Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 13, 2025

By Vansh Rajput and Ehteesham Ansari

Shares in Advanced Micro Devices Inc. (NASDAQ: AMD) surged 23.7% on October 6 to close at $203.70 after the chipmaker unveiled a multi-year partnership with OpenAI LLC to power artificial intelligence data centres using AMD processors. The agreement underscores AMD’s growing ambitions in the AI hardware market and positions it as a stronger rival to NVIDIA Corp. (NASDAQ: NVDA), which has dominated the space.

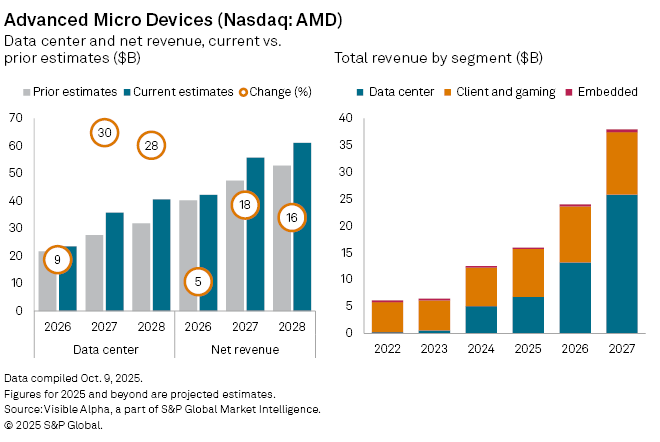

The deal ensures OpenAI continued access to AMD’s high-performance GPUs for next-generation models while providing AMD with a long-term revenue stream as its new MI450 facilities come online in 2026. Analysts responded by lifting forecasts for AMD’s data center revenue and overall growth outlook for 2026–2028, though estimates for 2025 remain largely unchanged.

Visible Alpha consensus shows analysts projects data center revenue of $16 billion in 2025, rising to $22.9 billion in 2026—5% higher than prior estimates—and accelerating to $33.9 billion in 2027 and $36.3 billion in 2028, reflecting upward revisions of 23% and 14% respectively. Total revenue for 2025 is expected to reach $33 billion, up 28% year-on-year, led by strong data center demand and a rebound in client and gaming sales. Embedded revenues, however, are set to dip 1% before recovering in 2026.

The partnership comes as competition in AI computing intensifies. Nvidia, which supplies most of the world’s AI chips, has recently signed a $6.3 billion with CoreWeave Inc. (NASDAQ: CRWV) and has also pledged up to $100 billion in staged investment to expand OpenAI’s GPU infrastructure.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment