Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept 29, 2025

By Shunyu Yao

In December 1988, the Channar iron ore mine in Western Australia, then owned jointly by Rio Tinto Group and Sinosteel Corp., embarked on its first stage of development. The project involved international financing and marked China's inaugural overseas mining investment. A decade later, in 1998, China completed its first overseas nonferrous mine transaction when China Nonferrous Mining Corp. Ltd. acquired the Chambishi copper mine in Zambia. Today, propelled by the "Go Out" policy, an increasing number of Chinese companies are actively exploring international opportunities. Those that have achieved success are further expanding their global presence. This investment strategy has significantly enhanced China's attributable production of gold and key energy transition metals.

➤ China's M&A activity focuses on Africa and Latin America for gold, copper and lithium resources.

➤ Leading companies, such as Zijin Mining Group Co. Ltd. and CMOC Group Ltd., have spearheaded China's overseas mining ventures, contributing to significant growth in copper production.

➤ China's low-cost lithium refining guarantees its hard rock lithium acquisition, enhancing its market position.

Africa, Latin America focus of China's overseas M&A

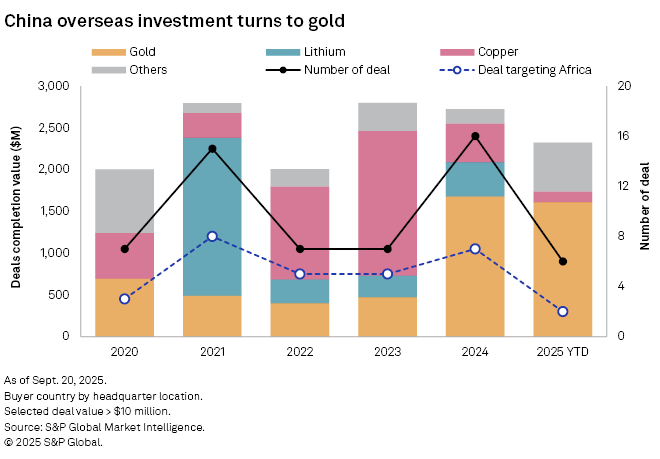

A 2021 study identified a growing emphasis on China's mining M&A in Africa and Latin America, particularly during the 2010s. Data from 2020 onward further corroborates this trend, with Chinese companies' M&A activities in Africa and Latin America comprising 49% and 30%, respectively, of their $14.6 billion of total overseas M&A spending till 2025 year to date. This indicates a deepening presence in these regions. Moreover, the M&A data highlights a strong interest in gold and key energy transition metals, with gold, copper and lithium accounting for 86% of the transactions.

Rising gold investments

Since 2020, China's overseas M&A spending has consistently surpassed $2 billion a year. However, after China Ex-work battery lithium carbonate prices dropped almost 90% from the peak in November 2022 at $79,650/t, the focus has shifted. Overseas lithium trades slowed after 2021, while gold investments surged in 2024, culminating in six deals worth $1.7 billion.

Among major Chinese mining companies, Zijin Mining Group leads in overseas investment, contributing approximately 28% of the total M&A spending since 2020. As a pioneer in global expansion, Zijin Mining has adhered to its principle of "leveraging world-class projects and prioritizing resources." Although rising gold prices have also pushed asset values up and raised the threshold for M&A, Zijin Mining continues its overseas ventures, completing significant transactions in Peru, Ghana and Kazakhstan. Shandong Gold Mining Co. Ltd. and Zhaojin Mining Industry Co. Ltd. are also actively acquiring stakes in gold assets. As the emphasis on critical minerals increases, noncritical minerals, such as gold, continue to present promising opportunities. Our latest Gold Commodity Briefing Service expects a continued bull run of gold prices in 2026, with a projection of $3,897 per ounce.

Copper production success

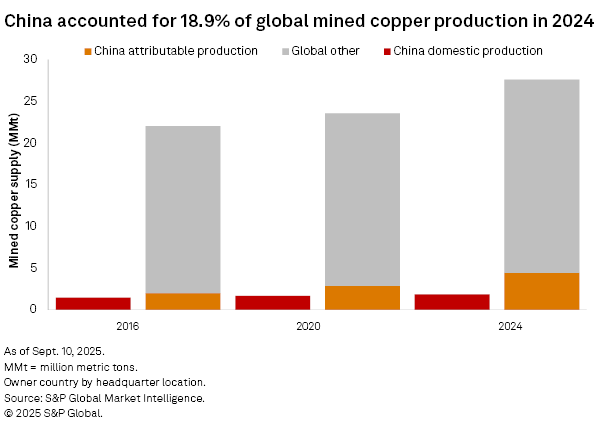

China's overseas copper investments have yielded substantial results. The country's attributable share of global mined copper production increased from 10% in 2016 to 19% in 2024, while its overseas copper production surged 369% during the same period, reaching approximately 2.6 million metric tons and surpassing domestic output. According to our Copper Commodity Briefing Service, while China's domestic mined copper production accounts for only 8% of the world's total, its smelter-grade copper output represents 48%. This disparity highlights China's reliance on overseas copper resources to satisfy its robust demand. China Nonferrous Mining was among the first to explore overseas copper resources, paving the way for other companies, such as CMOC Group and Zijin Mining, to join the race for copper mining.

Increased attributable production has enabled Chinese companies to achieve higher revenue. CMOC's Tenke Fungurume and Kisanfu mines have significantly boosted production; the two operations combined currently yield 600,000 metric tons per year of copper. The company plans to advance its expansion, with preliminary exploration underway at Tenke Fungurume West and Kisanfu Phase II. Meanwhile, the Kamoa-Kakula mine's third concentrator commissioning in May 2024 has driven Zijin Mining's copper growth. Kamoa Copper SA, a joint venture between Ivanhoe Mines Ltd. and Zijin Mining, expects copper production at the Kamoa-Kakula mine to reach 400,000 metric tons in 2025, despite the mine experiencing underground seismic activity.

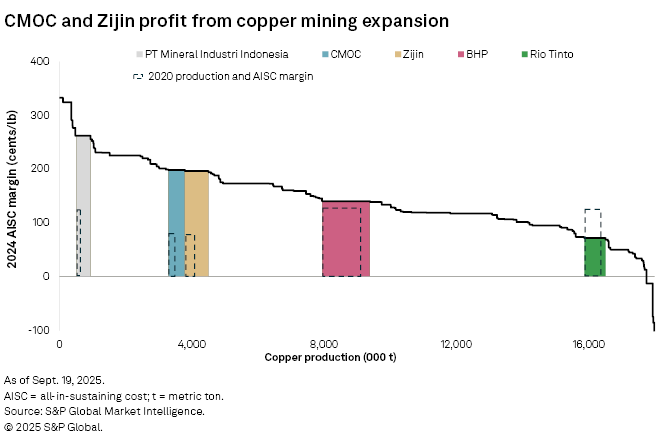

The success stories of CMOC and Zijin Mining are likely to inspire more Chinese companies to pursue world-class copper assets. Using the company-level cost curve, companies whose equity production in 2024 was at least 100,000 metric tons higher than in 2020 have been identified. We have also outlined these companies' 2020 production and all-in-sustaining margin with dotted boxes in the figure below, with these two major companies demonstrating significant production growth and increased unit profits.

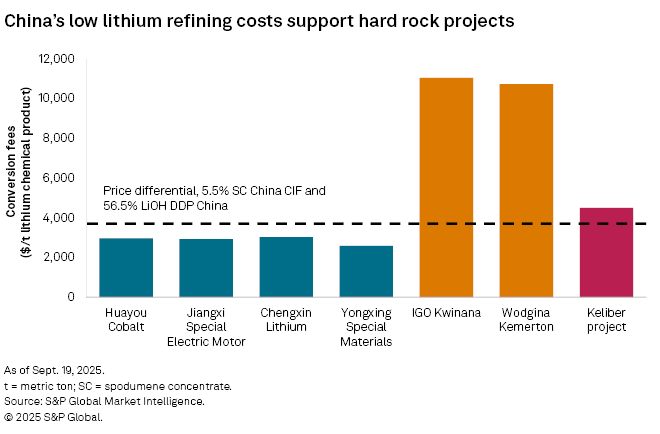

China's lithium refining advantage

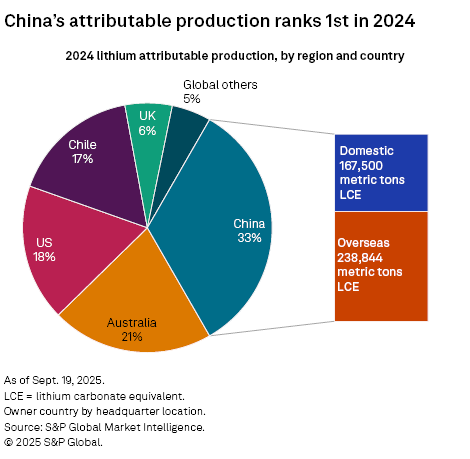

The conversion of lithium concentrate into lithium hydroxide or lithium carbonate is crucial for battery production. As of Sept. 23, 2025, the difference between the Platts lithium spodumene 5.5% concentrate CIF China price and the lithium hydroxide delivered duty paid (DDP) China price — on a lithium carbonate equivalent (LCE) basis — stood at $3,610 per metric ton. Platts is part of S&P Global Commodity Insights. This indicates that lithium hydroxide producers must manage their concentrate conversion costs below this threshold to maintain profitability. Outside China, few processing plants have managed to keep refining costs under $4,000/t. For instance, IGO Ltd.'s Kwinana plant reduced its unit refining costs significantly within a year by the June quarter of 2025 but it still exceeds $10,000/t. In contrast, due to fierce domestic competition, maintaining unit conversion costs below $3,000/t is normal in China. This cost efficiency has become a lifeline, ensuring China's acquisition of overseas hard rock lithium mines remains economically viable. In 2024, China's attributable lithium production ranked highest globally, accounting for 33.4% of the global total. Notably, its overseas output reached 238,844 metric tons LCE, with six hard rock lithium mines in Africa acquired and commissioned after 2021.

Continued global mining journey

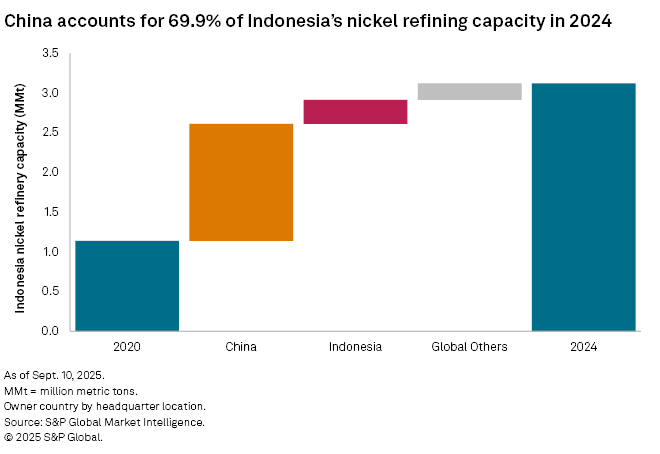

China's overseas mining ventures are expected to continue, evidenced by its nickel investments in Indonesia following the 2020 nickel ore export ban. Chinese companies have expanded smelting capacity in Indonesia, demonstrating that even with policy restrictions, China's substantial demand will continue to drive its pursuit of overseas mineral resources.

China has gained an advantage in the supply side of energy transition minerals such as copper and lithium, benefiting from years of consistent investment. As more Chinese companies engage in global ventures, they are also investing in bauxite, graphite, manganese and other minerals. This diversification indicates that China's global mineral resource development will continue to grow, potentially leading to even greater stories of expansion in the future.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.