Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 24, 2025

By Husain Rupawala and Tim Zawacki

The US P&C industry is poised to report its most favorable third-quarter statutory underwriting results in at least a decade, driven by the combination of a lack of landfalling hurricanes and the effect of rate increases on top-line growth.

While the commercial lines continue to experience decidedly mixed business trends, the industry is likely to post exceptionally strong results for a third quarter in the personal lines.

The presence or absence of landfalling hurricanes has contributed to tremendous volatility in the homeowners line in previous years, including Hurricane Helene in the final days of 2024's third quarter. While Tropical Storm Chantal made landfall in July and caused significant flood-related damage in the Carolinas, the continental United States has largely been spared to date during the 2025 hurricane season. With underlying trends in the homeowners business continuing to improve due to underwriting and pricing actions taken by carriers in response to elevated losses in recent years, we expect a highly favorable result in that line.

Business dynamics in the private auto lines are evolving amid the impact of US tariffs on loss-cost inflation and increasing competitiveness among some leading market participants, but we expect the loss ratio to continue to show cyclical strength, benefiting from past rate increases earning into carriers' books and largely benign year-over-year comparisons in incurred losses.

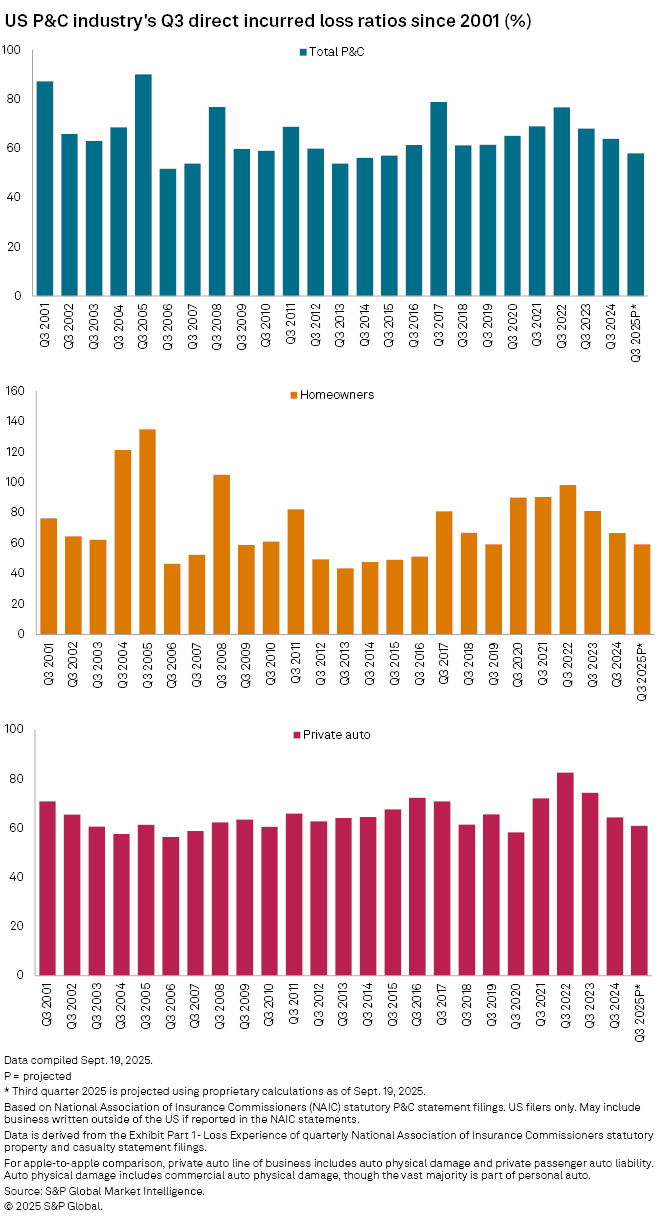

It has been since 2015 that a named hurricane did not make US landfall during a third quarter. Not coincidentally, the third quarter of that year marked the most recent instance where the US P&C industry's direct incurred loss ratio totaled less than 60% for a three-month period ended Sept. 30. We expect that drought will end in the third quarter of 2025, with the eventual result showing significant improvement from the 63.8% ratio in the year-earlier period.

The private auto and homeowners business combined to account for 51.3% of the US P&C industry direct premiums written during the first half of 2025. As such, the fortunes of those business lines have much to say about overall industry results.

Both business lines entered the third quarter with considerable bottom-line momentum, and there were few immediate external threats to slow it down aside from a landfalling hurricane. This favorable landscape has led to a positive trend in loss ratios, with third-quarter figures expected to show substantial improvements in line with historical benchmarks.

In the second quarter, the homeowners business experienced an 18.4% reduction in direct incurred losses, decreasing to $25.21 billion from $30.89 billion in the year-earlier period, which had been a historically active period for severe convective storms. At the same time, homeowners direct earned premiums surged by 13.3%, rising to $43.64 billion from $38.52 billion, as the business continues to benefit from multiple rounds of rate increases in many geographies. These dynamics led to a direct incurred loss ratio of only 57.8%, a 22.4 percentage point decrease on a year-over-year basis.

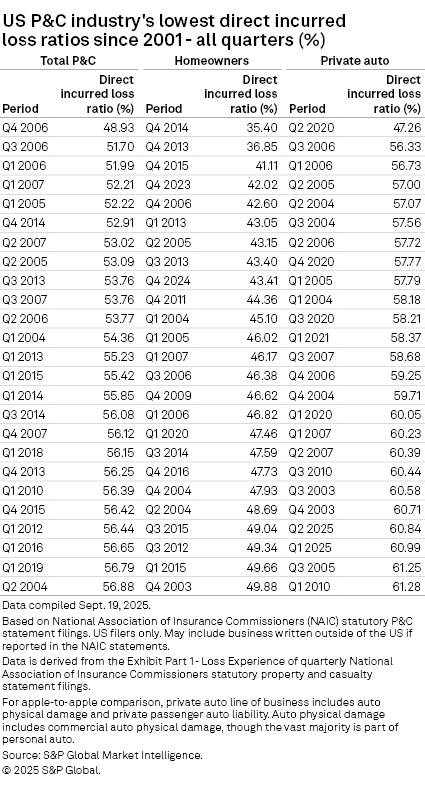

If top and bottom line trends held steady in the third quarter, this would imply a homeowners direct incurred loss ratio for the period of 47.9% as compared to a result of 59.2% in the year-earlier quarter. The industry achieved sub-50% homeowners direct incurred loss ratios for four consecutive third quarters from 2012 through 2015, but they have since ranged from a low of 51.1% in 2016 to a high of 98.0% in 2022, when Hurricane Ian made landfall in Florida.

Catastrophe loss reports for the Allstate Protection segment of The Allstate Corp. in the combination of July and August suggested a year-over-year decline of 51.2% even prior to consideration of September 2024 losses from Helene, offering more reason for optimism.

Year-to-date comparisons in the homeowners business may remain slightly unfavorable due to the impact of California's devastating January wildfires. Excluding the first-quarter results from three heavily exposed carriers State Farm General Insurance Co., California Automobile Insurance Co. and CSAA Insurance Exchange would significantly alter the homeowners' loss ratio. In the first quarter of 2025, the incurred loss ratio would have been 80.6% instead of 102.3%, indicating a much more favorable scenario. Those carriers, which rank among California's largest homeowners writers, posted staggering homeowners direct incurred loss ratios of 859.2%, 655.7% and 802.6%, respectively, in that line in the first quarter prior to the impact of reinsurance. On a half-year basis, the industry's homeowners' incurred loss ratio would have been 69.4% compared to 79.7% when including the results of these companies.

Despite the likely favorable comparisons for a second consecutive quarter, we expect homeowners insurers to continue to take a long-term view of business trends. North Atlantic hurricane season extends through Nov. 30, and there have been numerous examples of destructive fourth-quarter storms, including Hurricane Milton in 2024. Concerns about the rising severity of severe convective storms, including events characterized by hail, tornadoes and straight-line winds, has led to a wholesale reevaluation of how individual exposures are underwritten and priced in a number of states. And carriers continue to emphasize policyholder risk-sharing through higher rates and the broader implementation of higher peril-specific deductibles.

When the industry produced sub-50% third-quarter homeowners direct incurred loss ratios during a four-year stretch through 2015, the combination of good fortune and cyclical tailwinds combined to contribute to the highly favorable results. With two hurricanes both turning out to the open ocean, consistent with the tracks taken by five of the year's previous named storms, similar dynamics appear to exist today.

The private auto sector is also riding favorable cyclical trends as loss ratios continue to rebound from the challenges posed by post-pandemic highs, which played an important role in offsetting the significant impact of claims from the Los Angeles wildfires in the first quarter.

Entering the third quarter, private auto direct incurred losses (which for the purposes of this article include commercial auto physical damage coverages so as to provide a longer-term historical perspective) have fallen on a year-over-year basis for four consecutive quarters for the first time outside of the pandemic since 2004. Growth in direct premiums earned has continued to benefit from rate increases implemented in 2024, though quarterly rates have moderated since peaking in the first quarter of 2024.

If we assume a continuation of these dynamics, with the direct premiums earned growth rate at one-half of the second quarter's level and the year-over-year change in direct incurred losses ranging from flat to down 4.8% in line with the second quarter, we would arrive at a third-quarter private auto direct incurred loss ratio of between 59.2% and 62.3%. With the third-quarter 2024 result of 64.3%, the industry is on track for a ninth-straight year-over-year decline in quarterly private auto direct incurred loss ratios.

July and August GAAP results from The Progressive Corp. show meaningful improvement relative even to highly favorable data from the year-earlier months, with earned premiums rising more quickly than losses and loss adjustment expenses. We estimate that its private auto combined ratio fell to 84.2% from 87.7% in the combination of the two months on a year-over-year basis. Progressive's vehicle business sustained significant losses from Helene in September 2024.

The historical statutory trend shows considerable volatility in private auto direct incurred loss ratios over the years, with previous third-quarter figures ranging from a low of 58.2% in 2020 amid the pandemic to a high of 82.5% in 2022 as the industry endured severe loss-cost inflation. The industry's lowest third-quarter private auto direct incurred loss ratio since 2001 was 56.3% in 2006.

The commercial insurance sector presents a complex landscape, with liability lines grappling with ongoing challenges while profitability in workers' compensation remains strong. Commercial property results will benefit from the absence of landfalling hurricanes, but that business may be subject to higher levels of pricing pressure. Rising liability claims costs, largely driven by social inflation, continue to exert pressure on the commercial lines direct incurred ratio for the industry. The second quarter commercial lines direct incurred loss ratio of 54.9% compares favorably to the personal lines result of 60.2%, but these ratios exclude expense ratios, which tend to run considerably higher in the commercial lines.

From an overall perspective, the lower incidence of large catastrophic events and the continuation of favorable cyclical trends in the third quarter have presented a unique opportunity for the P&C industry to thrive. With premium growth rates in several lines trending downward, however, the industry may require additional good fortune on the catastrophe front to generate further improvements in future periods.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.