Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 11, 2025

By Tim Zawacki

After a relatively docile second quarter for the Canadian property and casualty industry, insurers face a complex interplay of uncertainties specific to their businesses and the economy as a whole in the near- and intermediate-term outlook for top- and bottom-line growth

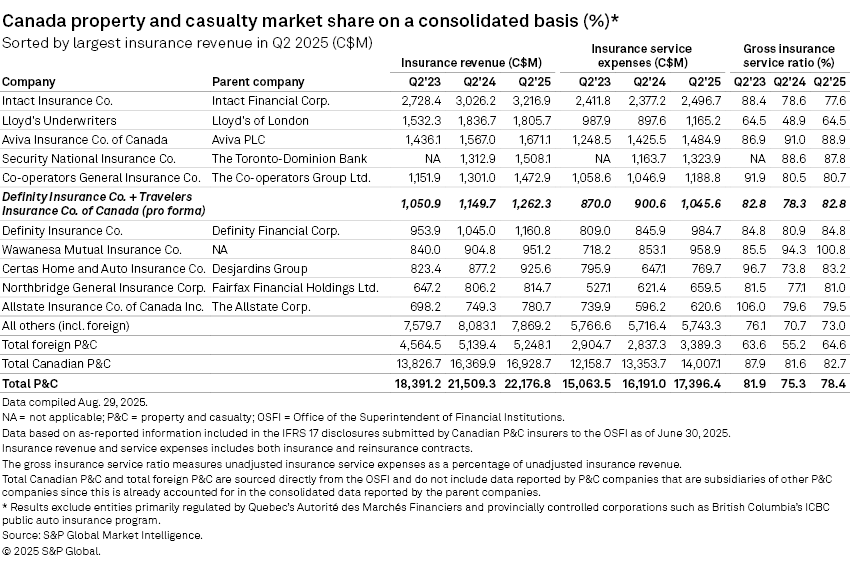

The prospective impact of catastrophes and US tariffs on key Canadian P&C business lines bears watching as the balance of 2025 plays out. But, in the meantime, the industry is poised in the second and third quarters to post two consecutive quarters of improvement in its overall insurance service ratio, a key measure of underwriting profitability under IFRS 17.

S&P Global Market Intelligence's analysis of second-quarter results finds that while insurance service expenses increased on a year-over-year basis by 11.6%, insurance service revenue climbed at an even more rapid rate of 13.5%. The insurance service ratio of just under 82.9% represented an improvement of 1.4 percentage points from the second quarter of 2024. Although insurance service ratios in the property and liability lines deteriorated on a year-over-year basis, a significant improvement in the automobile line more than made up for the difference. While four weeks remain in the third quarter, the industry posted an extremely high insurance service ratio in the year-earlier period amid a record summer for catastrophe losses.

Ever mindful of the negative effects on property insurance profitability from wildfires and severe convective storms as well as uneven, albeit improved, underwriting results in the private-passenger auto line, carriers will continue to refine their risk appetites and push for rate increases where needed. At the same time, the macroeconomic backdrop, characterized by a contraction in gross domestic product and declining exports, raises concerns about the potential for a recession to hinder growth prospects for the industry.

The automobile insurance sector, which represents 43% of total P&C insurance service revenue, generated revenue of C$7.35 billion and expenses of C$6.44 billion, resulting in a gross insurance service ratio of 87.6%. This marked the first time since the fourth quarter of 2023 that the automobile insurance service ratio fell below 90%, and it signified favorable comparisons from results of 92.9% in the second quarter of 2024 and nearly 95.7% in the first quarter of 2025.

Intact Financial Corp. said it expects "hard market" conditions to persist in the Canadian personal auto market through the next 12 months given its view that industry profitability remains challenged. It also indicated that levers such as adjustments to pricing and claims strategies would help Intact Insurance Co. mitigate potential tariff-related headwinds.

While the impact of US tariffs on loss-cost inflation remains a potential concern for the auto insurance business, our analysis of data at the coverage level suggests a muted effect on results at best in the second quarter. The insurance service ratio in the other automobile line, which includes the collision and comprehensive coverages and, as such, would be most exposed to a spike in the costs of parts and replacement vehicles, improved at nearly two times the rate of the liability and accident lines. The result of 81.2% (inclusive of non-Canadian business written by entities that operate in the Canadian market and file data with the Office of the Supervisor of Financial Institutions) marked a year-over-year decline of 10.7 percentage points from what had been the lowest insurance service ratio in the IFRS 17 era. It had exceeded 100% six times in the previous nine quarters, including a result of nearly 118% in the third quarter of 2024.

The Canadian government imposed 25% counter-tariffs on most US imports, including passenger vehicles and motor vehicle parts and accessories earlier in 2025. Effective Sept. 1, however, it removed counter-tariffs in light of the United States' approach to allow most Canadian goods to enter that country tariff-free under the Canada-United States-Mexico Agreement. Motor vehicles remain subject to the 25% counter-tariffs, but they no longer apply to parts and accessories. According to Statistics Canada data, the ongoing tariff situation has led to a notable decline in the export of passenger cars and light trucks, further straining an already pressured market.

Catastrophes have been a much more meaningful driver of automobile results. The automobile insurance service ratio hit its highest level since the broad adoption of the IFRS 17 measure at the start of 2023 in the third quarter of 2024 at 97.8% amid historically high catastrophe losses that included the costliest hailstorm in Canadian history in Calgary, the Jasper wildfire in Alberta and significant flooding in the Greater Toronto Area. Ongoing statutory challenges in Alberta, where rate filings had been paused by the government for much of 2023 and rate increases have been capped in 2024 and 2025, also serve as a drag on profitability. The insurance service ratio in Alberta was 111.9% in the private-passenger auto business in the second quarter as compared with 84.5% in the rest of Canada where business is reported to OSFI and not written by state-sponsored entities.

The property insurance sector continues to reel from the record 2024 catastrophes while keeping close watch on another active wildfire season. According to Natural Resources Canada data, wildfires have affected nearly 7.9 million hectares on a year-to-date basis through Aug. 27, more than double the 10-year year-to-date average.

The Bird River fire, which led to significant evacuations and property damage in Manitoba during the second quarter, exemplifies the growing threat posed by wildfires in the region and the impact they can have on property insurance results. The personal property insurance service ratio in Manitoba and Saskatchewan, the two provinces most impacted by wildfires to date in 2025 based on hectares burned, spiked to 165.7% and 248.4%, respectively, in the second quarter. This helped account for an increase in the total property insurance service ratio to just under 81% from 76.7% in the year-earlier period.

While catastrophe losses through the first two months of the third quarter would seem to significantly lag the record pace in 2024, there have been several additional reminders of the toll they took last year.

A July 13 hailstorm caused approximately C$92 million in insured damages, 11 months removed from a larger storm in the same region that caused over C$3.2 billion in losses. And loss estimates for the Jasper fire continue to creep higher.

In the second quarter, property insurance revenue grew 16.9% to C$6.33 billion as carriers continue to raise rates in response to the effects of more severe catastrophe losses on their results. Intact, for its part, projected that the industry would see hard market conditions for the next 12 months in the personal property business in response to adverse weather trends. But rate alone may be insufficient to fully address the cumulative effects of these increasingly frequent events.

The Insurance Bureau of Canada on its website discussed that the pattern of repeated hail damage requires urgent action, including improved building codes and financial support for retrofits. Furthermore, the recent catastrophic losses in Saskatchewan and Manitoba also show the urgent need for enhanced disaster preparedness and response strategies. As residents grapple with the aftermath of these events, the insurance industry is pushing for stronger building codes and improved infrastructure to mitigate future risks. The potential for elevated third-quarter losses due to ongoing storms and wildfires necessitates a proactive approach from the insurance industry so that it can better protect both policyholders and its own financial stability.

According to the second-quarter data, Ontario leads the Canadian property and casualty insurance market among OSFI filers with revenue of C$8.45 billion, followed by Alberta with revenue of C$3.14 billion. Due to Alberta's unique auto insurance rate restrictions and elevated catastrophe exposure, its overall gross insurance service ratio has exceeded the national total in five of the past six quarters, including the second quarter when its result hit 89.6%.

In the broader economic context, the Canadian insurance industry is also facing macroeconomic headwinds marked by a decline in real GDP of 0.4% in the second quarter, as reported by Statistics Canada. While household spending has increased by 1.1%, driven largely by expenditures on insurance and financial services, the overall economic climate remains uncertain. As insurers face these challenges, the importance of strategic consolidation may become increasingly apparent particularly to the extent a sluggish economy makes organic growth more difficult to attain. Recent mergers and acquisitions within the industry reflect a trend toward greater scale and diversification, enabling firms to leverage resources and share risks more effectively.

Methodology

In analyzing the Canadian market for the purposes of this article, we rely on the gross insurance service ratio for the Total Canadian P&C industry using nonconsolidated results for individual entities as the key measure of underwriting profitability. Note that the consolidated results for foreign P&C entities, which are defined as those incorporated outside of Canada, differed in magnitude and direction from those discussed in this article. Consolidated results by type of entity are available on tabs 8 through 11 of the data exhibits file.

The gross insurance service ratio incorporates two critical line items of IFRS 17 reporting: insurance service expenses, including incurred claims, claims-related expenses and acquisition costs, as a percentage of insurance service revenue prior to the impact of reinsurance. For the market share charts, we used consolidated results to include foreign entities.

The adoption of IFRS 17 at the start of 2023 makes for challenging apples-to-apples comparisons with prior periods. Certain year-over-year comparisons in 2024 at the industry level have also been impacted by the delayed adoption at the start of the year by the following insurers: The Toronto-Dominion Bank's Security National Insurance Co., Primmum Insurance Co., TD General Insurance Co., TD Direct Insurance Inc. and TD Home and Auto Insurance Co.; Royal Bank of Canada's RBC Insurance Co. of Canada; and Accelerant Holdings Uk Ltd.'s Omega General Insurance Co.

Additionally, our data is limited to results published by the Office of the Superintendent of Financial Institutions (OSFI), which excludes information for entities primarily regulated by Quebec’s Autorité des Marchés Financiers. It also does not contemplate results for public insurance corporations, most notably the government-controlled Insurance Corp. of British Columbia, which provides private-passenger auto insurance to drivers in its namesake province.

The data exhibits file contains additional discussion of the scope and limits of the data. Also, use the newly introduced Canadian market share tool for geographic and line of business level information. Take note of the currency selection in the settings of the S&P Capital IQ Pro Excel add-in when refreshing the spreadsheet.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.