Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct. 23, 2025

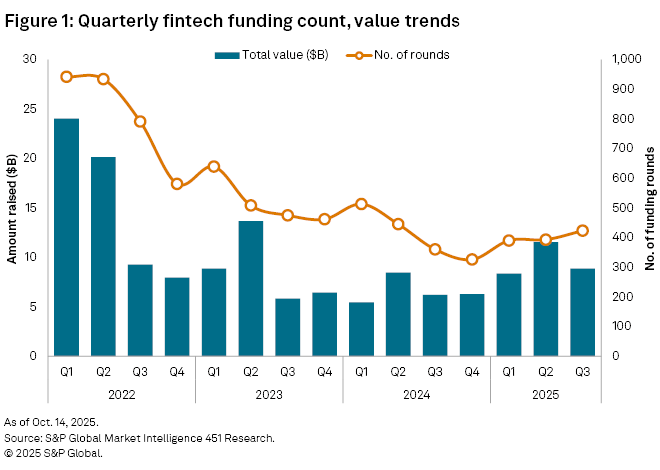

Global fintech funding reignited in the third quarter of 2025, with $8.85 billion flowing into private, tech-driven financial services startups, according to S&P Global Market Intelligence 451 Research data. With one quarter still in play, 2025 has already eclipsed 2024's total. Deal velocity also picked up momentum in the third quarter. North America remains the epicenter of this resurgence, but there are signs that optimism is gradually expanding. Funding activity either registered growth or arrested previous contractions across most fintech segments, stages and geographies.

With a quarter to spare, fintech funding in 2025 has already bettered 2024's $26.33 billion total, reaching $28.74 billion. More importantly, the data points to a broad recovery rather than a few headline rounds masking weakness underneath. The US remains the nucleus of global fintech innovation, accounting for over half of dollar volume. Its deep capital markets, strong regulatory signals around digital assets and expanding AI talent pool continue to anchor its dominance. Two narratives now define the next leg of growth: autonomous finance and stablecoin infrastructure. Unsurprisingly, venture portfolios are tilting heavily toward these themes.

Headline numbers in Q3 2025

After breaching the $10 billion threshold in the second quarter, global fintech funding fell short of that milestone but displayed healthier underlying dynamics. The third quarter marked the first year-over-year improvement in deal activity since the sector's downturn began in mid-2022. The quarterly deal count came in at 423, up from 393 in the previous quarter and 360 in the year-ago quarter.

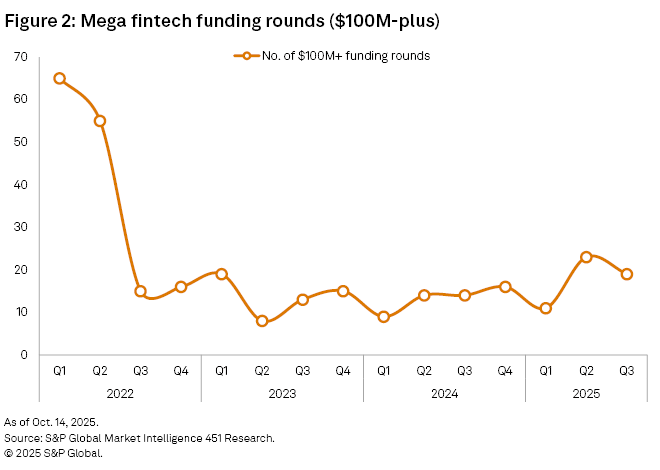

Investors continue to write bigger checks this year compared with 2024. There were 19 mega rounds (deals over $100 million) in third quarter 2025, up from 14 in third quarter 2024, amid ongoing investor enthusiasm for late-stage rounds. However, the third quarter did not log any billion-dollar funding rounds, which is not unusual as outsized funding rounds remain episodic.

Key funding rounds and emerging themes

The largest raise of the quarter came from Institutional Capital Network Inc. (doing business as iCapital), which provides private-market financial technology for wealth advisers. The fintech secured $820 million at a valuation of more than $7.5 billion in a round co-led by accounts advised by T. Rowe Price Associates, T. Rowe Price Investment Management and SurgoCap Partners.

Another standout was Ramp Business Corp., which returned to market just 45 days after closing a $200 million round in the second quarter. The company raised an additional $500 million led by ICONIQ, capitalizing on the emerging narrative of autonomous finance, where AI agents optimize spending, payments and treasury operations. The raise propelled Ramp's valuation to $22.5 billion, up from $16 billion, underscoring how investors are now pricing in AI as a core differentiator in corporate finance workflows.

Bilt Rewards continued to command attention with a $250 million raise led by General Catalyst, tripling its valuation year over year to $10.75 billion. Its rewards platform specializes in bridging rent, local commerce and travel rewards, in an illustration of how fintechs are expanding beyond transactions into full-stack consumer engagement platforms. Bilt projects to process over $100 billion in annual housing spending by year-end and expects to surpass $1 billion in annualized revenue by early 2026.

Stablecoins represent another funding theme that remains a magnet for capital. Among notable stablecoin startups raising capital is Signify Holdings Inc., doing business as Rain. The company closed a $58 million series B just five months after its series A, backed by Sapphire Ventures. The company notes accelerating demand from partners issuing on-chain cards and settling directly in stablecoins. Rain, which issues Visa Inc. debit and credit cards, appears keen on enabling consumers to spend with their stablecoin balances.

On the "seed to early stage" frontier, the following funding rounds involving either agentic AI or stablecoin startups caught our attention:

– US-headquartered Brale Inc., a platform for issuing stablecoins ($30 million series A).

– US-based Stable Financial Inc. (dba Stablecore), enabling banks and credit unions to offer stablecoin and digital asset products ($20 million series A).

– US-headquartered Circuit and Chisel Inc., an agentic commerce platform ($19.2 million seed).

– US-based Kira Financial AI, which blends vertical agents and stablecoins to enable the launch of embedded financial products ($6.7 million seed; $3 million in revenue).

– US-headquartered Lava Payments, a wallet-based payment system for agent-native companies ($5.8 million seed).

– Neurofin AI Technologies Pvt Ltd., an India-based startup that creates modular AI agents that automate and optimize workflows for financial institutions. ($1.6 million seed).

– Meshed, a UK-headquartered AI-native insurance broker ($1.28 million pre-seed).

Geographical trends: North America continues to surge

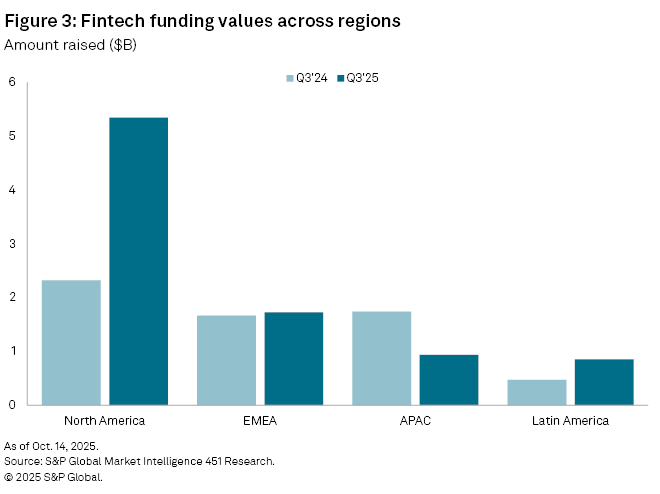

North America extended its funding resurgence in the third quarter, firmly outpacing 2024 averages. About 193 funding rounds worth $5.34 billion took place in the region, compared with 135 rounds yielding $2.32 billion. The US remains the dominant engine of global fintech capital, underpinned by sustained investor appetite for emerging technologies. The twin forces of AI-driven financial models and institutional adoption of stablecoins are reinforcing the country's position as the sector's innovation and capital hub.

The sentiment improved meaningfully across Europe, the Middle East and Africa (EMEA) and Latin America. All told, fintechs in EMEA drew $1.73 billion across 114 rounds, about 4% higher than the year-ago tally. Fintechs in Brazil and Mexico helped drive Latin America's 81% surge in funding value to $850 million via 25 rounds.

Over in Asia-Pacific, the mood is still subdued, largely due to the absence of mega rounds. As a result, funding dollar volume fell short of the $1 billion figure, versus $1.74 billion in the year-ago period. Encouragingly, deal count did not see any deterioration and remained flat at 91. India stood out with 42 rounds, the second highest globally, even as large late-stage financings remain scarce. A nascent wave of fintech IPOs, coupled with a favorable primary market backdrop, could unlock secondary capital recycling and reinvigorate private funding flows in the quarters ahead.

Segment analysis: Investment and capital markets, banking tech surge

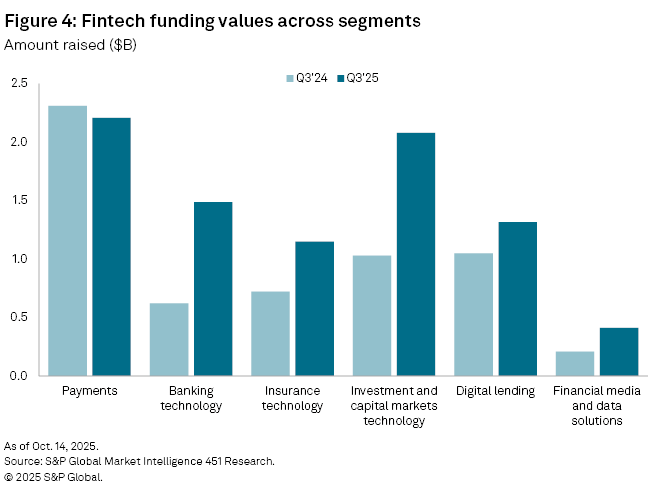

Funding momentum in the third quarter of 2025 was broad across core fintech verticals, signaling a healthier and more balanced recovery phase for the sector.

Payments remained the anchor category, drawing $2.21 billion across 108 rounds. Despite a slight year-over-year dip in aggregate value, the 38% increase in deal volume highlights renewed engagement. Investors continue to view payments infrastructure as the backbone of fintech innovation.

The improving crypto and digital asset sentiment lifted the investment and capital markets segment, which saw funding more than double to $2 billion across 86 rounds. This rebound reflects growing conviction that tokenization, on-chain liquidity and digital market infrastructure are likely entering a more durable growth phase.

Banking technology startups also posted notable gains, securing nearly $1.5 billion via 40 transactions, a 139% surge from the prior year. The sharp uptick underscores a pivot toward core modernization plays, as well as platforms enabling banks and credit unions to upgrade legacy tech stacks, improve compliance automation, and integrate AI into customer onboarding and risk processes.

Stage-wise analysis: Seed rounds show signs of improvement

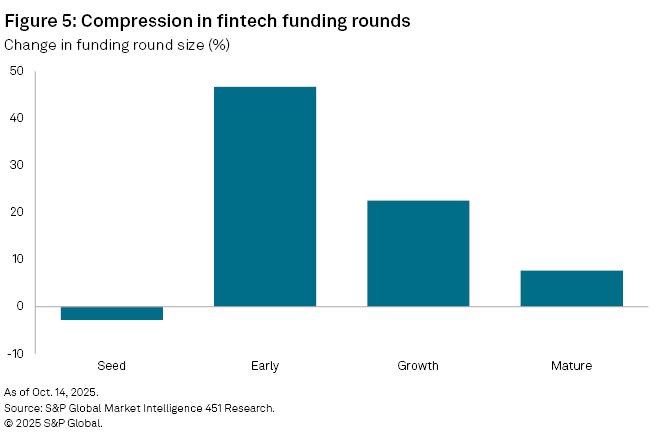

Funding momentum strengthened across all stages in the third quarter of 2025, but the revival at the seed stage was the quarter's most notable shift. After several quarters of contraction, pre-seed and seed rounds climbed to 143, up from 135 in the prior period. The 3% dip in average ticket size suggests investors are re-engaging with early-stage opportunities, but with a sharper focus on capital efficiency and validation milestones rather than outsized initial bets.

At the opposite end of the cycle, mature-stage funding rose 29% to $2.13 billion, driven by an uptick in deal activity rather than inflated valuations. Average round sizes expanded just 7.6%, suggesting that investors are maintaining valuation discipline and demanding clearer profitability pathways.

The growth and early-stage segments (series A and B) also showed meaningful recovery, with deal counts, total values and average check sizes all rebounding after prolonged weakness. This suggests the funding pipeline is reactivating across the mid-stage spectrum, which is typically a leading indicator of renewed venture confidence and the gradual reopening of exit markets.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment

Language