Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Sept. 4, 2025

By Malav Parekh and Michael Nocerino

The unflattering job report released by the US Bureau of Labor Statistics earlier this month has renewed concerns over the US economy. At S&P Global Market Intelligence 451 Research, our macroeconomic coverage studies both organizational and consumer sentiment to understand the factors affecting their business and spending decisions. Our latest data indicates softness in both the economy and the job market six months into 2025.

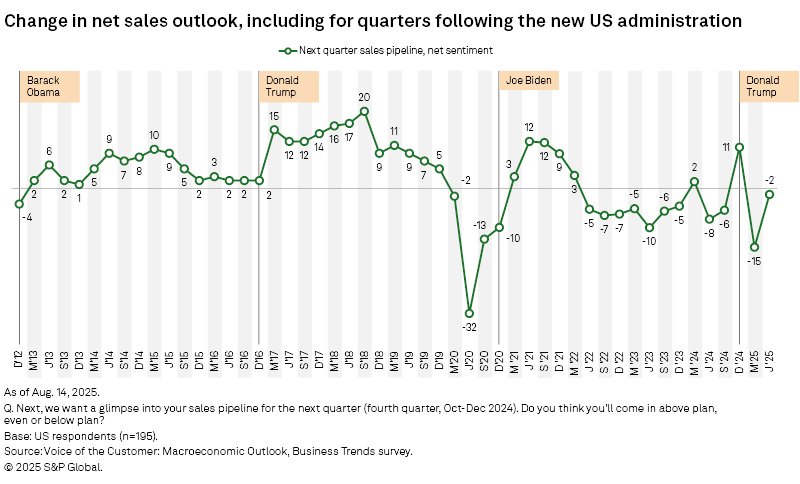

Over the past six months, economic sentiment has softened significantly as both businesses and consumers express persistent pessimism amid tariff-related uncertainties and technology-driven cost-cutting measures. Organizations have seen their sentiment plunge — from +19 six months ago to -22 in June — and the sales pipeline for the second quarter decreased by 26 points to -15 in March before a modest recovery to -2 for the third quarter. While it remains early, the word "recession" made a comeback after two years during the second-quarter earnings discussions of S&P 500 companies, with 355 mentions. Consumer sentiment has deteriorated, falling from +2 in January to -11 by July, reflecting fears caused by tariffs. Organizations are transitioning to a cautious stance — evidenced by a significant drop in hiring intent and a pronounced shift toward reducing full-time head count — while awaiting clarity on trade policies that could further squeeze margins. Consumers, already tempered by inflation and fears of job loss, are curbing discretionary spending, which reflects immediate cost concerns and signals broader apprehension about future economic stability. These trends indicate that both corporate strategies and consumer behavior may contribute to a period of slower economic performance.

Economic sentiment remains negative for the second consecutive quarter

Organizations are struggling to manage tariff-related uncertainty, employing a wait-and-see approach. While consumers are slightly relieved that the tariffs have been postponed, the relief is temporary. Once the tariffs are in effect, organizations will likely pass at least some of their additional costs to the customers. Both organizations and consumers are already cutting discretionary spending in anticipation.

Economic sentiment among organizations and consumers has dropped. Sentiment among consumers dropped from 1.5 in January to -11 in July, while sentiment among organizations fell to -21 in June from +17 six months before.

We reported in the first quarter how the sales pipeline for the second quarter had decreased by 26 points to -15. The sales outlook recovered for the third quarter as most of the tariffs were pushed forward, but it is still negative (-2).

Mentions of "tariff" skyrocketed in earnings calls of S&P 500 companies in the second quarter, jumping to 6,541 mentions from 335 mentions just six months earlier, according to our keyword analysis of S&P 500 earnings transcripts. Organizations in the IT, financial and industrial sectors were among the most concerned about the trade policy. Perhaps equally worrying is the return of the word "recession" to earnings discussions in the second quarter of 2025, jumping tenfold to 355 quarter over quarter, although still not nearly at the levels of the second quarter of 2020 (819 mentions) and the third quarter of 2022 (733 mentions).

Our analysis of the Capital IQ News Sentiment tracker further shows that nearly 40% of news relating to the impact of external factors on global consumer and technology businesses is negative, with a sizable number of negative reports focused on recent US trade policy decisions around tariffs. The average all-sector sentiment for external factors is at 32% negative.

Organizations' employment sentiment drops in Q2

In 2023, amid talks about economic slowdown and recession, the job market stood steady, but the recent US Bureau of Labor Statistics report suggests that even the job market is on shaky ground. US organizations have become more inclined to cut full-time employees and less inclined to hire more people or prioritize talent retention as economic uncertainty has prompted several organizations to consider cost-cutting measures, according to analysis of 451 Research's US Tech Demand Indicator and Macroeconomic Outlook, Business Trends Q2 2025 survey.

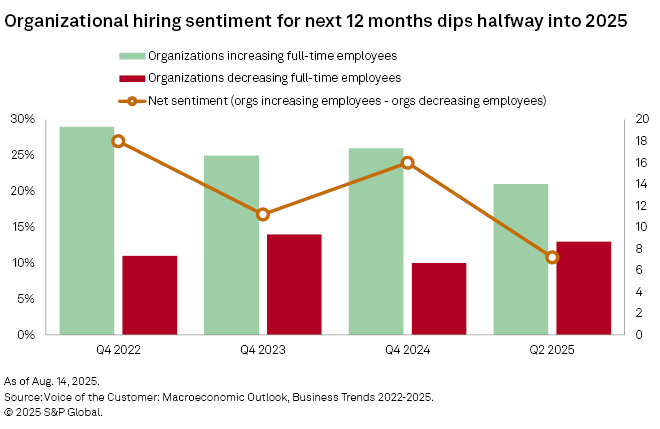

Respondents reporting that their organization is planning to reduce full-time employee count over the next 12 months rose to 13% in the second quarter of 2025 from 10% at the end of 2024, with a net hiring sentiment of +7, dropping significantly from a strong +16 at the end of 2024.

The drop in intent to increase employee head count is primarily driven by large enterprises as they employ a wait-and-see approach to tariffs and move to implement AI and automation. Nearly one-fourth (23%) of respondents from large enterprises report that their organization is likely to decrease full-time employees over the next 12 months. In comparison, only 8% of small and medium-sized enterprises are likely to reduce employee head count.

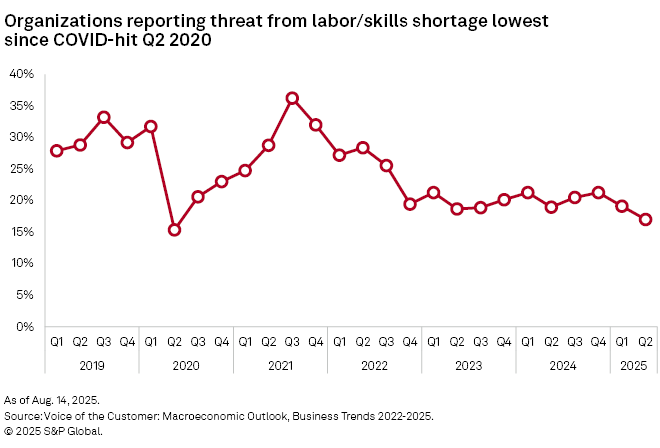

Additionally, employee retention dropped in priority among organizations, with only 24% of respondents picking it as a priority in the second quarter, versus 32% a year ago. The softness in workforce demand is further evident in our macroeconomic impact sentiment data, where labor/skills shortage as a threat to organizational sales dropped to 17%, which is the lowest since COVID struck in the second quarter of 2020 (15%).

Despite the softness, 33.3% of digital-focused organizations say that specific skills shortages remain the biggest obstacle in establishing digital transformation strategies. This indicates that organizations will continue to rely on employee upskilling to tap talent already on their payrolls.

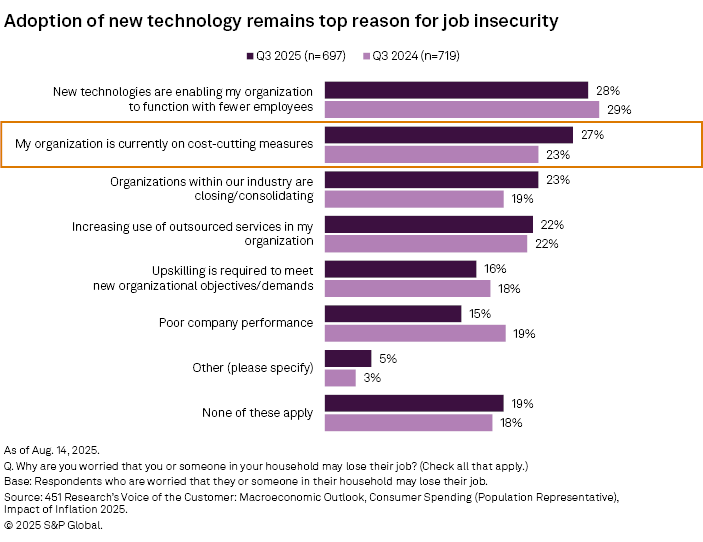

Consumer job security fears appear stable, but signs emerge of economic impact

The increased softness in hiring intent isn't immediately apparent if you look at the overall quarterly job confidence sentiment from our Macroeconomic Outlook, Consumer Spending survey, but a deeper look shows that economic challenges have started setting in. About 42% of the 1,644 consumers surveyed expressed strong fear — a great deal of worry or quite a bit of worry — of them or someone in their family losing their job at the beginning of the third quarter. For them, cost-cutting measures at the organization (27%) and industrywide consolidations/closures (23%) were the only reasons that saw a year-over-year growth in cause for concern (both up 4 percentage points). A third key reason for job safety concern was the impact of new technologies enabling their organization to function with fewer employees (28%), which was the same as the year before.

The economic sentiment among consumers came in negative for the second consecutive quarter, albeit with slight improvement at the start of the third quarter (-11) versus the second quarter (-18) as they were briefly spared the impact of tariffs after the administration postponed implementing harsher taxes on global trade partners to August or later. Nonetheless, consumers continued to overwhelmingly rate inflation (46%) and tariffs (33%) as the greatest threat to their household spending. Energy prices (22%) rounded off the top three threats.

451 Research's consumer survey data have traditionally been accurate in predicting economic slowdowns based on the way consumers change spending patterns. One of the most notable is their propensity, or lack thereof, to spend on discretionary items. Our latest data shows a strong correlation between job uncertainty and consumers reining in their spending habits.

Respondents to our consumer survey who are worried about their job security are also much more likely to pull back on discretionary spending over the next 90 days (76%) compared with respondents who are not worried at all (48%). The key discretionary areas they expect to spend less on include restaurants, apparel and movie theaters.

IT roles most at risk in Q3, cost cuts weighing on back-office jobs

Over the last five years, US consumers have held a consistently negative sentiment toward their job security. A larger number of respondents worry a great deal or quite a bit that someone in their household may lose their job, compared with a smaller number saying they don't worry at all. The trending data illustrates just how stable this sentiment has been over the long term. The post-pandemic employment environment has been such that consumers lean toward a healthy skepticism of the job market and employers.

Yet, some jobs, especially IT roles, are already seeing an unusually high level of softness. About 69% of respondents who work in IT roles expressed a significant degree of worry over job safety, followed by 67% of those working at front-office roles like sales and marketing (excluding customer service or other front-line functions). However, these fears are largely a result of technological advances such as AI, automation and outsourcing. Organizational cost-cutting, on the other hand, was the biggest cause for concern for those in back-office functions such as human resources, finance, legal and corporate (37% versus 27% overall).

The fear of job loss is highest among young, highly educated, middle-income urban individuals ($75,000-$149,999), particularly those working in the software, IT and computer services industries.

Despite the increase in respondents citing cost-cutting as a reason for potential job loss, they also reported the 4-point decrease in poor company performance (15%) as a reason from a year ago. While not conclusive, this indicates that organizations may be cutting costs either in anticipation of the potential downturn once tariffs are fully in effect or because they are implementing technologies that would make certain roles redundant.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment

Language