Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 08, 2025

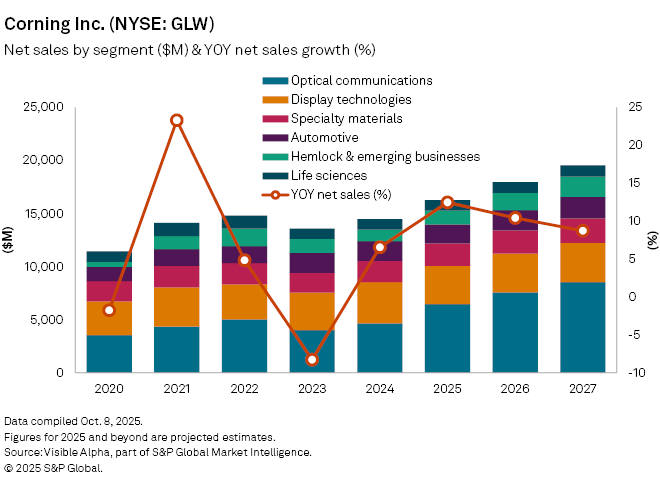

Corning Inc. (NYSE: GLW) is poised for accelerated growth in 2025. The glass and materials technology group, best known for its Gorilla Glass used in iPhones and other devices, is gaining momentum in its largest business segment — Optical Communications — as data networks expand to support the next wave of AI computing.

The Optical Communications segment, which accounts for roughly 40% of Corning’s net sales, serves both carrier and enterprise network markets. Analysts expect sales from the division to climb 39% year-on-year to $6.5 billion in 2025, fueled by enterprise demand for high-speed fiber connectivity in AI data centers.

Corning’s other divisions show a mixed outlook. Its Hemlock and Emerging Growth operations, which include its solar materials business, are expected to see sales rise 16% to $1.3 billion in 2025, supported by new wafer capacity. Specialty Materials and Life Sciences are forecast to deliver steady gains of 4% and 1%, reaching $2.1 billion and $991 million, respectively. However, the Display Technologies and Automotive segments are projected to contract by 7% and 3%, reflecting softer demand in legacy markets such as LCD panels and auto glass.

Profitability is expected to recover strongly. Net income is forecast to reach $2 billion in 2025, up from $506 million a year earlier, while diluted earnings per share are projected to rise to $1.79 from $0.58 in 2024.

The company’s shares have risen 83% year-to-date, supported by growing diversification and exposure to the surging demand for AI-related products. The company also recently expanded its partnership with Apple, which is investing $2.5 billion in Corning’s manufacturing facility in Harrodsburg, Kentucky. The plant will produce all the cover glass used in iPhone and Apple Watch devices, reinforcing Corning’s role as a key supplier in Apple’s premium hardware ecosystem.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment