Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 30, 2025

By Anirudh Mahesh

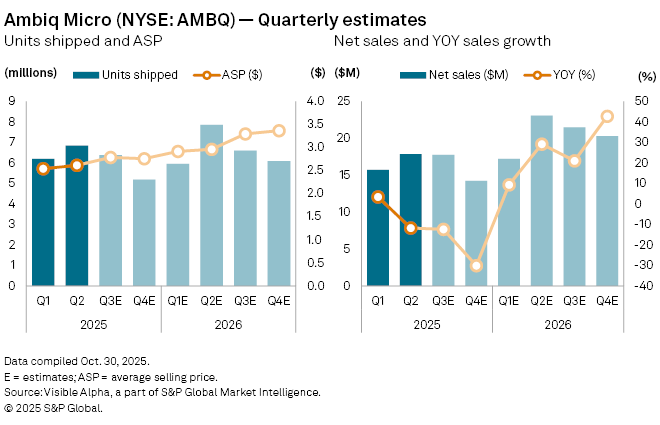

Ambiq Micro Inc. (NYSE: AMBQ), a US-based designer of ultra-low-power chips for AI applications, is expected to report weaker results for the third quarter when it posts earnings on Thursday, November 6. Visible Alpha consensus estimates point to a 12.4% year-on-year decline in net sales to $17.8 million, weighed down by a 43% drop in unit shipments to 6 million. The company’s net loss is forecast to narrow slightly to $8.2 million, compared with $8.5 million in the previous quarter and $9.8 million a year earlier.

Ambiq, which went public in July, reported its first quarterly results in September, disappointing investors with an 11.7% fall in revenue that sent its shares lower after hours. The weakness largely reflects a deliberate pullback from China as the company shifts focus to higher-margin markets and customers in North America and Europe.

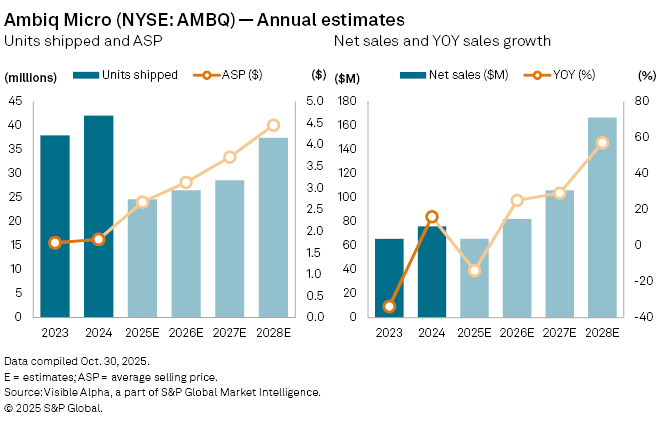

Consensus forecasts show net sales declining 14% year-on-year to $66 million in 2025, following a 16% increase in 2024, as Ambiq works through this transition. Unit shipments are projected to fall 41% to 25 million in 2025 before stabilizing in 2026. Analysts expect demand to recover from 2026 onwards, supported by stronger uptake of its next-generation edge AI chips, which allow connected devices such as wearables, drones, and sensors to run generative AI models locally rather than relying on cloud computing.

Revenue is expected to rebound 25% to $82 million in 2026 and nearly double to $167 million by 2028, with improving average selling prices as well as shipment supporting margins.

Still, Ambiq faces competition from established semiconductor firms including Infineon Technologies AG (ETR: IFX), Microchip Technology Inc. (NASDAQ: MCHP), and Texas Instruments Inc. (NASDAQ: TXN), all of which are expanding into low-power AI-enabled devices. Its dependence on Taiwan Semiconductor Manufacturing Co. Ltd. (TWSE: 2330, NYSE: TSM) as its sole foundry partner also leaves it exposed to supply-chain disruptions and geopolitical risks.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment