Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — October 24, 2025

By Melissa Otto, CFA

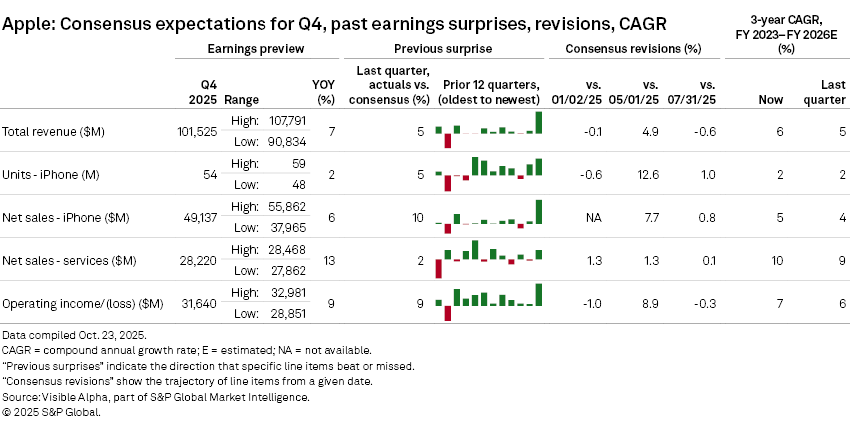

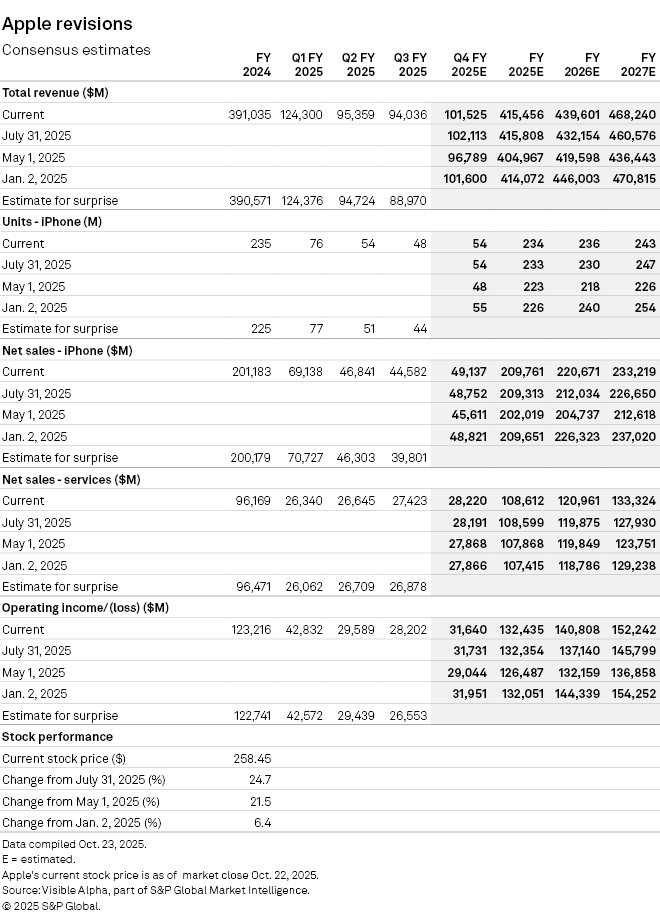

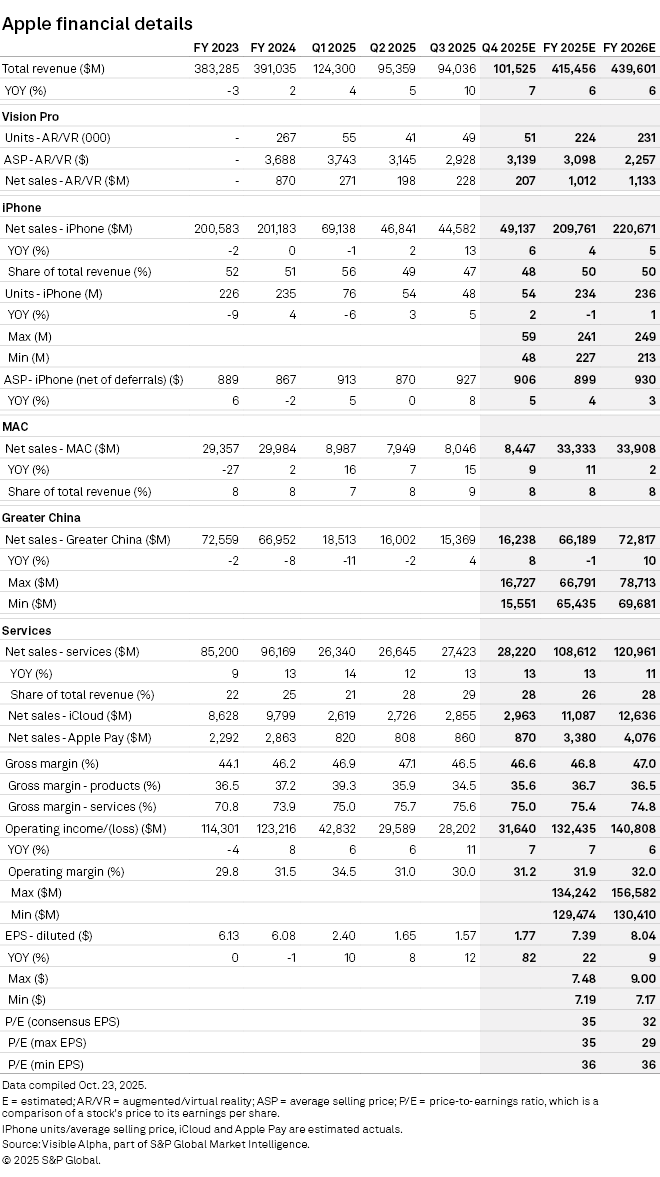

Apple Inc.'s (NASDAQ: AAPL) total revenues expected for fiscal Q4 have ticked up since spring but are down slightly from last quarter, according to Visible Alpha consensus, from $96.8 billion to $101.5 billion. Sentiment seems to reflect a view that iPhone buying is solid with improvements in China and users upgrading beginning to upgrade in the US. Since late January, expected Q4 iPhone units almost roundtripped back to 55 million and FY 2026 jumped up to 236 million. Currently, Q4 is expected to deliver $49.1 billion in iPhone sales and $209.7 billion in FY 2025 and $220.7 billion in FY 2026. Overall, large looming questions remain about the impact of tariffs on both their customer base and supply chain, however, upgrades recently are beginning to drive full-year iPhone revenue expectations higher.

Expectations for the high-margin Services segment remained stable for Q4 at $28.2 billion. The gross margin for the Services segment is over 70%, significantly higher than the 36% gross margin for Products. Given the large installed base, we are looking forward to what the company says in the Q4 earnings release about growth in Services and the role of Apple Intelligence in FY 2025.

Apple stock is up almost 25% since last quarter but is up only 6.4% year to date. The consensus P/E for 2026 is 32x, up from 28x. Could the Q4 release and outlook confirm the upgrade cycle and drive further outperformance in the stock?

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment