Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 08, 2025

By Ankita Patil

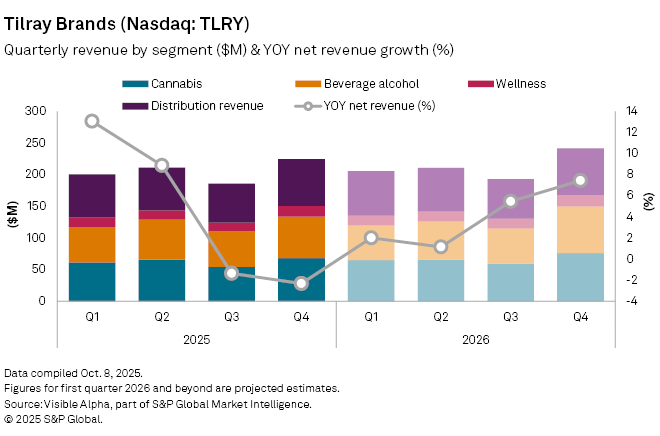

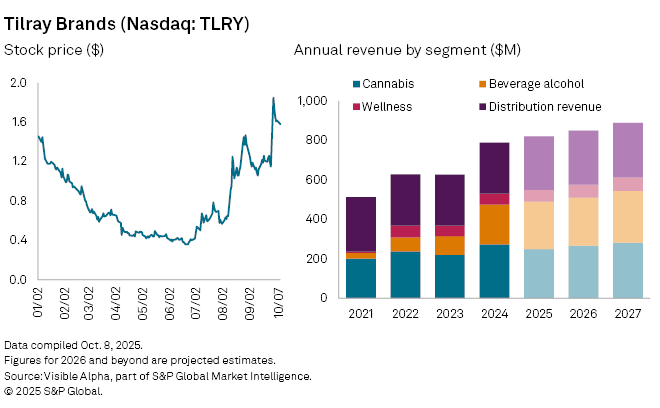

Canadian cannabis operator Tilray Brands Inc. (NASDAQ: TLRY) is set to report fiscal Q1 2026 earnings on Thursday, October 9. Analysts forecast net revenues of $204 million, a modest 2% increase year-on-year, reflecting a cautious recovery across its core segments.

Breaking down the business, cannabis revenues are expected to rebound 6% year-on-year to $65 million, ending a four-quarter streak of declines. Wellness and distribution segments are also anticipated to post modest growth of 7% and 3% respectively. In contrast, Tilray’s alcoholic beverages division, which had previously driven growth through Q4 2024, is projected to see revenues fall 3% to $54 million.

Tilray’s shares rallied in August on speculation that the Trump administration might reclassify cannabis from Schedule I to Schedule III, a move that could open up new opportunities. Beyond regulatory hopes, Tilray has been restructuring its operations, focusing on premium product differentiation and new offerings, while expanding its European footprint with EU-GMP certified medical cannabis strains in Germany.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment