processing it into a solid form. For example, in the hydrometallurgical process used at Tenke Fungurume and Kamoto, cobalt typically goes into the final cobalt production circuit as raffinate, a liquid solution that is not readily storable. Mineralogy also makes it difficult to reduce cobalt content in the ore feed using existing processes.

Given these challenges, DRC cobalt production will exceed the announced quotas by more than 100,000 metric tons for each of the next two years if cobalt supply is not cut. ARECOMS said it reserves the right to buy back cobalt stocks exceeding the authorized quotas of each company on a quarterly basis, which could be very costly. It is unknown whether the regulator would buy cobalt at the higher open market price or merely at a level sufficient to cover production cost. Regardless, the excess cobalt production will need to be stored, whether by the miners or ARECOMS.

The most common form of cobalt exports from the DRC is crude cobalt hydroxide products, which are typically stored in bags in an outdoor environment. The partially processed cobalt has a high moisture content and is in the form of lumpy paste. Longer-term storage of cobalt hydroxide requires the product to be monitored for moisture, temperature and exposure to air to minimize oxidation and carbonization and prevent degradation. Producers will face additional costs for storing cobalt hydroxide in a controlled environment. Despite this, the DRC government and companies will be incentivized to properly stockpile cobalt given its higher de facto market value.

In this environment of stockpiled product, the proper enforcement of quotas will be critical to controlling supply. The DRC government will need to tighten cross-border checks on the trucking of mineral products to prevent smuggling and over-exporting, and it will need to ensure that cobalt products are properly labeled and volumes accurately reported.

Quota adjustment and demand destruction

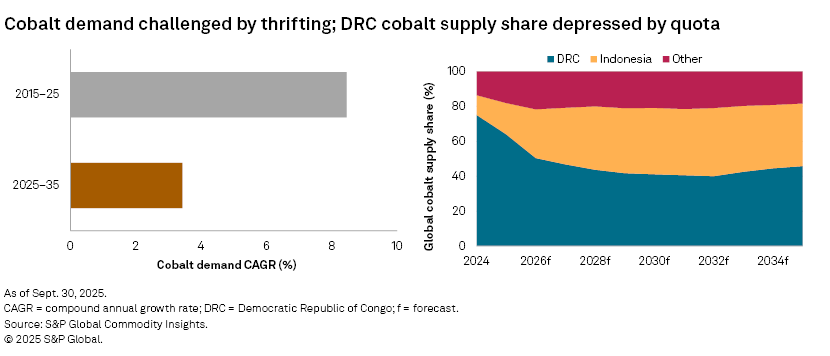

If cobalt prices increase substantially due to DRC quotas, it could accelerate the shift from cobalt-containing EV batteries toward lithium-iron-phosphate (LFP), which now offers energy density that delivers sufficient drive range for mass-market, everyday vehicles. The cobalt price increase would also coincide with a forecast sharp downgrade to EV sales in the US, a key market for cobalt-containing batteries.

Under our base case $16/lb cobalt price forecast, every battery-electric vehicle (BEV) in Europe and the US would need to foot between $370 and $630 in additional cost for a nickel-rich cobalt battery in 2030, compared to the pre-ban forecast. At the $20/lb scenario, the additional cost rises to $640-$1,080 per BEV.

While these numbers may not seem significant, cost-cutting in cathode active materials has been key in reducing input material costs. Higher cobalt prices make cobalt thrifting an even more obvious way for EV makers to reduce cost amid a push to bring EVs to cost parity with internal combustion engine vehicles in Europe and the US, especially in a low- or no-subsidy environment. Avoiding cobalt use also spares battery and car manufacturers from needing to navigate the complex regulatory landscape in the DRC.

ARECOMS said it will adjust allocations on a quarterly basis in the event of significant market imbalance. This will allow the DRC to adjust supply to ensure demand is properly met while also giving it leeway in responding to the market should price rises too high and demand drops too fast.

Things to watch out for

The DRC government wants to use its dominant position in cobalt supply to gain control of prices rather than being dependent on the decisions of companies headquartered in other countries. With only one lever to pull — controlling exports — it must strike a careful balance that sufficiently supports prices while not accelerating irreversible demand destruction. This unintended outcome is a real possibility at the $20/lb scenario, which is only $1 higher than the Platts-assessed European cobalt metal price on Oct. 1.

We expect cobalt prices to be more volatile as the DRC adjusts to quota volumes to meet demand. And adjustments will likely be necessary; the current export quota implies a sizable market deficit in 2026 and 2027, with no cobalt inventories in China to cushion the impact, as they will have been depleted by January 2026, according to our calculations.

The market will also be focused on how the DRC handles the strategic projects quota, which accounts for 10% of the total quota. The strategic quota is intended to bolster the development of local processing capabilities, but it remains to be seen how power issues — the key bottleneck to similar previous efforts — will be tackled. It is also unclear whether unused strategic quotas can be reassigned to base quotas, while the policy allows for the reverse.

The export quota will also dent the country's significance in global supply, while other suppliers benefit from a higher market price for cobalt. DRC's cobalt mine supply share will drop from 75% in 2024 to 50% in 2026, remaining below this level through 2035.

The DRC government has a clear goal, but the path requires delicate balancing of a multitude of factors, as well as close monitoring of market reactions. We expect quota adjustments to occur, but any large adjustments could undermine the credibility of the quota system. The DRC also wishes to attract and diversify investment, but the heavy-handed state intervention may not appeal to the private companies outside of China the country is trying to attract.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings