Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 27, 2025

By Sohan Sakharkar

Crinetics Pharmaceuticals Inc. (NASDAQ: CRNX) achieved a milestone with the US FDA’s approval of Palsonify (paltusotine), the first once-daily oral therapy for adults with acromegaly, a rare hormonal disorder caused by excess growth hormone. The late-September approval marks Crinetics’ first commercial product, signaling a pivotal shift for the biotech from clinical-stage developer to revenue-generating company.

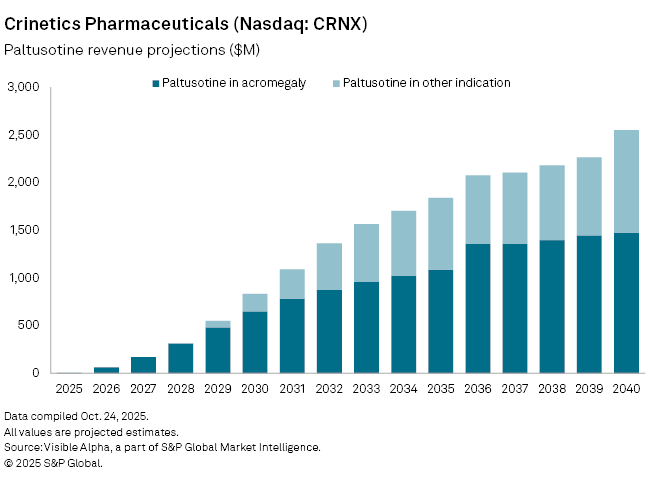

According to Visible Alpha consensus estimates, Palsonify in acromegaly is projected to generate $3.6 million in sales in its first year, rising to $61 million by 2026 and $649 million by 2030. Analysts expect the therapy to achieve blockbuster status — $1 billion in annual sales — by 2034.

Palsonify’s once-daily oral formulation gives it a distinct competitive edge over existing injectable treatments such as Novartis AG (SWX: NOVN) Sandostatin, Ipsen SA (EPA: IPN) Somatuline, and Pfizer Inc. (NYSE: PFE) Somavert. These long-standing drugs, which have dominated the acromegaly market for decades, are now expected to face steady erosion as patients and clinicians shift toward the more convenient oral alternative.

For context, Sandostatin sales are forecast to fall to $1.2 billion in 2025, while Somavert and Somatuline are expected to bring in $265 million and $557 million, respectively — with analysts projecting gradual declines across all three drugs over the coming years.

Analysts view the approval key for Crinetics. Consensus forecasts point to total company revenue reaching $5.1 million in 2025, with Palsonify contributing 96% of that figure, compared with just $1 million in 2024.

Beyond acromegaly, the drug is being tested in Phase III trials for carcinoid syndrome diarrhea and Phase I trials for neuroendocrine tumors (NETs) — two conditions that could significantly expand its addressable market. Success in these programs could further extend Palsonify’s commercial runway and strengthen Crinetics’ position in the endocrinology space.

The FDA nod marks not just a regulatory win but a potential inflection point in valuation, as Crinetics transitions into a commercial-stage biotech with a differentiated product and expanding clinical pipeline.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment