Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — SEPTEMBER 09, 2025

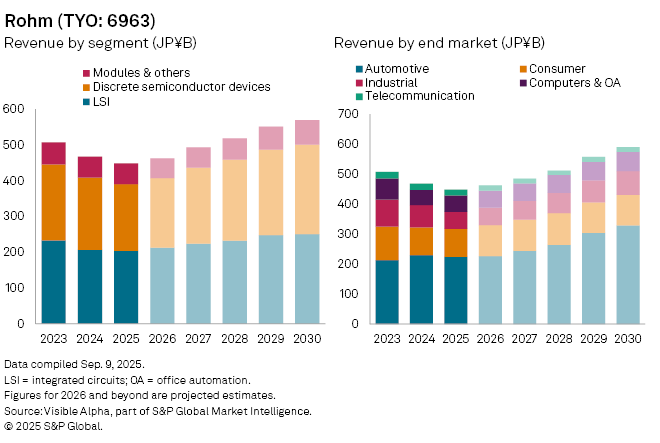

Japanese semiconductor manufacturer ROHM Co. Ltd. (TYO: 6963) is set to return to growth in 2026 after two years of declining sales, as demand recovers across its core electronics businesses. Net sales are forecast to rise 3.1% year-on-year to JP¥462 billion in fiscal 2026, following a 4.1% drop in 2025 and a 7.9% contraction in 2024, which were weighed down by sluggish electric vehicle (EV) demand, soft industrial and automotive spending, and a broader semiconductor market downturn.

The recovery is expected to be driven by the company’s LSI and discrete semiconductor segments, which together account for nearly 88% of net sales. LSI revenue is projected to climb 4.6% to JP¥213 billion after two years of decline, while discrete devices are forecast to increase 4.1% to JP¥195 billion. In contrast, the modules and other segment is likely to remain under pressure, with meaningful growth not expected until 2027.

End-market trends also point to a cyclical upswing. Automotive, which represents almost half of Rohm’s net sales, is forecast to rise modestly by 1.2% to JP¥226 billion in 2026, before accelerating to 8% growth in 2027 as EV adoption and advanced driver-assistance systems (ADAS) gain traction. Consumer electronics revenues are expected to expand 11% to JP¥103 billion, industrial demand is projected to edge up 2.5% to JP¥59 billion, and computers and office automation are set for modest gains. Telecommunications, by contrast, is expected to remain a drag, falling to JP¥18 billion.

Profitability is expected to rebound sharply alongside revenue growth in 2026. Net income is forecast to recover to JP¥13 billion in 2026, reversing a net loss of JP¥57 billion in 2025.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment