Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 16, 2025

By Jigar Saiya

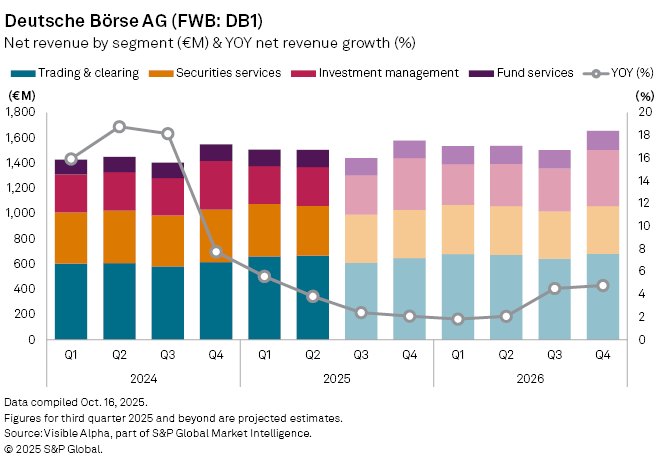

German exchange operator Deutsche Börse AG (FWB: DB1) is expected to post slower revenue growth when it reports third-quarter results on October 27, as easing trading activity and weaker securities services offset gains in data and fund management businesses.

Deutsche Börse’s Q3 revenue growth is set to moderate, offset by gains in investment and fund management, with full-year 2025 revenue projected at €6 billion.

Visible Alpha consensus estimates show analysts expect net revenue of €1.4 billion in Q3, up 2.4% year-on-year but down 4.5% from the previous quarter, signaling a moderation from the 3.8% growth recorded in Q2.

The Trading & Clearing division, which benefits from market volatility, is projected to see revenue rise 6% to €609 million, slowing from 10% growth in the prior quarter. The Securities Services segment, exposed to post-trade and settlement activities, is expected to contract 5.4% to €382 million amid softer transaction volumes and lower settlement income.

By contrast, Investment Management revenue is forecast to climb 7% to €314 million, supported by Qontigo’s index-related products and SimCorp’s software solutions, though ESG-linked demand has softened. The Fund Services business is set to grow 8% to €133 million, reflecting steady momentum in fund administration and distribution.

For the full year 2025, analysts expect net revenue of €6 billion, up 3.4% from 2024, with net income rising 2.2% to €2 billion and diluted EPS reaching €10.9.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment