Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — OCTOBER 14, 2025

By Sourav Kataria

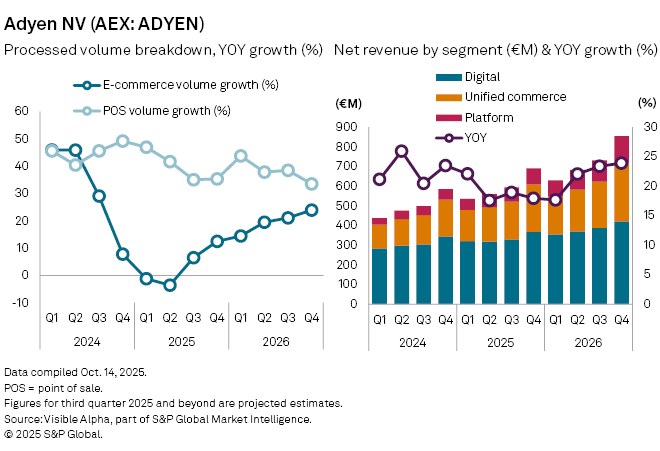

Dutch payment processor Adyen NV (AEX: ADYEN) is expected to post another quarter of solid growth when it reports its third-quarter 2025 business update on Wednesday, October 29, though analyst expectations have moderated after the company’s guidance cut earlier this year, citing the effects of US tariffs on cross-border consumer spending.

Net revenue is projected to rise 19% year-on-year to €593 million in Q3. Within this, digital revenue is expected to increase 8% to €329 million, unified commerce to climb 30% to €192 million, and platform services to surge 60% to €73 million — reflecting the growing contribution from its embedded finance and marketplace offerings.

Total payment volume (TPV) is estimated to reach €360 billion, up 12%, with e-commerce volumes improving 6% to €277 billion, and point-of-sale (POS) transactions jumping 35% to €82 billion as physical retail continues its recovery. Analysts expect e-commerce volumes to return to double-digit growth from Q4 onwards.

Adyen’s strategy remains anchored in its “land-and-expand” model with large enterprise clients — signing major merchants first, then deepening integration through additional payment services. The group is also investing in AI-driven tools such as Adyen Uplift and Intelligent Payment Routing to improve transaction success rates and lower costs for merchants.

The fintech will host its Investor Day in Amsterdam on November 11, where management is expected to outline medium-term growth priorities, including expansion in North America and India, pricing amid intensifying competition, and the trajectory of margin recovery.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment